If you are a business owner with retained profits or surplus cash, you know the challenge of holding taxable investments in the corporation. Investment growth creates passive income which is taxed at 50.17%, much higher than the active business income at a rate of 26.5%. It often makes sense to evaluate and diversify corporate assets to ensure both tax efficiency and to maximize future estate value. As investment assets accumulate and grow, so may the tax burden. This could result in your hard work being reduced to paying tax rather than becoming an asset to your beneficiaries.

There are options when you have surplus investment assets in your corporation and you want your beneficiaries to receive them. You can continue to pay tax on the income earned or you can reallocate some of those assets into a little known planning strategy, the Corporate Wealth Transfer.

The Corporate Wealth Transfer is best suited for individuals who:

- Have surplus cash/ investments inside a Canadian controlled private corporation

- Have a strong desire to leave a legacy

- Like to find ways to reduce the tax on passive investment income in their company

- Would like to enhance a higher estate value

- Want to invest retained earnings in a tax efficient way

How it works

The corporation purchases a tax-exempt life insurance policy on shareholders life. The company is the owner and beneficiary of the policy. Premiums are paid from excess cash flow or from a reallocation of existing investments.

The Corporate Wealth Transfer repositions your surplus profits or investments from being tax exposed to a tax-exempt life insurance policy. The permanent policy offers life insurance protection and an investment account that allows for tax-exempt growth.

Upon death

On the death of the life insured, the corporation receives a policy death benefit tax-free. Death benefit proceeds create a credit to the corporation's capital dividend account for the amount of the life insurance proceeds less the insurance policy’s adjusted cost basis. Distributions may then be made by the corporation as tax-free dividends to the shareholder.

Accessing capital while alive

Tax-exempt life insurance policies have the ability to accumulate cash values. The cash surrender value may be accessed by withdrawing or borrowing against. Funds may be accessed from the policy’s cash surrender value or the policy may be used as collateral to receive a bank loan which can be used to supplement retirement income. Tax-free growth on policy cash values may be extracted from your corporation tax-free through the capital dividend account. The decision may have tax consequences so it's important to consult with your qualified tax advisor.

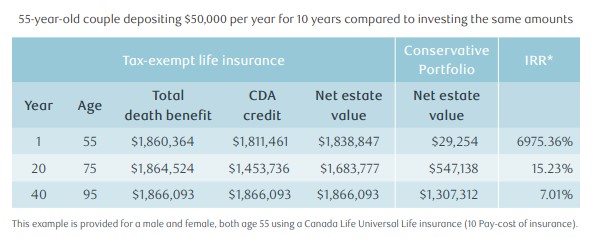

Using universal life insurance as a recommendation we are showing a 55-year-old couple depositing $50,000 per year for ten years compared to investing the same amount in a conservative portfolio for the purpose of transferring wealth to the next generation. We have assumed that the company’s tax rate on passive investment income is 50.17% with the dividend tax rate of 43.90%.

The Corporate Wealth Transfer strategy allows you to move corporate investment dollars from a tax- exposed environment to a tax-deferred one, maximizing the amount that is available to your estate. If you have surplus cash or retained earnings invested in your corporation, a desire to leave assets to your heirs and are concerned about the erosion of your corporate assets, you should discuss the corporate wealth transfer solution with your trusted advisor.

Please reach out if you have any questions.

Vito, Eric & Rachelle