Tax-free savings account limit

The tax-free savings account (TFSA) limit will remain at $7,000 for 2025. That’s because the TFSA limit only gets increased when the cumulative effect of the annual inflation adjustments after 2009 (the year the TFSA began) is enough to push the limit to the next highest $500 increment. The indexed TFSA dollar amount for 2025 is now at $6,963, meaning that the limit gets boosted to $7,000, the closest $500 increment.

Registered Retirement Savings Plan limit

The Registered Retirement Savings Plan (RRSP) dollar limit for 2025 is $32,490, up from $31,560 in 2024. Of course, the amount you can contribute to your RRSP in 2025 is limited to 18 per cent of your 2024 earned income, which includes (self-)employment and rental income, up to the RRSP dollar limit of $32,490, plus any unused RRSP contribution room from 2024, subject to any pension adjustments.

Old Age Security (OAS)

If you receive Old Age Security, the OAS repayment threshold is set at $93,454 for 2025, meaning that your OAS will be reduced in 2025 if your taxable income is above this amount.

Basic personal amount

The basic personal amount (BPA) is the amount of income you can earn without paying any federal tax. Back in 2019, the government announced an increase of the BPA annually until it reached $15,000 in 2023, after which it was to be indexed to inflation.

As a result, for 2025, the increased BPA will be $16,129 meaning an individual can earn up to this amount in 2025, before paying any federal income tax. For taxpayers earning above this amount, the value of the federal credit is calculated by applying the lowest federal personal income tax rate (15 per cent) to the BPA, making it worth $2,419. (Because the credit is “non-refundable,” it’s only worth the maximum amount if you otherwise would have paid that much tax in the year.)

But higher-income earners don’t get the full, increased BPA, as there is an income test. The enhancement to the BPA is gradually reduced, on a straight-line basis, for taxpayers with net incomes above $177,882 (the bottom of the fourth tax bracket for 2025) until it has been fully phased out once a taxpayer’s income is over $253,414 (the threshold for the top tax bracket in 2025). Taxpayers in that top bracket, therefore, who lose the enhancement, will still get the “old” BPA, indexed to inflation, which is $14,538 for 2025.

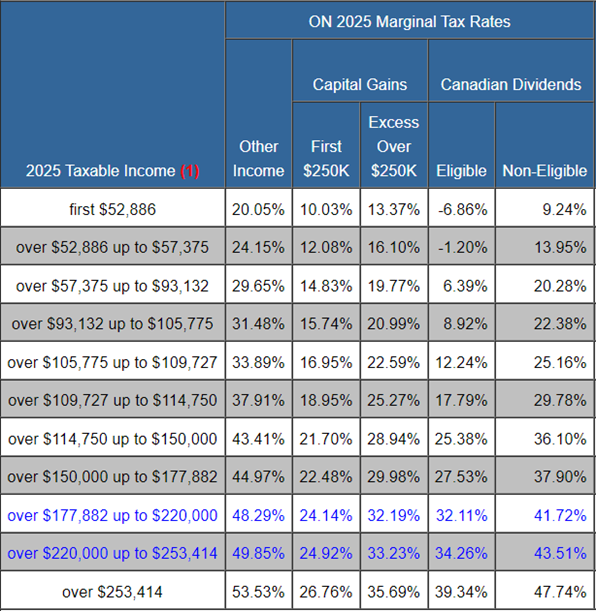

Tax brackets for 2025

For 2025, tax brackets have been indexed to inflation using the 2.7 per cent rate. Please find the 2025 Marginal Tax Rates below.