"Only when the tide goes out do you discover who's been swimming naked"

- Warren Buffett

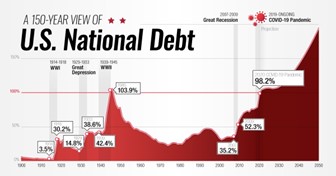

The US national debt will most likely exceed an incredible $34 trillion by year-end. That’s up by nearly $10 trillion dollars since January 2020, with $8 trillion added in 2020 and 2021 alone. In the last six months, the US national debt grew at its fastest pace ever. The problem with large national debt isn’t that it’s big or difficult to pay off – in fact, an enormous debt can be sustained indefinitely by government so long as it manages to pay the interest – the problem is when interest rates rise. For most of the past three decades, the US government has had it easy in this respect: It ran up huge deficits, incurred trillions of dollars in new debt, and interest payments on that debt remained remarkably stable, leading to a false sense of security.

The fact is, interest payments will gradually consume the entire federal budget. It’s here were we start to see the problem with such huge debt levels – payment becomes far more sensitive to movements in interest rates.

(Source: https://www.crfb.org/blogs/debt-rises-interest-costs-could- top-1-trillion)

In practical terms, this means that a government with enormous debt levels likely can’t sustain a sizable increase in interest payments.

(Source: https://www.visualcapitalist.com/timeline-150-years-of-u-s- national-debt/)

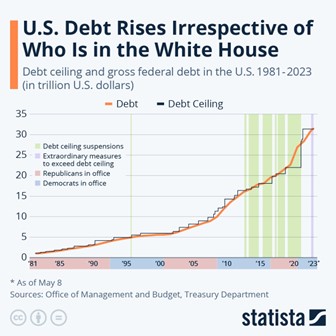

And lately, it doesn’t seem to matter who’s in charge:

(Source: www.statista.com)

Furthermore, central banks will no longer have the freedom to force down interest rates as they did a decade ago. Back then, then they simply bought up new government debt to prop up demand and keep the rates it was issued at down. This required central banks to engage in significant monetary inflation on top of the fiscal inflation the governments engaged in. And some still wonder how we got where we are!

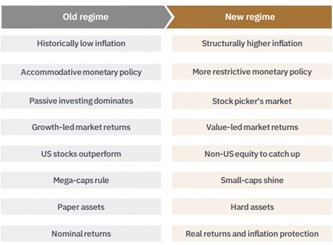

The era of easy money is over, and we are starting to see the market shifts that come with it. The Fed can no longer print up an additional trillion dollars to buy up government debt and simply hope no price inflation appears. We are in the process of unwinding the last decade’s policies that resulted in higher structural inflation and a challenging return environment.

At some point, the voters are likely to say “enough” when it comes to escalating debt payments. And that’s when the risk of hyperinflation or a sovereign debt crisis could pop up.

The past decade’s playbook won’t work for the next decade. It’s time for a new playbook and market rotation. New leadership is emerging, favouring value over growth as well as hard assets and shorter durations. Stock picking will matter more than just riding indices as earning valuations tighten.

Those paying attention have already noticed structural changes taking place in interest rates and inflation. Next will come valuations and artificially low interest rates being replaced by normalizing rate levels. The artificially low volatility we’ve experienced will most likely change. Artificially higher asset prices (ahem Crypto, NFTs and Meme Stocks to name a few) will revert to a time where fundamentals matter once again.

Equity markets, which have become over-indexed (and which account for a lot of the moves in the Magnificent Seven), will revert to active over passive management. The rising tides that lifted all ships in the past will now disclose who’s swimming naked, as Mr. Buffett said.

(Source: Canoe Financial)

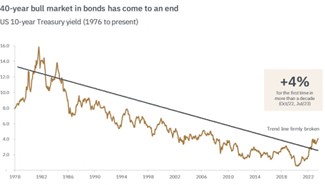

And in the fixed income markets, where interest rates have been declining on a longer trend since the early 1980s, the 40-year bull market in that asset class has come to an end:

(Source: Canoe Financial)

Recessions are ultimately about mistakes. They reflect too much optimism given underlying economic conditions and the need for economic activity to adjust lower. Covid spending programs have wound down, and consumers won’t have the same purchasing power. Businesses are facing labour cost pressures escalating quicker than productivity growth. Government policies implemented the past several years have proven to not boost long-term growth prospects, and although AI might add productivity gains down the road, it’s far from generating enough short-term growth to help prevent a downturn.

Speaking of mistakes, this current US Federal Reserve is trying to avoid the “Volcker Mistake.” Fed Chair Powell does not want to repeat the mistake of Paul Volcker, who also fought inflation with rate hikes, but cut rates too early and came to regret it.

When Volcker was appointed Fed Chair in 1979, he immediately set out to tame the worst inflation the US had seen since the end of WWII. Then the US was hit by recession in January 1980, and Volcker came under intense pressure to cut interest rates. Volcker blinked. He lowered interest rates by seven percentage points.

The recession was over by July 1980, but inflation was not. The Fed (and Volcker) had damaged all credibility as inflation fighters. They were forced to raise rates again.

This became known as the “Volcker Mistake.” If Volcker had ignored the 1980 recession, inflation might have come down by 1981. Instead, it lasted until 1983 and was only defeated by a recession worse than the one Volcker was originally worried about. I know this period of history well – I started with RBC in the summer of 1982. We are not back to the 1970s yet, but there are similarities.

Great society spending pushed government spending on a steep trajectory in the 1970s in spite of the wind down of the Vietnam War. Today, we have two major wars eating up spending. The result then was a wet blanket of large government spending, slowing growth but boosting inflation with “easy money.” Sound familiar?

Back in the 1980s, President Reagan came under enormous political pressure because he presided over a budget deficit that peaked in 1983 at, get this, 5.9%! The Biden administration’s budget deficit for this year (about $1.74 trillion) will be 6.5% of GDP.

Powell does not want to repeat the “Volcker Mistake.” He knows how it turned out, and he doesn’t want to go down in the history books repeating the error. We all know legacy is very important to today’s bureaucrats. I would guess the Fed remains firmer for longer.

I’ve been saying for some time that I believe the unprecedented explosion in US government spending is the key reason a recession has yet to materialize. A surge like we’ve seen in deficits this large can sometimes artificially maintain growth in the short term. But given the now higher interest rate scenario, it can’t last.

Show me insane US government spending (like they have been), a historically high US dollar, a 10-year rate at 5%, widening credit spreads and lower consumer confidence (largely due to higher mortgage rates), and I will magically show you a US economy where government deficits will soon be non-stimulating.

For now, the punch bowl is still going, but the hangover will come. Deficits will matter. But hey, we’ve survived the insanity of 2020 to 2022, for which most of which the global economy was literally shut down. We will deal with this as well. We are focused on positioning for this coming cycle, looking at energy, commodities, materials, value over growth, cyclicals, industrials and proactive over passive strategies.

As always, we appreciate the confidence and trust our clients put in us, and we will continue to do our best to continue to earn it, and will endeavour to the best of our abilities to figure out what is taking place in this rapidly changing (crazy?) world of ours.

Stay tuned,

Vito, Eric and Rachelle