2021 Final Thoughts

There are essentially 2 ways to make money in the capital market:

1) Trading stocks, or;

2) Investing in companies.

We don’t trade stocks, we invest in companies. In our view, the highest probability for clients to compound their capital, over the long-run, is to invest in a select basket of high quality businesses.

There are three ways you can invest:

- Bet on an emerging company becoming good

- However you will need to place a lot of bets as the success ratio on any emerging company is modest

- Bet on a damaged company repairing itself or becoming less damaged

- However you have to rinse and repeat for consistent returns, always trying to find the most undervalued companies

- Bet on a great company staying great and hold the investment for years as the company compounds

We prefer method 3, buy great companies with good track records and hold those companies. The market has a litany of examples that demonstrate no company is immortal, and all companies need to be continually reviewed, but the chances of a great business model staying great is, in our view, significantly higher than the ability to systematically execute on strategies 1 and 2.

Ted Weschler was a former portfolio manager for a hedge fund, Peninsula Capital Advisors, for 12 years where he enjoyed enormous success. In 2012, Ted was recruited by Warren Buffett to be an equity portfolio manager at Berkshire Hathaway, along with Todd Combs, where he now oversees over $20 billion in investments. Ted’s final letter to shareholders of Peninsula Capital, before beginning at Berkshire Hathaway in 2012, was his last public comments on investing. He articulates the important points of managing money, which are analogous to our investment philosophy:

Putting myself in your shoes, there are a few observations I think are appropriate:

- I have never been good at picking stocks for less than a one-year horizon – in fact, I have always guided toward measuring success or failure over a three-year period. Along these lines, the individual stocks you [own] can change in value substantially (up or down) over any given time period, but the likelihood of their value appreciating increases based on your investment horizon, i.e., the longer your expected holding period, the higher likelihood of increased value,

- Many financial pundits view stocks as inherently risky, and they are. That said, they are not necessarily more risky than other ‘safe’ assets, e.g.., U.S. Treasury bonds. As an example, the U.S. government can currently borrow money for 10 years at roughly 2% annual interest. If you chose to lend the government $100 for 10 years at 2% and interest rates suddenly shifted, (e.g. due to inflation) to 10%, the value of your $100 “safe” investment would fall by half. Companies can be adversely impacted by things like inflation as well, but businesses are generally in a much better position to evolve and adapt to outside influences (like inflation), while a Treasury security is simply a contract with no ability to adapt,

- One of the key roles I’ve played at Peninsula on your behalf over the past 12 years is resisting the temptation to sell – doing nothing can run counter to a serious work ethic, but in the world of investing it can be a very effective strategy in that it….1) minimizes taxes, and 2) respects the fact that as a practical matter, market timing is a fool’s errand.

What will the stock market do next year?

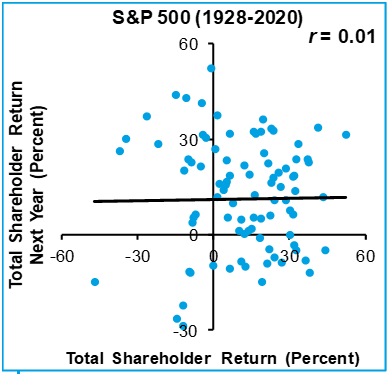

This is a good time to recall that this year’s stock market performance tells us essentially nothing about what the stock market will do next year.

The chart below shows the correlation of total returns in any given year compared to the next calendar year. Statistically, the chart is totally random. Historically, there has been no discernable relationship between the returns of any two back-to-back years. If there is anything to draw from the analysis, it is the fact that on scatterplot most of the dots are clustered in the upper right quadrant, in other words, most of the time, stocks are positively predisposed to going up. Or, annual returns tend to be positive. Remember, you have a better chance of achieving >20% return than a negative return in any given calendar year (including after a year of strong returns).