*****

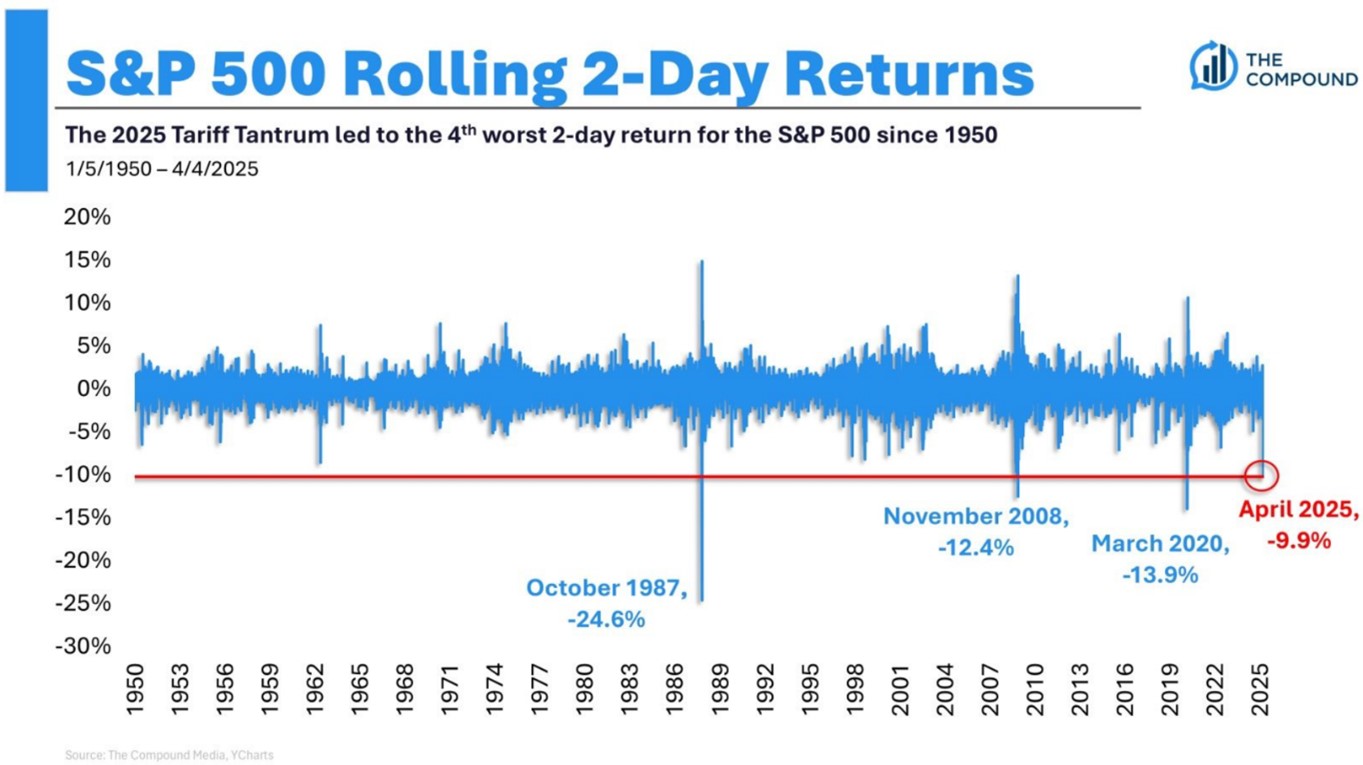

Thursday/Friday were the 4th worst two-day returns in the S&P 500 since 1950.

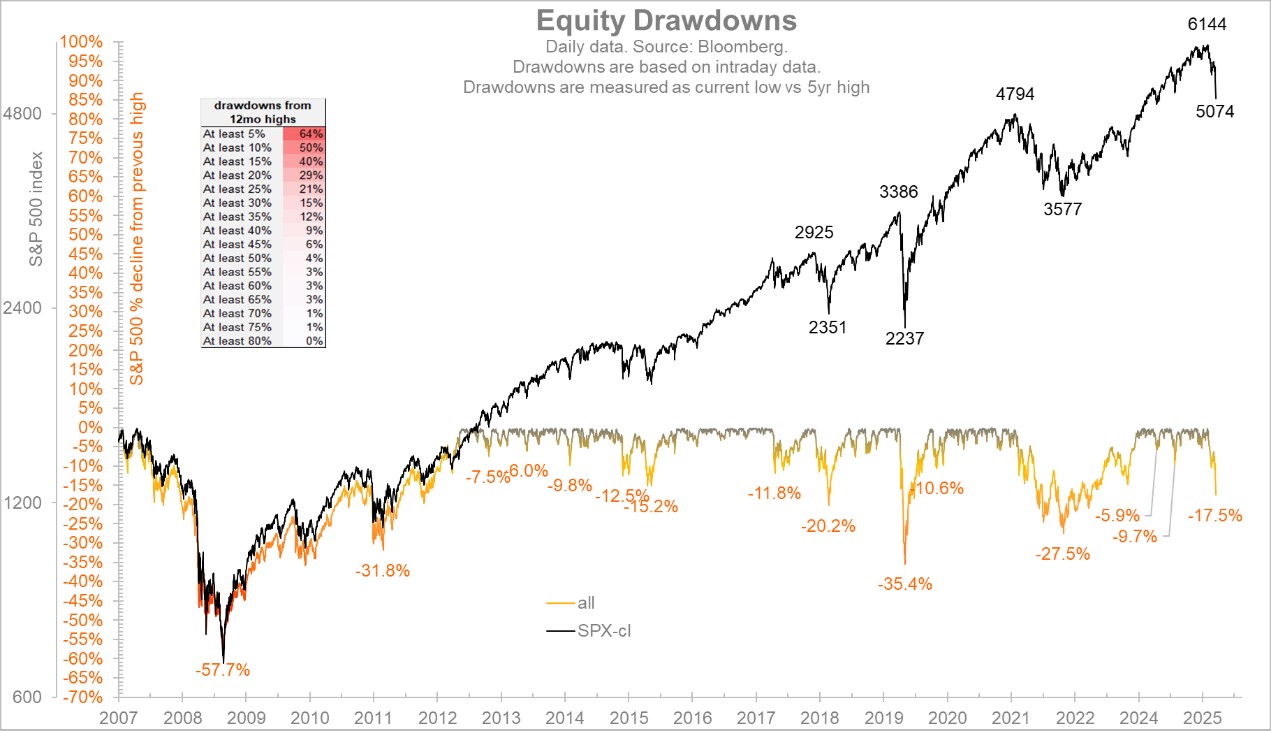

The S&P 500 is down 18% from its high and it has done so in short order. Declines of this magnitude happen every few years. The last one was in 2022 (-28%), the one before that was in 2020 (-35%) and the one before that in 2018 (-20%). So, this happens every few years, and the market always recovers, often quickly and sometimes slowly.

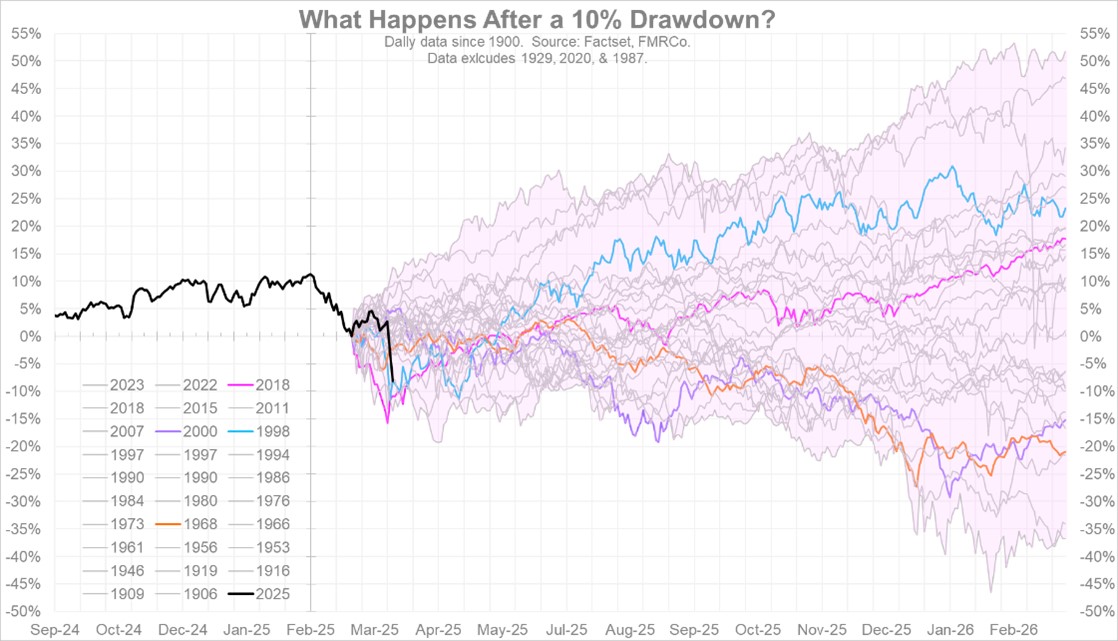

Historically, forward S&P 500 returns are strong when current volatility levels are reached. Volatility likely won’t subside soon, but there is historical evidence to remain invested (and invest more if you can).

“What happens after a 10% drawdown?”. The good news is that we are now near the bottom of the range in terms of speed and magnitude. That suggests that the market could find some balance in the weeks ahead.