Each week we provide market context and a snapshot of the salient items for our clients’ investment and wealth management needs. Our goal is to present informative, relevant information when it comes to investment matters.

2022 was a year of challenges on every level, and we aim to bring you context that will help clarify and navigate the difficult times we are currently experiencing.

There is a lot to reflect on in 2022, as virtually every prudent investment strategy and diversified portfolio had negative performance.

Year in Review

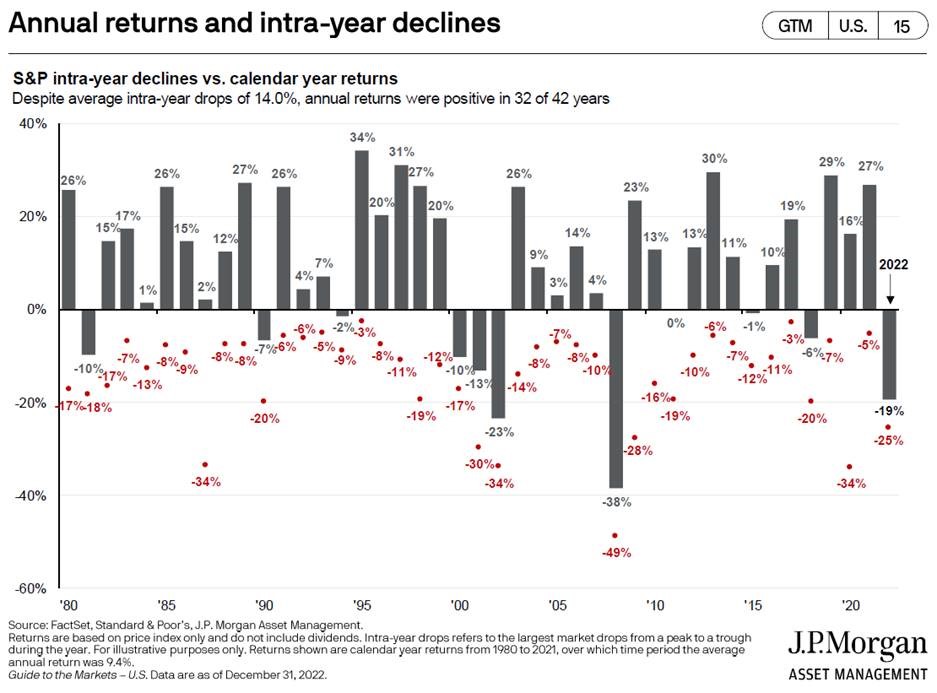

To start, 2022 was the seventh worst year for the S&P 500 in the last 100 years, and the 4th worst of the post-WW2 modern era. The first 4 months of 2022 experienced the fastest decline in the S&P 500 since 1939.

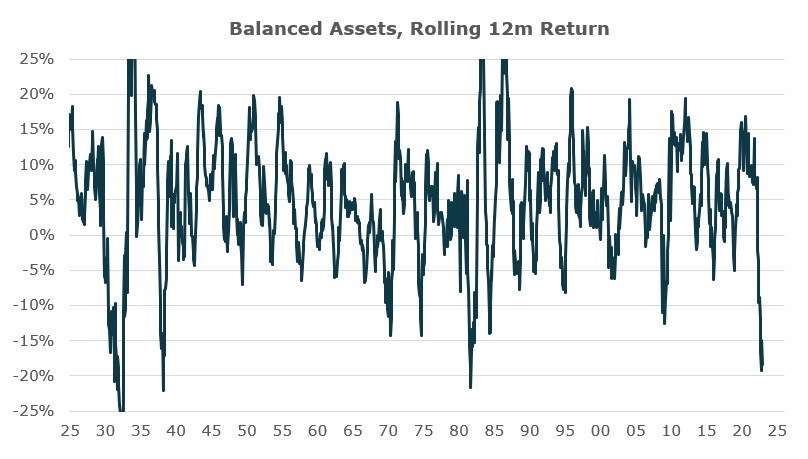

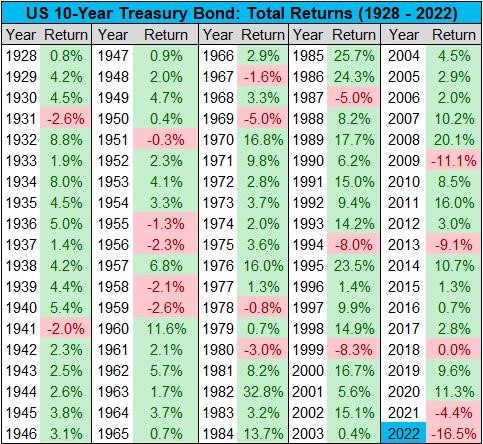

In addition, 2022 was the third worst year in the last 100 years, and the worst year post-WW2, for the balanced portfolio (defined as a 60% weighting in the S&P 500 and 40% weighting in the US 10 Year Treasury Bond).

To put it into perspective, Apple and Amazon were the biggest market cap losers in 2022, losing $830 billion each. With Tesla not far behind, losing over $774 billion in market cap and Microsoft trailing closely.

These are historical losses in absolute dollar terms, which we’ve never seen in the history of the capital markets.

Bob Elliott, CIO of a US-based hedge fund, said “Any way you slice it, this was one of the worst years for financial assets in all of history. The only other years where a diversified financial asset portfolio did this bad was the Volcker tightening [1974], the Depression [1931], and the premature 1937 tightening.”

At the beginning of 2023, it is interesting to look back over the stories that the market told itself one year ago. There were a lot of narratives of what we thought we knew about the economy at the end of 2021 that simply were not accurate or true.

It is remarkable how 2022 was an extinction-level event for narratives that had thrived in the previous few years. Michael Sembalist, Chairman of Market and Investment Strategy for JP Morgan Asset and Wealth Management, published a report looking at the equity market catalysts in the last decade, and in particular in 2021-2022, the peak pandemic years. What were the narratives that were driving growth during the pandemic years? These included:

-

Promises without profits. Profitless innovation and the millennial consumer subsidy (Uber, Lyft, Doordash, Peloton, Beyond Meat, DocuSign, Twilio, Teladoc, Carvana, Snap Inc., – growth at any cost with no bottom-line profits) – all have crashed;

-

Quantitative Easing. Not only has the Federal Reserve openly attacked the financial markets, it has also openly pushed for deteriorating economic conditions. Clearly QE is done;

-

Inflation was over (or at least contained) and we were in an era of eternally low inflation growth – definitely not the case as evidenced in 2022 (the highest inflation in 40 years);

-

Modern Monetary Theory – the idea that fiscal stimulus could solve basically any problem without negative consequences – a significant, and hard, lesson for governments around the world;

-

TINA acronym, There Is No Alternative to equities – that has disappeared with 1-year GIC currently offering more than 5% interest (highest GIC rates since 2007);

-

Metaverse and fintech narratives. Tens of billions of dollars committed with no result: dispelled and gone;

-

The pseudo-libertarian gibberish of unregulated crypto – billions of dollars lost in this carnage, not to mention the mounting illegal activity that occurred in the crypto space (FTX fiasco);

-

SPACs (Special Purpose Acquisition Companies) – see how Chamath Palihapitiya’s ventures resulted here

2022 has left a graveyard of economic and market narratives.

However, the markets are forward looking, and with 2022 behind us, the question for 2023 becomes how to set-up a portfolio to be at the forefront of a market recovery, when it occurs.

Market Update for January 9, 2023

Here we go...

A good starting point for discussion is: why do we even invest?

The short answer is: as individuals, we have to invest. The markets have never been more important to individuals, as businesses have shifted away from the defined benefit pension system in the past 30 to 40 years. A successful retirement in the future will depend upon personal retirement accounts such as Retirement Savings Plans (RSPs), Tax-Free Savings Accounts (TFSAs), and Defined Contribution Pension Plans (DCPPs), all of which require individuals to keep their investment dollars working actively.

As a result, most of the wealth for everyone (that is not in real-estate) revolves around the stock market and what the stock market does. It should not matter what the stock markets do each week, but it does matter due to the affect price changes have on the way people make decisions about spending, and how wealthy – or how poor – they feel.

We have said that stock market is not the economy – which is generally true – but that may be changing as the Federal Reserve is using the stock market as a tool to influence the economy. This is called the “Wealth Effect”, a behavioural economic theory suggesting that people spend more as the value of their assets rise.

The first trading day of last year, January 3, 2022, was the annual peak for stocks. The markets never traded higher after that and it was almost a waterfall straight down with a handful of corrective rallies along the way: every rally leading to lower lows. What we kept hearing about the economy was “The consumer is strong! The consumer is strong!”

In reality, what we’re learning is the consumer was running on fumes, and the economy is now starting to deteriorate and match what the stock market had been indicating it would do since the start of last year. It took a while but now the economic data is starting to reflect what stocks had already been presaging.

Though it may seem a contradiction, this is good news for savers and the 73 million millennials building the foundation of their wealth, as they have little choice but to invest for their retirement, still decades away. When markets are down in extreme scenarios, it is actually beneficial for young savers: they just don’t know it yet.

However, that is not the same for retirees who are no longer contributing to their investment accounts or withdrawing income from their portfolios.

Psychologically Impactful

There is an emotional reaction when an investor sees the value of an investment account go down, and it’s alarming and anxiety inducing. This is called ‘loss aversion’. People feel the effect of a loss multiples more than they feel the effect of a gain.

Academically, and psychologically, this is referred to as Prospect Theory, as originated from Nobel Prize Winner, Daniel Kahneman.

When investors review how difficult the investment year was, it is important to realize that they were not alone in 2022. Some of the best managed endowment and pension funds in the globe have seen declines deeper than -20% in 2022. Individual investors are not alone in this down year. Everyone is in this bucket, and this is not the end of the road. 2022 was a pothole in the road, albeit a rough one. There is a lot of mental energy that investors focus toward portfolio values and what stocks are going to do next, and of course stocks can – and will – do anything they want.

Stomach-churning stock market sell-offs are normal

What about Bonds?

2022 was one of the worst years of all time for bond investors. The purpose of owning bonds in a long-term portfolio is not to make a lot of money. The idea is that bonds are supposed to provide a counter-balance for when the stock portion of the portfolio is getting whipsawed, as we saw in the first half of 2022. Bonds are meant to be a stabilizer, offsetting stock volatility and providing ongoing income.

As central banks around the world embraced Zero Rate Interest Policy (ZIRP), by January 2022 bonds provided zero, or even negative, income and quickly became as volatile as stocks. In fact, it is the worst first six months for the US 10-year Treasury since 1788, literally back to when George Washington was President of the United States of America, and before they were even called Treasury Bonds. For the Balanced Portfolio investor, 2022 was a serious gut-punch as there was nowhere to hide assets from price declines. The Barclays/Bloomberg Aggregate Bond Index had its worst single annual decline ever.

Where is the opportunity?

The right way to think about the current environment is this: in December 2021 the stock market was trading at 23x earnings, which is historically high, and the bond market had effectively zero yield. Investors were not being compensated for any risk in the bond market. The only reason you owned bonds was for their “perceived” stability at the time.

Fast forward one year to today. The stock market is now selling at a 15x earnings multiple, meaning you’re buying stocks 30% cheaper than you were a year ago. And investors can take almost no risk in owning short term Treasury bonds that are paying 4.5% or GICs paying over 5%.

At this moment, investors are getting a much better deal than they were getting last year because the only thing that matters is not what already happened, but what happens next. Prospective returns are better moving forward, as stock valuations are lower and bond yields are materially higher.

The hard lesson of 2022: Interest Rates Matter

Bonds have a fairly straightforward mathematical relationship to interest rates. But all stock valuations are, at their core, the present value of future cash flows, and those future cash flows are also discounted using interest rates. In general, when interest rates go up, the present value of everything goes down.

The impact of interest rates is fundamental financial knowledge, and 2022 gave investors a jarring refresher course.

Interest rates affect stock prices in three ways:

-

The first way interest rates affect stock prices is through their influence on underlying business decisions. If a company can borrow capital at 0%, they’re going to do a lot of stupid stuff with the money. They’re going to make huge acquisitions and pay sky high prices (ex. Square – now Block – purchasing Afterpay; Teledoc purchasing Livongo). They’re going to do a lot of fruitless research and development, or incinerate funds into imaginary platforms with virtually zero ability to monetize the investment (Metaverse). Companies are going to make outrageous choices if the cost of capital is zero. And if the cost of capital is zero for 12 years, like it has been, parts of the market are going to become cartoonish, and that’s exactly what we’ve seen happen. Investors are going to behave the same way. Investment dollars will flock to the promise of future growth, with absolutely no chance of profits anytime soon and be perfectly okay with that. They’re going to buy digital coins. They’re going to speculate in digital art (Non-Fungible Tokens (NFTs)). 2022 went through all of that. When interest rates changed, the behaviour changed.

-

The second way that interest rates affect stock prices is valuation. Every portfolio manager, every pension fund, every insurance company, must allocate new cash. Cash flows in investment portfolios routinely and managers have to put it to work somewhere. Cash cannot be held as cash forever, especially if inflation is 7.5%. The question is not “should I invest?” the question is “what do I invest in”? When rates move up, all of a sudden high-yielding short term corporate bonds and largely risk-free Treasury bonds become a viable alternative, driving a decline in the valuations of stocks. If the “next investable dollar” can buy a two-year Treasury at 4.5%, and that satisfies the investor’s goals, the case for buying an expensive high-growth company with unsure profits and much higher volatility becomes much less attractive.

-

The third way interest rates affect stock prices is sentiment. And this may be the most important effect. Great companies exist that can, for the next ten years, grow earnings by 10% or 15% a year while still protecting their profit margins. The core variability is what investors will be willing to pay for those yet-to-be-realized future profits. Low interest rates are analogous to high earnings multiples – it takes a longer period of time to be paid the same amount of money from an investment. Low interest rates and low inflation buoy the ‘hope’ that is always present in the stock market. Conversely, higher rates and high inflation will quickly erode that hope and flip it to pessimism, destroying positive sentiment and erasing investor’s willingness to pay higher multiples on stock valuations, even for the best companies with rock-solid businesses.

In those three ways, we have witnessed 2022’s significant and rapid global interest rate increases assert their effect on stock prices, leading to profound changes in sentiment, valuation, and business practices. The bond market has provided a head-spinning masterclass on the fundamental importance of interest rates to novices and professionals alike.

An Uncomfortable Reality of Investing

Without a doubt, if you’re an investor, you should prepare yourself to see a bear market every 5 years on average, and one-third of those bear markets is going to lead to price declines of 30% or more. We believe that accepting the reality of ‘bear markets’ is important, even if it might turn some investors off.

It is easy to look for the one strategy that worked the best in 2022 and desire to pivot toward it, or to look for somebody who says “We are only going to make money! We are never going to lose money!” However, we refuse to accept those platitudes, and sophisticated investors know better. What worked in 2022 will likely not work in 2023, we have never come across a group or strategy that can accurately time the markets in a systematic and repeatable manner.

It bears repeating, volatility is a function of a healthy market – not an ailment. Investors need to embrace – and be comfortable with – volatility to be successful in the long-run.

The Importance of Financial Planning

The important take-away is to bake these market episodes into investors’ expectations when we build financial plans for clients. The financial planning process seeks to uncover the purpose of your money, and ensure your investment portfolio will satisfy the goals you have made. When are you going to use it? Why are you going to use it? With whom will you share your wealth? What is your tax situation? What is the impact of changing inflation?

It is critical to have a financial plan. Every plan we undertake for clients has an alternate scenario analysis which includes -10% and -25% declines in investable assets factored into the plan. The purpose for this scenario analysis is exactly for years like 2022: so that even in the midst of a significant market crash, investors can take comfort in knowing their situation remains secure.

Are financial bubbles, like what occurred during the pandemic, ever good?

Believe it or not, there are benefits to bubbles.

With the economic firepower deployed as a response to the pandemic, society advanced in important technologies, such as cloud computing, faster than we would have otherwise. This enabled companies to bring new and efficient technologies to market relatively quickly, arguably a very positive development from the urgency created by the pandemic. Having two-thirds of the workforce transition overnight to doing their jobs remotely – compared to a fraction before the pandemic – has left an indelible mark on society and the economy.

Good things do occur from the collapse of asset bubbles, as innovation and progress typically occur when people are going through hardship and they need to innovate their way out of it. An asset bubble bursting is the origin for companies like Uber and AirBnB. These highly innovative and disruptive companies were created during the Great Financial Crisis and subsequent recession of 2008/2009.

Asset bubbles collapsing also play a critical role in maintaining the long-term health of financial markets, as they expose systemic fraud hidden by too-favourable conditions. Take for example the Great Financial Crisis, which exposed Bernie Madoff’s Ponzi scheme, and the systemic “No-Income-No-Job-or-Assets” (NINJA) mortgage fraud perpetuated by AIG.

2022’s asset bubble will be remembered for the collapse of endless fraudulent cryptocurrencies and the valueless NFT market, as well exposing massive fraud and corruption at crypto trading platforms such as Voyager and FTX, and their attached hedge fund and private equity life-support system, which lost investors, and even entire countries, hundreds of billions of dollars.

Will there be a recession in 2023?

To be honest, the recessionary risk is a coin flip. Investors of all stripes will argue and twist themselves into a mental pretzel, and there are strong cases made by strategists on either side of the debate. The real question is: Will the answer to the recession question effect anything relating to portfolio management? Surprisingly, no.

The stock market is forward-looking and will trade in anticipation of a recession. A critical point about recessions is we do not find out that we are officially in a recession until we are more than halfway through. The official recession call, if and when it comes, is a purely technical definition, and will be obvious by the time it is confirmed. In the midst of the recession, when you’re getting the confirmation, the seeds have already been planted for the recovery.

Keep in mind that the economy did well in 2022. It added over 4 million new jobs, corporate earnings increased, and the back-half of 2022 saw real GDP grow at ~3%.

And yet, the stock market was down -20%.

I would not use the "is there going to be a recession in 2023?" as a reason to invest or not invest. The market has already priced in an awful lot.

Summary

We have just been through a horrific year for investors. The S&P500 closed down about -20% on the year, but the average stock is not down -20%. The median stock price is down more closer to -30% to -40%. It has been that bad.

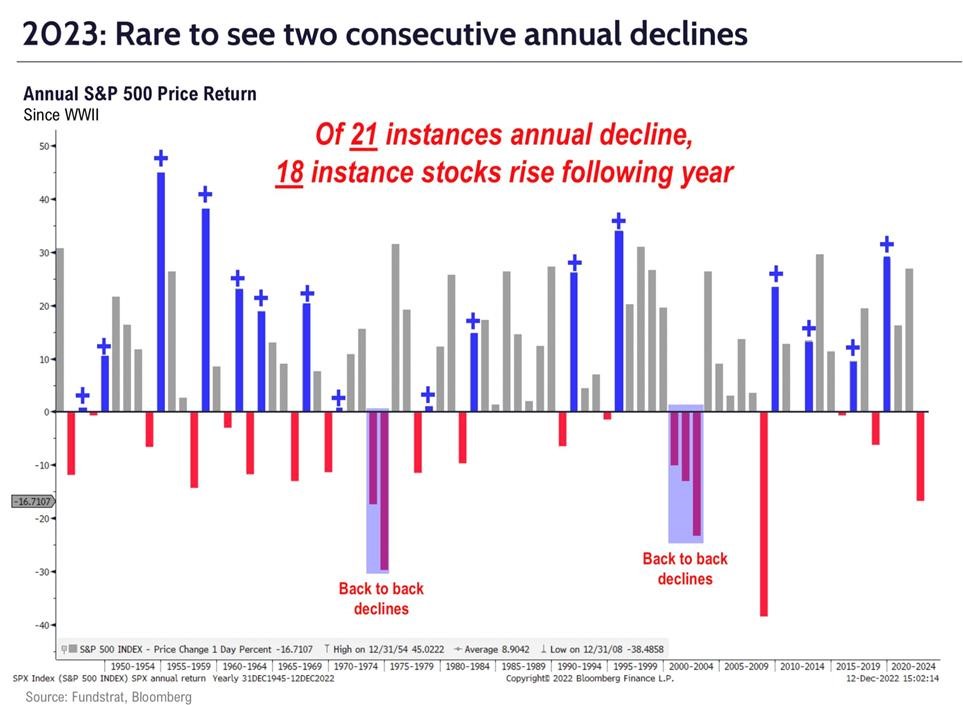

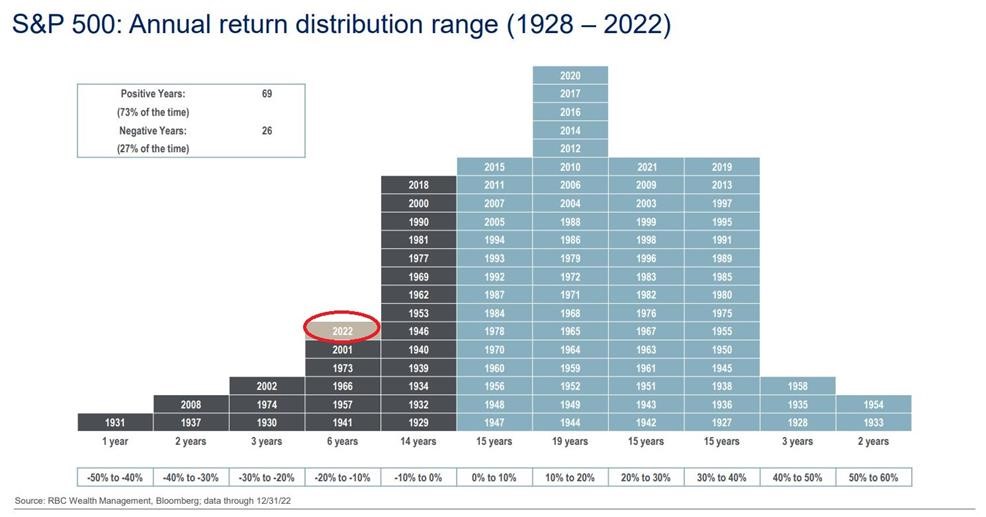

However, here is the good news historically: stock prices rarely move down two years in a row.

Here is a figure to keep in mind as we enter 2023: 85%

Historically speaking, there is an 85% probability that stocks are going to go up in 2023.

Since WW2, there have been 21 years where the S&P500 experienced a loss compared to the previous year’s closing value.

Of those 21 “down years”, 18 were followed by an increase in the price level of the S&P500. That leaves just three years where back-to-back losses were experienced, and in fact included only two periods. 1973 and 1974 were back-to-back losses triggered by the 1973 oil crisis, and exacerbated by high inflation triggered by the Vietnam War and Nixon ending the Gold Standard. 2000, 2001, and 2002 was the sole instance of losses accruing back-to-back-to-back, beginning with the collapse of the notorious NASDAQ tech bubble in 2000, and further damaged by the 9/11 terrorist attacks and the subsequent wars in Afghanistan and Iraq.

To think that because 2022 was a bad year - so 2023 will also be bad - is a form of recency bias and can lead to bad decision making by investors.

As bad as things have recently been, and while they could get worse, investors should keep an open mind about the fact that historically they do not.