Higher productivity

In the opaque realm of economic indicators, we think few metrics are as mystifying as “productivity.” Fundamentally, it measures how efficiently resources—such as labour and other inputs—are harnessed to generate economic value.

While economists have devised many ways to define and quantify productivity, one of the more straightforward approaches is labour productivity: the amount of economic output per hours worked to produce it.

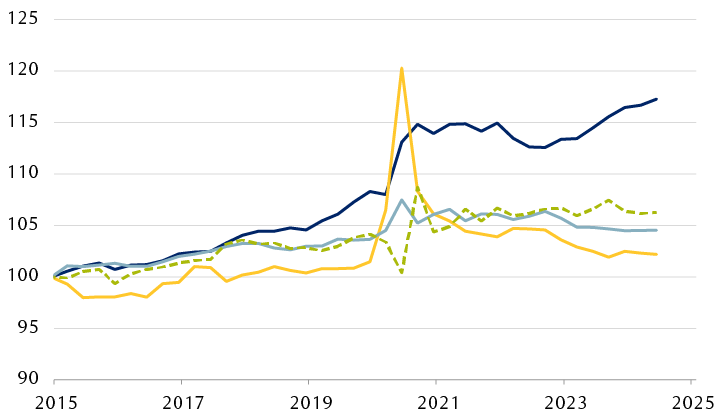

On this measure, the U.S. has been consistently outpacing major advanced-economy peers for some time. Since 2014, workers in the U.S. have boosted their productivity by 17%. By contrast, gains in the eurozone and the UK have been limited to 5% and 6%, respectively, while Canada’s productivity has stagnated.

U.S. labour productivity pulling ahead

Output per hour, indexed to 100 (1/1/15)

The line chart shows changes in productivity, expressed as output per hour, from 2015 through June 2024 for workers in the United States, Canada, the eurozone, and the United Kingdom. Productivity is indexed to 100 on January 1, 2015. Productivity has increased the most in the United states, reaching 117 in June 2024. Canadian productivity initially declined, then climbed back above 100; it spiked to roughly 120 in 2020, more than any of the other countries shown, before falling back to between 100 and 105, and is now roughly 102. Eurozone productivity rose gradually to around 105 and has stayed around that level since 2020. United Kingdom productivity largely followed the same trajectory as the eurozone, although it fell and rose at different times during the pandemic, and is now roughly 106.

Source - RBC Wealth Management, Bloomberg, European Central Bank; data through 6/30/24

Notably, the U.S. economy seems to have become more dynamic in recent years, standing apart from other major advanced economies which have seen a slowdown in labour productivity, particularly in the wake of the pandemic.

This rise in worker efficiency has been a major—if underappreciated—factor underpinning the U.S. economy’s faster growth trajectory over the past two years. Between Q2 2022 and Q3 2024, U.S. real GDP expanded by 6.7%, compared to 4.5% for Canada, 1.5% for the eurozone, and 1.4% for the UK.

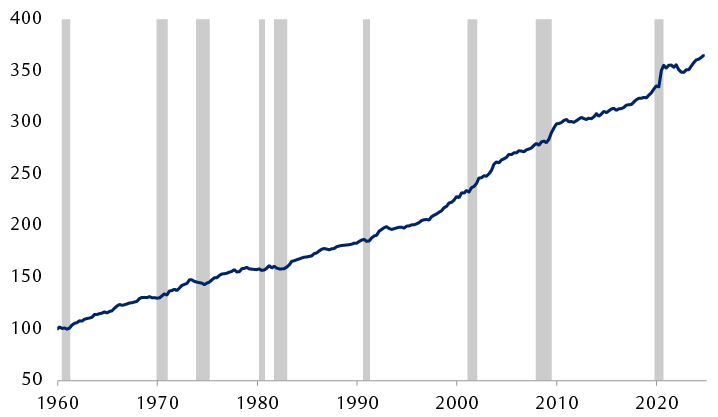

The long arc

U.S. workforce productivity boasts a reliable record of long-term improvement. Since 1960, U.S. productivity has grown at a 2% compounded annual growth rate. Though seemingly modest, this steady pace has an extremely large cumulative effect: workers in the U.S. are now roughly 250% more productive than their 1960 counterparts.

U.S. labour productivity has risen substantially

Output per hour, indexed to 100 (1/1/60)

The line chart depicts the rise in United States worker productivity since 1960, and highlights periods of economic recession in the U.S. Indexed to 100 on January 1, 1960, productivity rose fairly steadily over the next 64 years and was at 366 in mid-2024.

Source - RBC Wealth Management, Bloomberg; data through 9/30/24

Productivity growth, however, has ebbed and flowed over the decades. The recent upswing has come on the heels of a period of tepid progress in the 2010s, when productivity grew at a compounded annual rate of just 1.2%—one of the slowest rates in the past seven-plus decades.

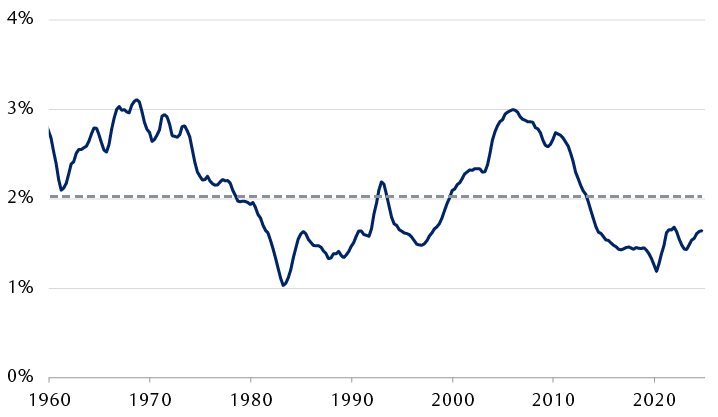

U.S. productivity growth has ebbed and flowed

Ten-year rolling average change in productivity, y/y

The line chart shows the 10-year rolling average rate of change in United States worker productivity from 1960 through mid-2024. Productivity increases were above the average rate of approximately two percent until 1978, then mostly below the average until 1999. Increases were above average from 2000 through mid-2013, and have since fallen back below average.

Source - RBC Wealth Management, Bloomberg; data through 9/30/24

Small variations in productivity growth rates compound over time into vastly divergent economic outcomes. At 1.2% annual growth, output per worker doubles roughly every 58 years. At 2.5%, it doubles in just 28 years. In real-world terms, that difference determines whether workers double their output once or twice over their careers. The long-term trajectory of economies and the standard of living for households are closely tied to this arithmetic, as wage growth tends to track productivity gains over time.

The invisible catalyst

Productivity, though often overlooked, is the engine of long-term economic progress—and has implications for financial markets. When productivity rises, economies can produce more goods and services with the same inputs. This not only boosts the value businesses derive per worker but also raises an economy’s “speed limit,” allowing faster expansion without fostering inflationary pressures. More productive workers also tend to act as a tailwind for corporate profitability, creating a virtuous cycle of growth and reinvestment.

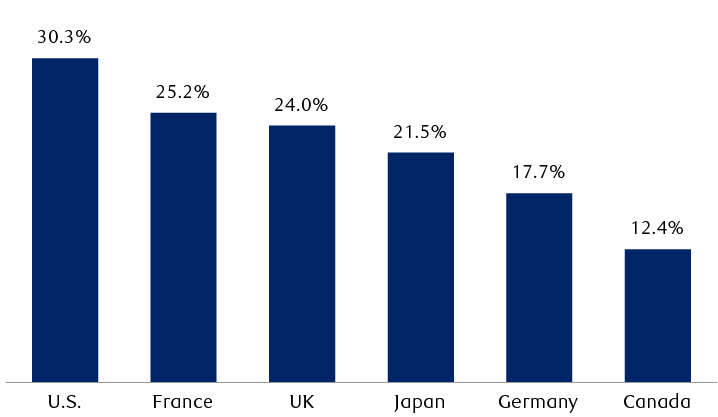

For the U.S., the recent rebound in productivity growth is encouraging, but the lesson from history is that sustaining it will require a concerted effort. We think the persistent productivity edge the U.S. has achieved recently can be attributed to several key factors. A deep-rooted culture of innovation and risk-taking has fostered rapid business formation and accelerated the diffusion of technologies through the economy, while flexible labour markets adeptly match workers to jobs aligned with their skills. Crucially, high levels of investment in research and development have kept the U.S. at the forefront of technological leadership (see exhibit below). This offers a useful playbook for other major economies seeking to strengthen their productivity trajectory.

The U.S. invests more heavily in intellectual property products than other developed economies

Investment in intellectual property products as percentage of gross fixed capital formation in 2021

The column chart shows national investments in intellectual property products as a percentage of gross fixed capital formation as of 2021 for the United States (30.3%), France (25.2%), the United Kingdom (24.0%), Japan (21.5%), Germany (17.7%) and Canada (12.4%).

Source - RBC Wealth Management, Organisation for Economic Co-operation and Development

The GenAI factor

Meanwhile, we believe the emergence of generative artificial intelligence (GenAI) presents a unique opportunity to reset the global productivity landscape, potentially allowing lagging countries to bolster their productivity growth and close the gap with the United States. As we argued in a recent series of reports (see links below), GenAI has the transformative potential to radically change the way tasks are performed throughout the economy, much like the computer did in the late 1980s.

- Global Insight – GenAI: Enablers and adopters

- Global Insight – Exploring the impacts of AI and GenAI across industries