“Market Snapshot: Midterm elections usually give stocks pause in September, but pave way for later gains”

- Wall Street Adage

Since 1896, when the Dow Jones Industrial Average was created, the index has lost an average of 1.03% in September. That compares to an average gain of 0.76% for all other months. September has historically not been a friend to markets.

There have been many who have tried to explain the September action, but I have yet to see a reason which withstands scrutiny. Some plausible excuses:

- Investors have sky high tuition bills due this time of year

- Once summer is over, psychology turns negative and selling is more prone emotion

- Institutional (hedge funds, mutual funds, etc.) with fiscal year ends of September 30th engage in window dressing selling

- A large number of other reasons…

But hey, not all September’s are negative. In fact, back to 1896, 42% are positive, so it’s almost a coin flip. But over the last 20 years, it’s been tough as shown on this chart:

However last year, the Dow Jones had an impressive September and gained a whopping 2.1%!

But the other factor which will impact 2018 is that it is a US mid-term election year.

The chart below show the mid-term seasonality:

We are coming off the best August on the S&P 500 since 2014 and the Nasdaq’s best August all the way back to 2000. There is much talk about the age of this current bull market and how long it still has to go, but the uptrend since 2009 is similar to the bull markets of 1974-1999 and 1942-1966 that had many pullbacks, corrections and even “bear markets” of 20%.

But a cogent argument can be made that this current bull market really didn’t start until April 2013 when the S&P 500 bettered its previous all-time high. If that is the case, we are only in the 6th or 7th inning.

Bull markets tend to run higher than most expect and go until the economy is booming and sentiment reaches euphoric levels. Right now that still feels some ways away. Speaking of sentiment…

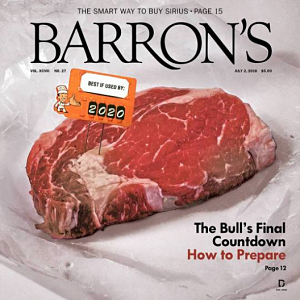

Recent covers of major business magazines tell me we are nowhere near highs if one uses them as a contrarian (which by the way, over time has been mostly correct).

Here is an interesting statistic: Since the 2009 Financial Crisis the S&P 500 has moved higher each and every year between Labour Day and year end. The gains have averaged 7.2% annually and range from a low of 1.4% in 2010 and 13.9% in 2010.

I think we are due for some sort of pullback/correction, but I remain bullish over the next few years and think any pullback is an opportunity to add to positions.

Stay tuned,

Vito Finucci, B.COMM, CIM, FCSI

Vice President and Director, Portfolio Manager

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under license. © 2018 RBC Dominion Securities Inc. All rights reserved.