In the world of investing, the journey to creating wealth is often anything but a straight line. It's a rollercoaster of highs and lows, twists and turns that can challenge even the most seasoned investors. In this edition, we explore the dynamic nature of wealth creation in the stock market.

1. Embracing Market Volatility

Contrary to popular belief, the market is not a linear path to financial success. Markets are subject to constant fluctuations influenced by a myriad of factors such as economic indicators, geopolitical events, and unforeseen circumstances. Understanding and embracing this volatility is crucial for long-term success.

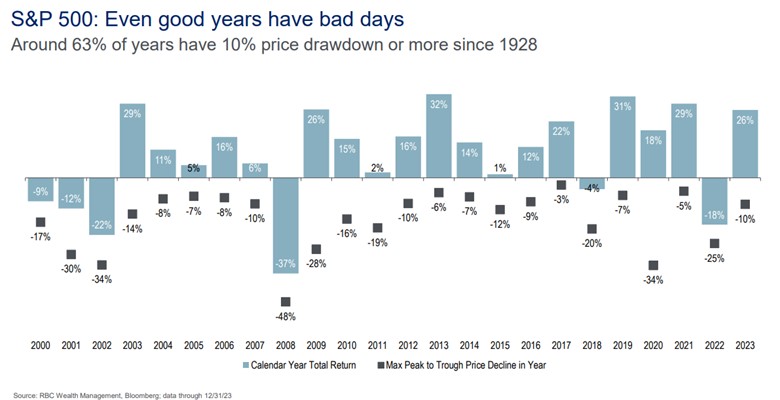

An investor must always remember, there will be drawdowns. When markets move lower, investments become cheaper and the risk/reward to for long-term investors improves. If you measure time horizon in decades as opposed to days, market corrections can be viewed as an opportunity to add new capital at lower prices.

Market corrections are inevitable and without them, there would be no upside.

2. Diversification: A Key to Resilience

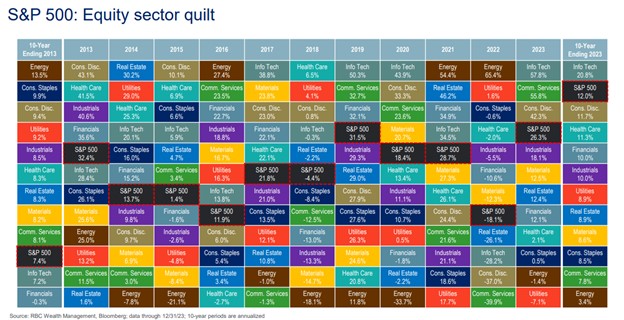

Creating wealth involves more than betting on a single stock or sector. Diversification is a key strategy to mitigate risk and enhance the resilience of your investment portfolio. By spreading your investments across different assets, you can better navigate the inevitable market twists.

In the chart below, each investment category varies in performance from year to year relative to other asset categories. Diversification may be able to help mitigate losses by diversifying across multiple types of investments.

3. Adaptability and Continuous Learning

Successful investors understand the importance of adaptability. The stock market evolves, and so should your investment strategy. Staying informed, continuously learning, and adjusting your approach based on market dynamics is essential for sustained wealth creation.

4. Patience as a Virtue

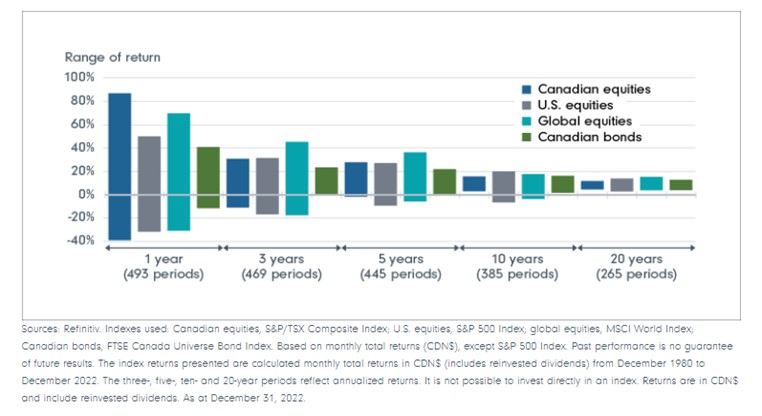

In a world driven by instant gratification, patience remains a timeless virtue in the stock market. Market corrections and downturns are part of the process. Patiently weathering these storms can lead to significant gains over the long term.

Staying invested over time reduces volatility across different investments. Historical data emphasizes the benefits of a consistent, long-term investment approach.

5. Consider Professional Advice

Seek guidance from wealth professionals, such as Finucci Janitis Allen Wealth. With $1.4 billion in assets under management, our expertise can provide valuable insights and help you make informed decisions aligned with your financial goals.

Final Thoughts

Creating wealth in the market is an intricate journey, filled with challenges and opportunities. By recognizing the non-linear nature of this path, staying diversified, remaining patient, adapting to change and obtaining professional advice, investors can position themselves for enduring success.

Whenever you’re ready, here’s 1 way we can help.

We help high-net worth investors and entrepreneurs to grow and protect their wealth.

Vito, Eric & Rachelle

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.