“History shows that, over a long period of time, government will spend whatever the tax system raises plus as much more as it can get away with.” – Economist Milton Friedman

After a challenging year for virtually all asset classes in 2022, this year has seen gains for a very narrow group of larger cap tech names. Everyone knows who they are: Tesla, Apple, Microsoft, Nvidia, and Meta/Facebook. This group has recovered on the backs of strong earnings and an investor feeding-frenzy for anything possibly related to AI (Artificial Intelligence).

This lack of breadth is the worst we’ve seen since the 1999 Dot-Com tech bubble. Tech may have a hard time continuing to lead the charge because valuations are so far stretched. Nvidia, for instance, has traded recently at 40X price to sales. Cisco (CSCO) at the Dot-Com peak in 1999, traded at what was considered “expensive,” just over 30X sales, and has only recovered its stock price in recent months (two decades later) to its 1999 price levels.

Traders are gradually resigning themselves to the fact that the U.S. Federal Reserve (the Fed) is not done with its rate hikes. The Fed meets in week or so, but the mood on Wall Street has certainly changed. Traders now realize that the Fed will not let up until inflation is gone.

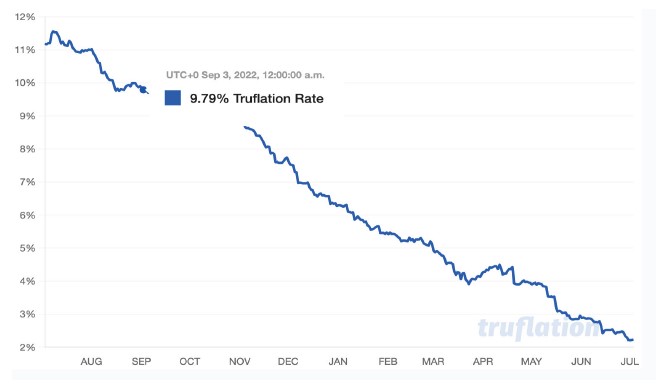

There is a website called “Truflation” that computes inflation on a mostly real-time basis. Here’s the latest from them as I type on the July long weekend: (it says we are at 2.20%, but it doesn’t feel like 2.20%).

(Source: Truflation https://truflation.com/)

The Fed follows the least path of embarrassment. The Fed does not try to make money (if it does it’s a bonus), but it does care about politics, optics and public opinion. They missed inflation entirely with their foolish “transitory” theory. Then they were slow to ramp up rates when needed. Why?

There were two possible scenarios for them to take:

- Hike rates and fight inflation, bringing it down earlier than expected; or

- Hike rates early in error and cause a recession when it may not have been necessary.

Which did they choose? That is right. The least embarrassing one.

Today the Fed again has two choices:

- Keep hiking interest rates and fight inflation as they have clearly stated; or

- Pause, and watch inflation go higher.

Which of these current possibilities will cause the most embarrassment for the Fed? Clearly, the latter.

The mood change is also apparent in the stock market. For much of this year, growth stocks were leading value stocks. Lately, however, value stocks have struck back. This is likely due to the changing outlook for the Fed policy mentioned above. When rates go higher, investors become more conservative. We just cannot say if it’s a meaningful turn we have been looking for, but it is good to see.

I think too many investors thought that lower rates would bring us back to the free-and-easy investing of the COVID-19 years. When rates are near 0%, P/E Ratios really do not mean much. Now that rates are over 5%, investors have become a lot more discerning because there is now a decent risk-free alternative.

My concern is that too many growth stocks have been allowed to get to a very rich valuation without any market pressure. We have not had any meaningful correction or pause since March. A good example, in fact, may be the ideal example: Tesla (TSLA). I need to preface this by stressing that I am in no way anti-Tesla, but the stock has had a remarkable run this year. At one point, shares of Tesla were up 120% this year. The stock was trading at nearly 100 times this year’s estimated earnings.

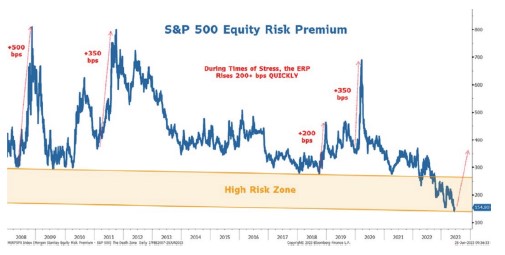

To provide a little food for thought on why that might be the preferred course of action, please take a good look at the following chart. What this is measuring is the well- known (at least by investment pros) equity risk premium. This metric compares the earnings yield on stocks with the interest rates that can be had from government bonds.

(Source: Gavekal Research - Haymaker - Friday Edition In The Ring - June 30th, 2023 )

What is clear is that equities are in a higher risk zone compared with bonds. What is also clear from the chart above is that the current status is not typical. In fact, it is very “atypical,” at least over the last decade. Admittedly, this was a period of unusually — and artificially — suppressed interest rates. Yet, the last time the equity risk premium (ERP) was this low was in 2007. You may recall that what followed was a rocky period for the stock market — i.e., a brutal bear market.

We also like to track the VIX, which is the Volatility Index or, as some call it, the Fear Index. Last Thursday, the VIX closed at 12.91, which is a three-and-a-half-year low. The last time the market was this calm was just before COVID-19 hit.

(Source: Stockcharts.com)

Since 1956, there have been 13 instances where stocks have rallied 20% (as we have from the recent October market lows): 12 times (or 92 % of the time), stocks are +17.7% higher a year later. Only three times did stocks make new lows; two times it was during the tech bubble and once during the 2008-09 financial crisis.

Ultimately, Fed Chair Powell has himself declared he wants to be seen as a Paul Volcker-type Fed Chair rather than an Arthur Burns. For those who are not aware of Fed Chair history, Burns was the Fed Chair from 1970 to 1978 who kept monetary policy too loose and let inflation reignite, whose name is now “Monetary Mudd.” Volcker came in as Fed Chair in later 1979 and tightened monetary policy to what was then considered excruciating levels in the early 1980s (when I started in finance with RBC). Despised by many at the time, he is now regarded as the slayer of the great inflation dragon that Burns let loose.

Now, Powell has a tough decision as we are on the cusp of a Presidential election in November 2024, in which any moves by the Fed could have a huge impact on the results of the election, depending on how the impact of his policy plays out. A hard recession in 2024 could make Powell more of a Burns than a Volcker.

Going forward, everything hinges on inflation levels and, subsequently, the path of interest rates. Central banks may be forced to decouple rate policy from inflation given we are starting to see things “break” (like the U.S. regional banks in Q2).

In my overall macro view, these markets have seemed a bit tougher to figure out than past cycles. I think that is because most economic models and predictions have been suffering from that psychology phenomenon of “recency bias.” We have lived through an extraordinary 40+ years with three distinct advantages that are, most probably, very unlikely to repeat:

- Low debt with lower interest rates;

- Favourable demographics, especially in North America;

- Plentiful, cheap energy.

Are these three advantages now gone?

Stay tuned,

Vito, Eric and Rachelle