“If you’re not a little confused by what’s going on you don’t understand it. We’re in uncharted territory.”

– Charlie Munger at the Berkshire Annual meeting, May 2021

“Central bankers always try to avoid their last big mistake. So, every time there’s the threat of a contraction in the economy, they’ll over-stimulate the economy by printing too much money. The result will be a rising roller coaster of inflation, with each high and low being higher than the preceding one. Inflation is always and everywhere a monetary phenomenon.”

– Milton Friedman

Those of us who grew up in the 1960s and ’70s likely recall the old wooden-box TVs with the “rabbit-ear” antennas. We didn’t have a lot of stations to choose from, and we always had to get up to adjust the antenna to try to get a clearer picture. The global economy is a lot like this right now, with so many confusing signals. We would all like to have a clearer picture, but we don’t have any rabbit- ear antennas around to help us.

Markets don’t like uncertainty at the best of times, and we’ve had quite a bit of it.

Lockdowns put the global economy into a virtual coma for the bulk of two years during the first global pandemic in 100 years, and then fiscal and monetary powers-that- be decided to pump about $10 trillion in stimulus into the U.S. economy. We began to get a brief glimpse of what the new “normal” might look like last fall as we attempted to reopen the economy, but then inflation ran up and decided to hang around for a while and, in fact, ramped up. The U.S. Federal Reserve (the Fed) then went from a “dovish,” slow and steady approach, to a suddenly aggressive “hawkish” sense of urgency. Throw a war in the mix between two nations with deep implications on commodity markets, some really questionable government policy decisions, and here we are.

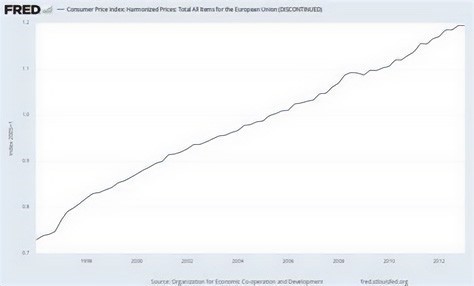

We have the Fed aggressively raising rates in a U.S. mid- term election year, something I’ve never witnessed in all my years, and on the verge of putting the U.S. economy into a recession. But months before that election (again, unheard of), and despite the fact you may have the North American economies teetering on the edge of recessions, no one can seem to get enough workers, house prices are still hanging in while rates rise, and so on. In Europe, inflation is at a new cycle high not seen for decades at almost 9%, yet much of the EU still has negative interest rates.

Consumer Price Index Harmonized Prices: Total all items for the European Union (discontinued)

(Source: FRED Charts https://fred.stlouisfed.org/ )

This more than any other item hits home: When, ever, in your lifetime, have you ever seen used car prices go up? That alone tells you how broken the economy was.

So, yes, it’s probably OK to be a little confused here. Much of Economics 101 has gone out the window for now.

When I began my career in finance in 1982, inflation was running close to 15% annualized, bond yields had peaked at 20% during a time when we boomers were buying our first homes. We would have danced in the streets to get today’s 4% to 5% mortgage rates. As rates have declined over the past 40 years, the existing supply of bonds went up, accelerated in 2008 with quantitative easing, which spilled more money into the market. Interest rates kept diving and, right through the global pandemic, this trend didn’t just keep up, but it accelerated, and bond prices kept on rising – until this year. An excellent article in the Globe and Mail recently described how many bond traders seldom sold a bond at a loss during their careers, but not this year. That ended this year with many bonds in free-fall.

Usually when stock markets get into a more volatile situation, capital flees to safety: i.e. cash and bonds. But not in 2022. The Canada bond index was down 10% in the first quarter alone. Long bonds in the U.S. are down 20% by mid-year. Now that rates have begun to rise sharply, we have been able to revisit yields at 4% or better.

Since 2020, the investment landscape has been unlike anything ever witnessed before. There are so many things going on that are considered out of the “normal,” and some so counterintuitive that it is hard to nail down what the ramifications will be on a portfolio.

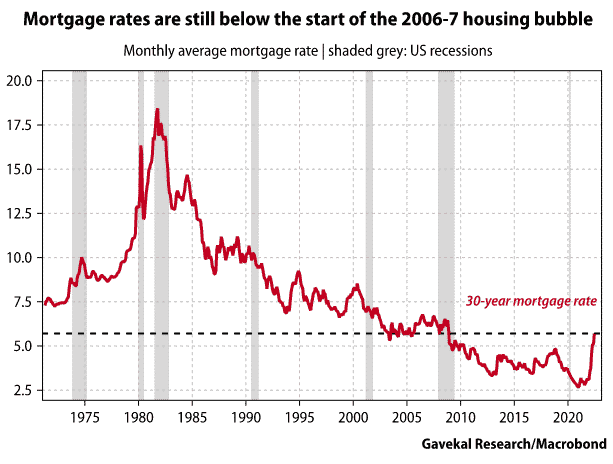

Here is an interesting contradiction: U.S. mortgage rates, as of the end of June, still remained lower than in 2006-07 as the housing bubble was inflating:

(Source: Gavekal Research https://evergreengavekal.com/dont- believe-theus-recession-forecasts/ )

In fact, by June 30, the end of the first six months of 2022, a 60/40 balanced portfolio had its worst start to a year – ever – and, as you can see in this chart, the second-place occasion is not even close.

(Source: Morningstar https://www.morningstar.com/articles/1037531/ long-live-the-6040-portfolio )

The good news is, of the 14 worst starts to any market year since 1931, 10 of them went on to turn in positive returns for the back half of the year, although only five of those 14 years turned things around enough to attain positive returns for the entire year. (Source: https://www. investopedia.com/a-history-of-bear-markets-4582652)

Some investors see their equity portfolios go down and want to switch it all to cash or bonds. That seems like a good idea until you realize inflation is over 8%, and valuations tend to be much lower when inflation is higher. CEOs seem to love to complain about high inflation in their earnings calls, but I can’t recall many times when they didn’t simply pass those rising costs to consumers. We are certainly seeing that happen right now in all segments of the economy.

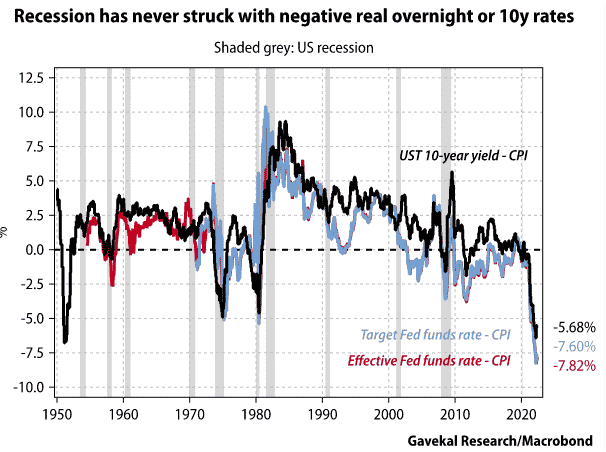

Some will say monetary policy in the U.S. is not remotely restrictive enough to cause a recession because interest rates are still deeply negative in real terms — and a recession has never begun at a time when real overnight or real 10-year yields were lower than 1%, never mind below zero or at -7.6% and -5.7%, respectively, which is where they are today.

(Source: Gavekal Research https://evergreengavekal.com/dont- believe-theus-recession-forecasts/ )

To say the first half of 2022 was painful for investors would be big understatement. They suffered large losses on equities, bonds, emerging markets, crypto, commodities, and so on. For most of the last six months, investors received no protection from government bonds, whose traditional risk mitigation attributes gave way to big losses as well. The only assets classes that worked consistently were energy and cash.

This is an environment in which it’s hard to argue for silver linings, especially when so many analysts are warning additional losses may be ahead in both public and private markets. In my view, the current economic meltdown has its roots in the lockdowns. For some reason, many people imagined governments and corporations could just lock down economies for almost two years and then turn them back on without any consequences. Lockdown the global economy for two years and wonder why supply chains are broken? Or hand out a lot of “free” money and wonder why there’s inflation? Or tell people not to come to work and now wonder why they won’t? It all seems like logical outcomes to me. And yet, here we are.

Is this a recession?

Officially? Not yet. The textbook definition of a recession is at least “two consecutive calendar quarters of negative gross domestic product or GDP.” But we are getting close. I can’t recall seeing so many “Help Wanted” signs, locally or in our recent travels, or employers complaining about finding workers. There has never been a recession without a loss of employment. Jobs are being added in the U.S. by hundreds of thousands per month. Industrial production has also been rising, and so have earnings in many sectors. The U.S. consumer is about 60% of the U.S. GDP number and, so far, demand remains strong, particularly in the hospitality and travel sectors. But the reported consumer confidence numbers overall are falling, and the last report is the lowest ever on record.

Sure, it is possible that the stated inflation rate could fall faster than many people anticipate and upcoming earnings could exceed expectations. As one financial talking head recently quipped: “If this is a recession, we need more of them.”

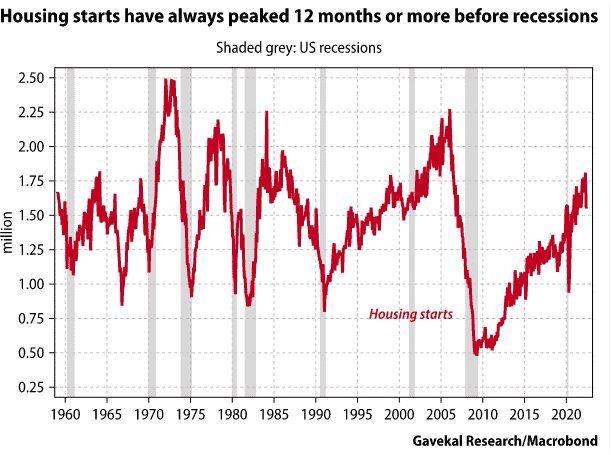

Here’s one example: The housing construction sector remains strong.

This interesting chart from Gavekal Research shows that, going back to the mid-1950s, housing has always peaked 12 months or more before a recession (the gray bars), and to date, we don’t have that – yet:

(Source: Gavekal Research https://evergreengavekal.com/dont- believe-theus-recession-forecasts/ )

History would suggest this isn’t the time to sell. If we don’t go into a hard recession, non-recessionary downturns have reversed quickly in the past. Perverse as it sounds, 20% downturns have been extremely good for future returns over one, three and five years. In 87% of those circumstances, the markets advanced in the next 12 months that the economy avoided recession (source: Fidelity Investments – Market Commentary – April 30, 2022).

Mid-term election years (the second year of a U.S. President’s term) have historically been lacklustre, but that alone doesn’t entirely explain why this year has been so awful so far. The main culprits are broken supply chains, higher interest rates brought on by higher inflation, and the Ukraine conflict. But there are a lot of other smaller items gnawing at investor minds.

For long-term investors, I think over time it will be proven that it’s been beneficial that markets have exited an artificial regime that was maintained for far too long by the Fed and other central banks, resulting in many frothy valuations, price distortions, resource miscalculations and investors completely ignoring fundamentals (real estate, meme stocks, cryptos, quickly come to mind).

Unfortunately, economic transitions, and the adjustment that comes with them, create the current uncomfortable and bumpy journey we are on.

I started in finance when Paul Volcker was doing his thing at the Fed to crush inflation using 20%+ interest rates. Jay Powell may imply he is Paul Volcker, but he is no Paul Volcker. Fed members talk tough on inflation but I think they will crumble under pressure. Soon. Worries about the stock market and the economy will overtake worries about inflation. We may be there already as I type. If you recall, the Fed only raised interest rates when it became politically necessary for them to do so. If they really wanted to crush inflation as they say they do, all they have to do is raise interest rates – a lot. Simple.

Members of the Fed have said their actions do nothing to fix the supply side – that they only fix the demand side. And that is true. However, if you fix the demand side, you also fix the supply side. Raise rates, the economy tanks, people lose their jobs, and cancel orders for renovations, appliances and cars. The supply chain issues are fixed.

Magic!

So now it comes down to this: What would the Fed/you rather have: Unemployment of 7% or shortages of food, fuel, durable goods, baby formula, etc. I guess that would depend on your point of view. It isn’t like 40 years ago when a recession rolled through, people got laid off or lost their jobs, they looked for jobs, found jobs and went back to work again. Today, if a recession rolls through, people get laid off and they may get weeks of unemployment benefits, forms of universal basic income and, in the meantime, they could lose skills or lose those jobs permanently to robots or artificial intelligence (AI). We have a dynamic global capitalist economy now, so in the past 20 years we’ve started looking at job losses as the “End of the World.”

The markets are currently in what may be described as a “no-man’s land” – too late to sell, too early to buy.

If you think the Fed will blink, then you are loading up the buy list getting ready for the pivot. We think they will, and have moved accordingly in our fixed income, extending duration from shorter-term maturities to longer. We haven’t made a big move in equities yet, but we are ready. I think the Fed will blink because it has a track record over the past 30 years of doing what’s expedient rather than what is right. I’m waiting to become extremely bullish and soon, but I think we may still have two to three months of volatility.

We are doing our best to figure this out, and be less confused than most, but this cycle truly doesn’t have any historical precedent. I truly believe if we just get over this hump, better times are not far off.

Stay Tuned,

Vito

Here is the PDF if you wish to print / email this.