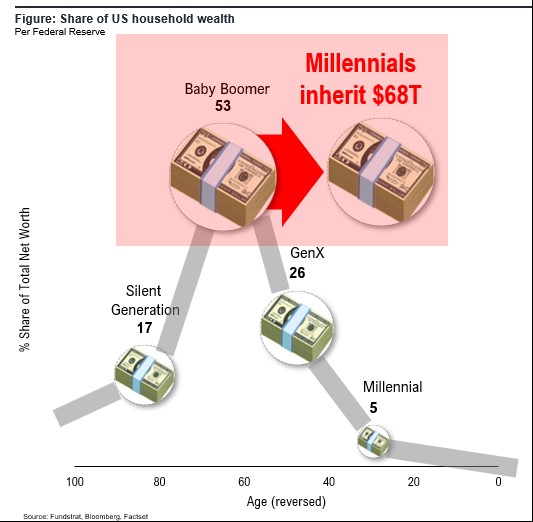

In this installment of our investment journal, we would like to discuss demographic shifts within the investments industry. Over the next 20 years, it is estimated that there will be a $68 trillion inheritance transfer from Baby Boomers to Millennials, of which $6 trillion will be invested into the equity markets over the next decade.

While Baby Boomers have most of their wealth invested in balanced portfolios, Millennials, due to the investment culture they were raised in, have a much more growth oriented mindset that is thematically influenced. This difference in investment styles has pronounced influences on the equity markets. Millennials tend to have two attributes: First, a greater willingness to allow earnings to grow into their valuations, and second, a more forward looking perspective on early stage start-ups that have a less concrete history.

In our investment practice, we believe that a more discerning way to invest is to ally our views on the outlook and valuation of a business with durable growth themes that the market will eventually recognize. In deriving the valuation of a business from our own internally crafted models, we can be better equipped to understand how the business is performing relative to our expectations, and also develop greater confidence in the long-term durability of the business as it grows. In terms of investment discipline, the shift in assets from Baby Boomers to Millennials will have several positive influences on growth investing: First, a greater receptivity to growth companies, especially those in their early stages; Second, a lower discount rate on the equity markets, which translates into a lower hurdle rate for investing, as a result of greater confidence in the developing track records of companies; and finally, likely a more forward-looking outlook of what growth companies are capable of delivering over the long term. These influences will contribute to a more positive set of investing behaviors, allowing value to be surfaced among growth companies with long-lived and durable economics.

We would also like to expand on our philosophy of valuation. Valuing a company is important in assessing how the business will perform under varying scenarios. In conducting various scenarios of the business, we gain a deeper understanding of its cash generating potential under these different scenarios, and hence, its true intrinsic value. While many of our past successful idea generation practices have been qualitative in nature, going forward, we intend to merge our qualitative insights with a deeper and more thoughtful assessment of a business’s value creation opportunities. A deeper comprehension of an industry’s long-term economics, how a company is performing, the longevity of its growth, and ultimately its real business value will be areas of focus going forward. This investment process will be especially applicable to “new economy” industries, upon which the value of a business largely rests on being able to monetize large market opportunities. We expect this to add further refinement to our investment process, and help us merge insights from different areas of our research process.

In future installments, we will discuss how we identify growth investments, the specific factors we look for in industries, how we develop our DCF models, and how our process continues to evolve. We wish everyone well in the meantime!

Warmest regards,

Grace, Sam, Leslie and Jennifer