Market volatility is an inevitable part of investing and although challenging, with the right strategies, investors can steady their portfolios and seize opportunities amidst the uncertainty. In this edition of Our Two Cents, we explore 5 essential strategies designed to manage and mitigate volatility, ensuring that your portfolio remains resilient through market fluctuations.

1.Maintain discipline

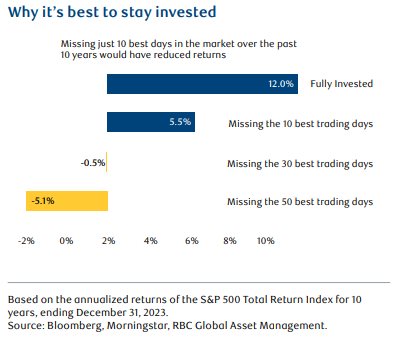

Reacting to short term market noise by making dramatic portfolio changes, like moving in and out of the markets, can have a negative impact on achieving your long-term investment goals. By maintaining discipline and perspective during market downturns, history has shown that patient investors have been rewarded when markets returned to an upward path. An investor who stays in the market generally has a much higher probability of long-term success than one who tries to pick the perfect time to invest.

2. Use time to your advantage

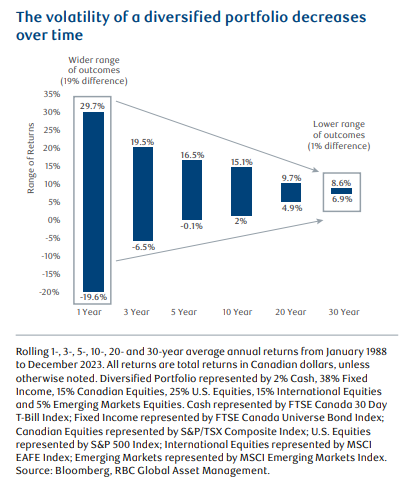

Staying invested and trying not to ‘enter and exit’ the market when volatility increases can help reduce fluctuations over the long term. The longer an investment is held in a portfolio, the less chance it has of incurring a negative rate of return. This is because fluctuations in value tend to smooth out over time as the impact of market volatility diminishes. In addition, years of strong equity markets can outweigh periods of decline resulting in long-term returns that outperform other asset classes.

3. Regularly rebalance

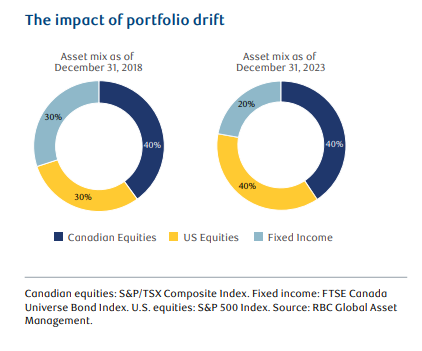

Market fluctuations can often cause a shift in how your assets are divided in your portfolio (commonly known as portfolio drift), leading to a very different asset mix and an investment experience than originally intended.

Rebalancing is an effective way to stay on track to reach your investment objectives. It helps keep your portfolio aligned with your investment goals and risk tolerance and gives you the opportunity to lock in gains from one asset class and redeploy them to other asset classes that have become inexpensive.

4. Diversify your portfolio

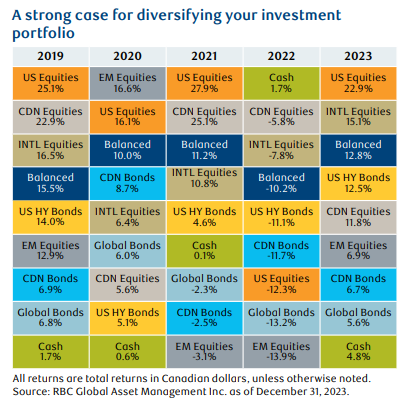

Diversification may help reduce portfolio volatility and risk. This means including in your portfolio a combination of investments from different asset classes, including cash, fixed income and equities, as well as different industry sectors, geography graphic areas and investment styles. Financial markets do not move in conjunction with one another, and individual asset classes will perform differently in any given year. At any time, one asset class may be leading the market, while the others lag.

Diversification can help reduce the impact of market volatility on your overall portfolio by combining assets that react differently to changing market conditions. As the chart below shows, it can be difficult to predict which asset classes will lead the market each year and which ones will underperform.

5. Invest regularly

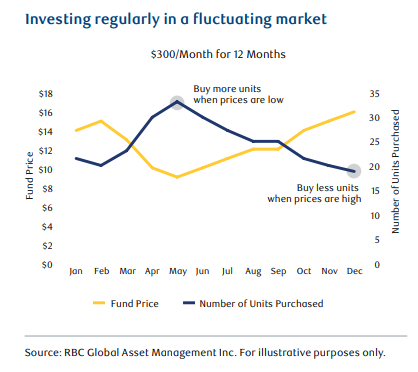

Investing a fixed amount on a regular basis ensures that your investment strategy remains a priority through all types of market conditions.

Regular investing also provides the opportunity to help smooth out returns over time, ultimately reducing overall portfolio volatility. This is achieved because investing a fixed dollar amount on a regular basis gives you a chance to buy more investment units when prices are low and fewer units prices are high, producing a more level investing experience over the long term.

While market volatility can be unsettling, employing these 5 strategies can help safeguard your portfolio and position for long term success. Remember, the key to weathering volatility lies not in avoiding it, but in equipping yourself with the tools and strategies to turn challenges into opportunities. Stay informed, stay disciplined, and your portfolio will be better prepared for whatever the market may bring.

Learn about Finucci Janitis Allen Wealth

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved