We would like to address a subject that has been circulating through the investor psyche as of late: the concern is that the Federal Reserve, in its hawkish stance, is unable to engineer a soft landing, and that the contemplated series of interest rate increases will result in a policy mistake that ultimately throws the economy into a recession. Some market commentators have speculated that the market is starting to discount this scenario using the S&P500’s trough forward P/E multiple (excluding the pandemic) of 14x recorded in Q4 2018, during the global trade wars at the end of the prior rate tightening cycle. This results in a downside of 3500 on the S&P500, approximately 15-20% from current levels. We wanted to prepare clients for this eventuality, as markets are forward-looking, and even if this scenario does not occur, sentiment and emotions can sway the decisions of even highly intelligent and informed investors. We expect downside to be shortlived, as we would like to remind investors of the Federal Reserve’s statutory mandate: 1) Orderly price stability, as measured by inflation targeted at 2% in the long run and 2) Maximum full employment, as measured by both the unemployment rate and labour force participation spread across demographics. Indeed, the treasury curve – a measure of inflation expectations – is flattening at the long-end, indicating that we may reach peak inflation levels sometime toward the end of this year.

Moreover, it is important to analyze the Federal Reserve’s most recent meeting minutes (March 15, 2022) to discern the thinking behind the economic landscape. As of March 15, the terminal interest rate – which represents the long run sustainable interest rate the economy can exchange money at – was actually reduced from 2.5% (as of December 2021) to 2.375%. This signifies that over the long run, the Fed is expecting a return to secular disinflationary forces, which would also be a return to the slow growth and moderate inflation investment climate that we have predicated portfolio decisions upon (during COVID and prior to COVID).

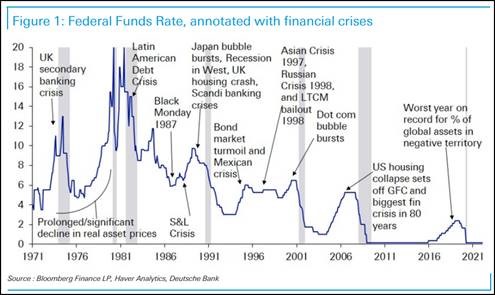

We would also like to address the commentary that the Federal Reserve is prepared to raise interest rates until the economy goes into a recession. We find very little evidence to support this. In past economic cycles (starting from 1971), there has not been a recession when the Federal Funds Rate was below 4% (with the exception of the pandemic – see Figure 1 below). Furthermore, even in the meeting minutes themselves, the Fed has signaled a willingness to overshoot inflation in exchange for orderly growth. 2022’s inflation projections are 4.1%, then moderating to 2.6% by 2023 and 2.1% by 2024 (still above the 2% target level). We liken the current environment to 2015/2016, where markets initially sold off on fears of an early rate tightening cycle, only then to reverse course when it became understood that growth would accompany these interest rate increases, causing the yield curve to steepen eventually, a signal of a robust economy to begin with.

Figure 1:

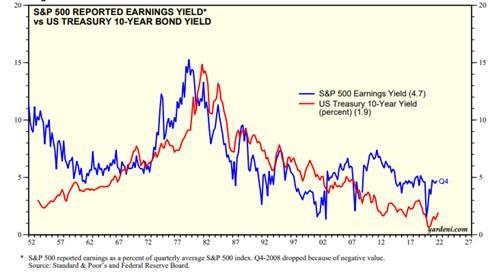

Finally, a note on valuation. To this, we turn to charts produced by market strategist Ed Yardeni, outlining the spread between bond yields and earnings yields. This still exhibits a very healthy gap, indicating that the fundamental and relative risk-reward of holding equities versus treasuries as an asset class is still favourable (Figure 2 below).

Figure 2:

As a reminder to clients, high quality, annuity producing, secular recurring companies at attractive valuations have tended to produce meaningful returns through a full market cycle. This is because these companies are “productive assets” which can retain their value even if inflation is temporarily elevated. For example, take two companies: First, a capital intensive equipment rental company that must replace its depreciated assets every year. Even as this company reinvests in its property, plant and equipment, it is unable to raise prices and pass through the cost of higher inflation due to the commoditized nature of its industry. This results in declining profitability resulting from inflation.

On the other hand, a productive asset such as a difficult-to-replicate software platform is capital light because little re-investment is required to retain customers, and higher pricing as a result of inflation can be passed through to customers due to the unique nature of the asset. Cloud computing and semiconductors used in data centers would be two such examples. As demonstrated by the S&P500 versus gold, productive assets (as measured by the S&P500) have outperformed non-productive assets (e.g. gold) by 6.86% per year over the last full market cycle (2008-2020).

Figure 3:

The main reason for this outperformance is that the S&P500 has successfully compounded earnings per share by 7.4% per year over this time period, while gold has produced no earnings. This is why we encourage investors to remain fully invested in productive, annuity producing assets that offer defensive characteristics during times of pronounced volatility. On the flipside, these assets also produce steady, compounded investment growth during more normal economic times, such as the slow growth and low inflation environment of the post 2008/09 era.

We hope clients found this installment informative. Should you have any questions, please feel free to reach out.

Warmest regards,

Grace, Samuel, Leslie, Jennifer and Kim