October 13, 2017

MARKET ENVIRONMENT

The obvious synchronized global economic growth is proving more powerful than the various geopolitical risks which have received recent media attention.

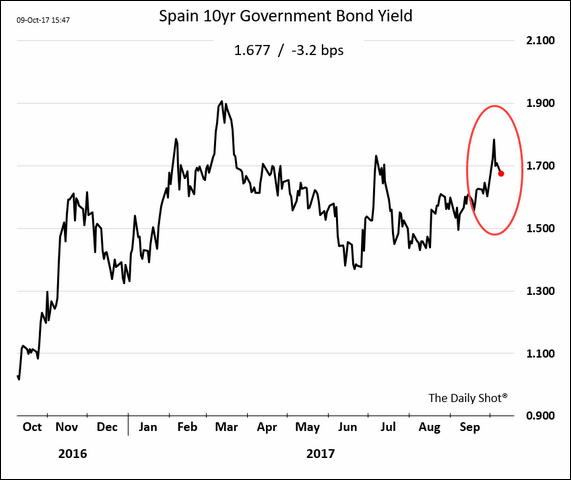

For example, last week, a major region of Spain (Catalonia) voted for succession with scenes of police clashing with angry protesters and voters.

However, as per below, the impact on Spanish equities and government bonds was miniscule and quickly reversed.

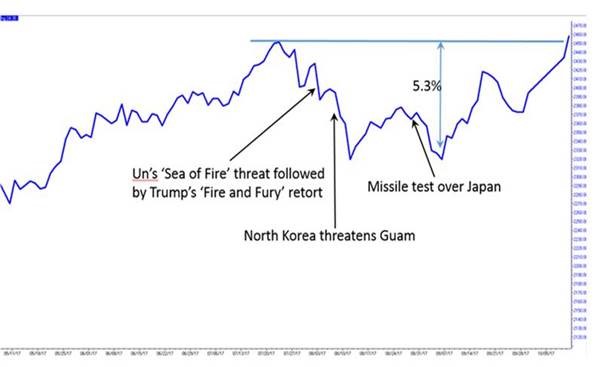

Another hot topic recently has been North Korea and the (perhaps) threat of nuclear war. However, this has not had much of a market impact - even in the region.

While South Korea, especially its capital Seoul, is within easy range of thousands of North Korean artillery positions, the fear of imminent war has not upset their stock market (the Kospi) as illustrated below.

Similarly, Japan, which actually experienced North Korean nuclear missiles overflying its territory is, nevertheless, trading at multiyear highs.

What is the underlying dynamic?

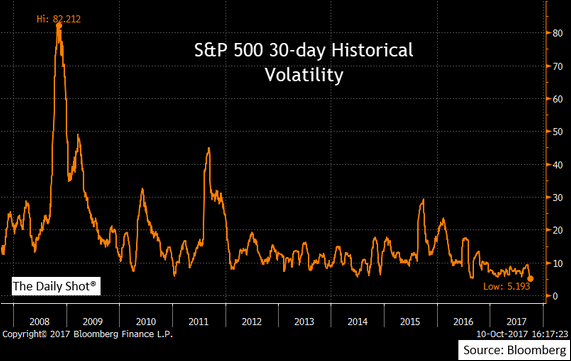

This consistent low volatility, despite significant geopolitical risks has been sustained for several months and across most markets. Its historical decline is illustrated in the below chart.

While the underlying dynamics are unconfirmed, the key factors could include:

Rational, gradual and carefully stated communications from the central banks;

Less market influence from easily excited young traders; more importance to the mathematicians and other programmers of the computer trading algorithms;

Generally favourable economic conditions, low interest rates, growing corporate profits (independent of geopolitical scares).

JUST FOR FUN

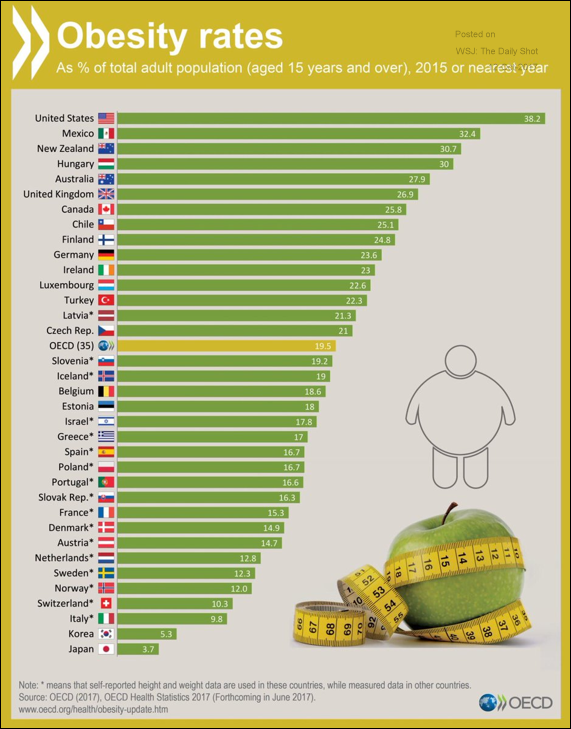

The below chart comparing obesity rates around the world has no particular importance to the market environment but is interesting anyhow.

October 6, 2017

MARKET ENVIRONMENT

Happy Thanksgiving (Canada) and Columbus Day (US).

The broad markets are continuing their upward trend and with little volatility.

By Thursday, the S&P 500 had completed 6 days of successive record highs – a record going back to June, 1997 (which then was in the midst of a prolonged multi-year bull market).

Similarly, current volatility has reached all-time lows (with no pullback of 5% within the past year).

(The broad Canadian markets have been more volatile due to its higher proportion of energy companies, miners and other commodity companies. We essentially avoid these sectors though).

This consistent (US) growth pattern is supported by continuing strong economic and corporate fundamentals and carefully constrained interest rates.

Market stability is also supported by the increased importance of algorithmic computer based trading. Trading decisions seem now increasingly driven by dispassionate mathematical calculation and less by young traders’ emotion-laden reactions to the news-of-the-day.

The perverse market reactions to mass gun murders …

Traders react perversely to gun-related tragedies such as that in Las Vegas this week.

As background, prior to last year’s US election, gun lovers feared the expected presidency of Hillary Clinton. In expectation of future tightening of gun ownership laws, firearm sales increased dramatically; manufacturers’ profits and share prices rose sharply.

However, the election of a Republican majority Congress and Presidency brought confidence that ownership would not be restricted. This lowered the urgency of adding to personal armories and revenues of companies like American Outdoor Brands (parent of Smith & Wesson) fell by 22% and profits fell by 50%. Share prices, of course, declined sharply.

However, (similar to previous gun massacres in Sandy Hook, Colorado, Orlando and San Bernardino) the recent Las Vegas shootings led to new expectations of pressure on politicians to tighten regulations. Once again, gun lovers are expected to rush to buy more firearms before the imagined deadlines. Share prices are up 5% in anticipation of rising revenues and profits.

At any rate, we do not invest in gun manufacturers (as an ethical principle).

September 29, 2017

MARKET ENVIRONMENT

Three surprises for speculators this week…

1. The Bank of Canada (BOC) is reluctant to raise rates further.

The BOC raised rates in back-to-back meetings (July, September) and speculators expected this aggressive pattern to continue.

Since foreign exchange is often correlated to the relative national interest rates, traders sought to profit by holding the highest level of Canadian dollars in 5 years.

However, Stephen Poloz, the BOC Governor, effectively squashed this speculation by announcing that he was neutral (“data dependent”) on future increases.

The Canadian dollar immediately declined on the news.

2. However, the US Federal Reserve will likely raise in December.

Speculators have avoided the US dollar recently in their belief that the Fed would continue to hold rates steady for the foreseeable future.

However, Janet Yellen, in her speech this week strongly indicated a commitment to a rate rise later in 2017. (There are likely an additional three more rises planned in 2018).

The US dollar immediately rose against all other currencies on this news.

3. There will likely be some form of US tax cuts/reforms and this will boost economic growth.

The repeated failure of the Trump administration to repeal Obamacare led to speculation that they would also be unable to deliver on their (much desired by the markets) pro-business agenda.

However, on Wednesday, the administration did announce a (high level) proposal for several substantial corporate and personal tax changes.

Realistically, there will certainly be extensive political haggling and reshaping of the tax package before its final approval.

However, the increased confidence that there will be significant tax-based economic stimulus has lifted the share prices of companies in the economically-sensitive sectors e.g. financials, industrials, energy and materials, small caps and value stocks.

Coming soon …. Our Facebook Page

We’re now beta-testing our business-oriented Facebook page.

We intend this to be a sort of “vision board” where we provide a constant stream of background information on the underlying technology, socio-cultural, demographic, consumer and other trends which are shaping our world.

Stay tuned for a formal launch.

September 22, 2017

This week’s post was written jointly by Patrick Fisher and Alessandra Naccarato of our investment management group.

MARKET ENVIRONMENT

The Great Unwinding

As the global economy strengthens, central banks continue to withdraw the extraordinary stimulus they put in place to defend against the potentially dire impacts of the Great Financial Crisis (2008- 09).

This week, the US Federal Reserve announced a plan to start the reduction of some of their giant ($4.3 trillion) stockpile of government bonds and mortgage backed securities which they had amassed through their earlier “ quantitative easing” (QE) programs.

As a reminder, although central banks have direct control over short term rates (and can lower these rates at will to stimulate consumer and corporate borrowing) they have no legislative power over longer rates which are set by market trading.

QE has been the process whereby the US Federal Reserve acted as another (very large) market player and they, themselves, purchased long bonds on the open market.

By adding to the buying pressure, the US Fed raised the price of bonds which had the consequence of lowering their yield.

In this way, the central bank ensured low yields across all durations. This has been very helpful in fostering the current economic and market recovery.

The Fed had long ago stopped one part of its QE program (i.e. it was no longer adding to its net reserves). However, whenever one of their bonds matured, then the Fed bought sufficient new bonds to compensate.

In effect, their reserves have been neither growing nor shrinking.

That will end in October when an increasing number of maturing bonds will not be automatically replaced.

Since the Fed will be a much less active buyer in the bond market and, so, longer yields may rise a little.

The Fed is being extremely careful not to frighten the normal skittish bond traders. The changes were discussed months ago and the relative adjustments are relatively small.

So far, so good…

The market reaction to this news (which was essentially nothing) is a good indication that the Fed has both effectively communicated and engineered what the market views to be a successful ending of QE.

But that’s not all…

This month the Fed also updated its projection as to the level of future interest rates.

Interestingly, they showed that interest rate increases are likely to end at a lower point that previously thought (i.e. low interest rates for longer is now more likely).

Citing continuing low inflation, this is a good signal for equity investors since the chance of a lower terminal rate means that the Fed is less likely to “overtighten” and damage the economy.

That said, the Fed also indicated the potential for another 25 basis point increase to the overnight rate later this year.

As a result, US 10-year bond yields moved slightly higher to the 2.28% range (but are still lower than where they started the year).

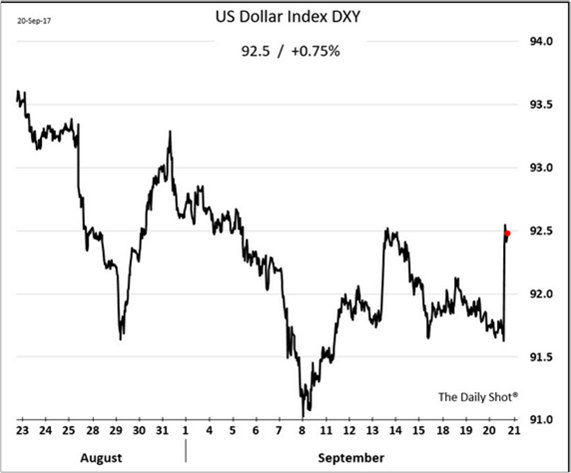

Traders purchased US dollars (which has been surprisingly weak this year) thereby increasing the value of the USD against a basket of currencies including the Canadian dollar.

September 15, 2017

MARKET ENVIRONMENT

Several of the risks that had earlier worried traders have been either bypassed or deferred:

- Concerns about crossing the US debt ceiling, which could cause a systematically damaging default on its debt obligations, has been deferred. While the new deadline is formally December 8, the US Treasury has explicit permission to use “extraordinary measures (i.e. arcane accounting and debt management procedures) after then to effectively delay the date that this issue has to be addressed. In fact, this issue will not be raised again until next March at the earliest.

- Hurricane season may have passed its peak without the mega disaster feared by worried traders. Hurricane damage by Harvey and Irma will depress economic growth on a national US level in the short term. However, the recovery and repair efforts will certainly provide subsequent economic stimulus.

- Although the US government fiscal year starts on October 1, the required passage of the US budget has also been deferred to December. Delay of budget approval would require the short-term closing of certain non-mandatory government services.However, it is not uncommon for the US government to temporarily close itself down during periods of political wrangling, and, the markets generally are not greatly vexed by these events.

North Korea and terrorism remain very salient issues of political and social concern. However, the markets seem to have inured themselves to these macro level events and they no longer have a material impact on equity pricing.

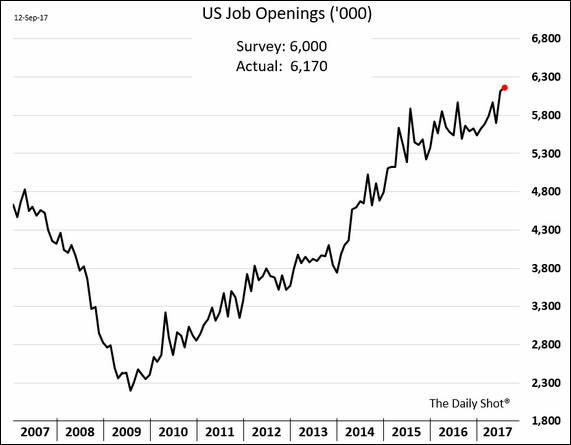

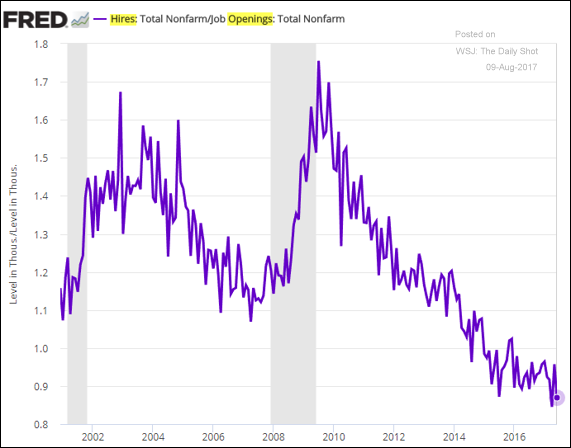

Regardless of all of the above, the global economy continues its fundamental progress. The below chart, showing the rise in new US job openings, illustrates this upward trend.

Recently, there is some optimism that Washington will bring forward their intended tax reform legislation as the keystone of the eagerly anticipated pro-business economic agenda.

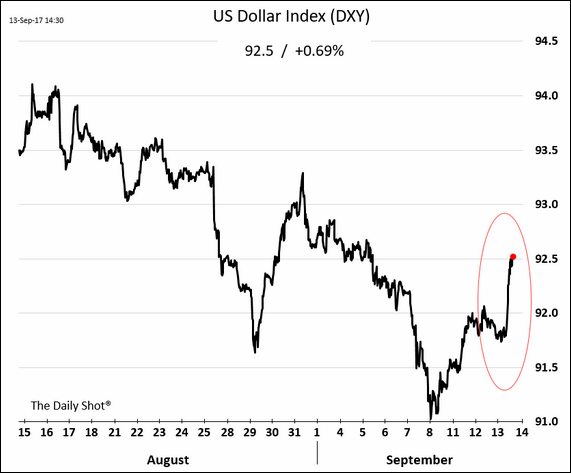

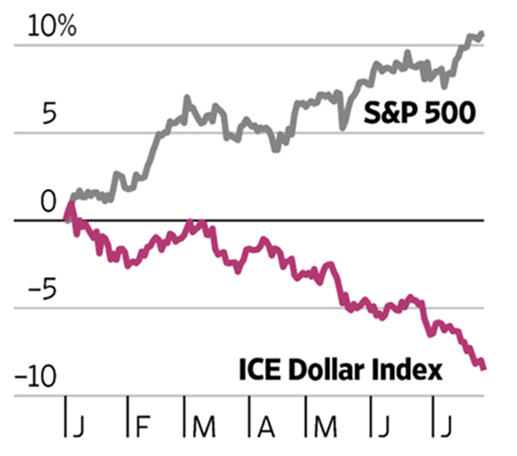

While the final outcome of this initiative is yet to be determined, greater optimism for stronger US economic growth is translating into a (mild) increase in the US dollar (see below).

This stabilization of the US currency is welcome for Canadian and international investors holding US assets i.e. since value of these US assets had recently been in decline as viewed from the perspective of their own domestic currencies.

September 8, 2017

MARKET ENVIRONMENT

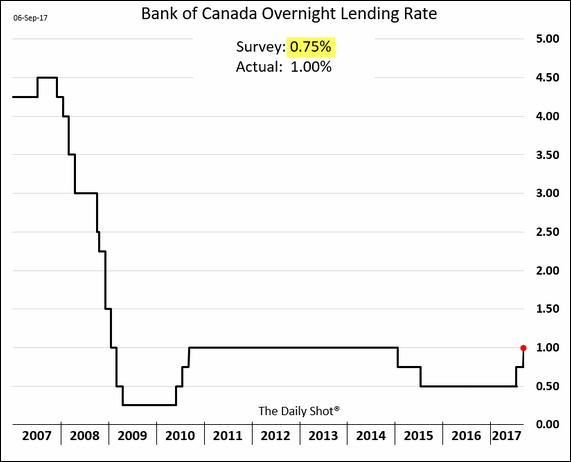

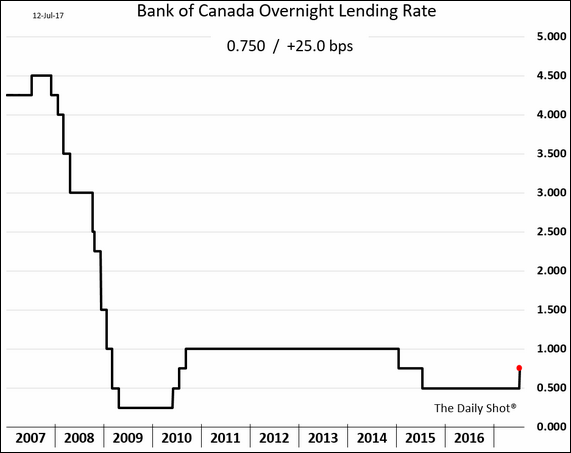

The Bank of Canada raised short-term rates by another 0.25% based on strong domestic growth. This follows a similar rise in July.

The rates are still exceptionally low by historical standards (see below chart).

Increased Interest Costs

Canadian banks immediately raised their prime rate by the same amount (0.25%) thereby raising interest costs for all types of variable rate debt (e.g. home equity credit lines, variable rate mortgages).

In concrete terms, the monthly cost of $100,000 of variable debt is up by about $12.

However, there was less impact on the longer term interest rates (which are set by the markets). The 5-year and 10-year bonds only increased by 0.10% and remain in a trading range which started in July.

Higher Canadian Dollar

Faster Canadian economic growth and higher rates, combined with uncertainty and lower growth in the US, is pulling the Canadian currency (CAD) higher.

As per the below chart, the CAD is up:

- 2.7% since the Wednesday rate announcement;

- 13.3% in the past four months (i.e. when the Bank of Canada first signaled the potential for rate increases).

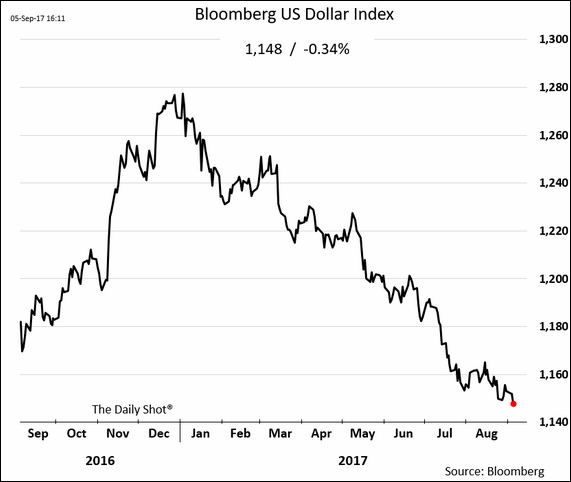

Beyond Canada, the US dollar (USD) has been in general decline against most other currencies (e.g. euro, yen, shekel).

As per the below chart (which measures the USD against a trade-weighted basket of currencies) uncertainty in the US is taking its toll as viewed by the international financial community.

What happens next?

Short rates …

As I have been writing for a while, the era of ultra-low short term rates has ended.

Beyond the two recent increases, the consensus forecast for Canada is three more (0.25%) increases in 2018.

RBC also forecasts another 0.25% increase sometime later in 2017.

Of course, this is a highly dynamic environment and many economic and geopolitical factors will shape the final outcome.

Long rates …

Despite several years of expert consensus forecasts of higher long term rates, this is not happening.

The US 10-year Treasury rate is at the low point for the year.

Canadian 10-year rates have risen a little this year but not at the quick pace of the short rates. In fact, long rates now are the same as five years ago.

Long rates, which are set by the markets, continue to be constrained by such factors as:

- Low inflation;

- Generally low economic growth;

- Conservative investors seeking safe havens;

- Mandatory bond purchases by financial institutions and pension funds;

- Worries about future risks (US political uncertainty, North Korea, etc.)

CAD USD exchange rates ...

The key variable now affecting the USD – CAD exchange rate is the differential between the short term interest rates of the two countries.

As above, Canada seems to be growing steadily and without major distractions. Short rates are rising.

Conversely, the US is bedeviled by political uncertainty, slow growth and geopolitical concerns.

The hoped for pro-business agenda is not in place. Further, the basic government processes (ability to pay debt, ability to approve the annual budget) have been in contention.

This, added to the economic pressures from multiple natural disasters (hurricanes in major population areas) has led to forecasts that future US short term rate rises are indefinitely on hold.

The differential between the US and Canada is growing.

The recent US currency decline could be part of a larger picture.

It is important to realize that the USD can be considered as another financial commodity and be subject to the same cyclical patterns.

In fact, the USD has had three lengthy bull and bear market cycles since the 1970s.

The most recent US dollar bull market, started in 2011 and has featured a 43% rise since then. However, between 2002 – 2011, the USD was in an extended bear market and fell over 39%.

Many currency strategists now view that the USD has likely passed the apex of its current bull cycle and has begun a decline.

RBC, discussed this in more detail in its August issue of the Global Insight Monthly in its feature article “Implications of a Peak (US) Dollar World”. (If you would like a copy, please let us know).

It is important to note that each national currency follows its own path against the USD. For example, the Canadian currency is much more closely aligned to the US economy and will continue to track the USD more closely than, say, the euro or the yen.

Impacts on Investment Management

The recent rapid currency moves have had a significant impact on investors –especially international investors.

The 13% USD decline over the past four months means that all US investments have lost that much in value when considered in Canadian currency terms.

So, a Canadian-based portfolio containing 30% USD investments, would have experienced a 3.9% performance drag (30% * 13%) over this period based purely on foreign exchange changes.

Other international investors in the US markets have shown a similar pattern (but with different degrees of currency changes.

Domestic US investors would be unaware of the foreign exchange changes and would simply benefit from the increasingly profitable US global companies.

Certain US investments will continue to be attractive to international investors regardless of foreign exchange factors.

- Companies whose exceptional value and growth features more than compensate for the currency drag.

- Multinationals, reporting in USD, which have extensive foreign revenues and earnings i.e. in appreciating international currencies. From a USD perspective their foreign markets would seem far more profitable and their US share prices would reflect significantly the benefits of a lower USD.

September 01, 2017

MARKET PERSPECTIVES

A HEALTHY ECONOMY …

Markets always operate with a background hum of low grade worries.

However, long term market performance is ultimately based on reality – and the reality is that the global economy is progressing nicely.

Canada

Canada is the fastest growing of the G7 countries with a very strong 4.5% GDP growth rate.

(Note that GDP is always described in “real” [after inflation] terms; in nominal terms, Canadian GDP is growing at well over 5%.)

This is powered largely by higher average domestic wages i.e. up an annualized real 6.6%.

This overall wage growth has allowed for significant increases in both consumer spending (up 4.6%) and consumer saving (also by 4.6%).

This growth has led to an immediate rise in the Canadian dollar, and, increased expectation of rising short-term (e.g. prime) rates this fall.

More specifically, another 0.25% short term rate increase is likely at the Bank of Canada’s October 25th meeting. Perhaps, the rate increase could occur as early as their September 6th meeting.

The US

US GDP growth is annualizing at a healthy 3.0% real growth i.e. well over 4% nominal growth.

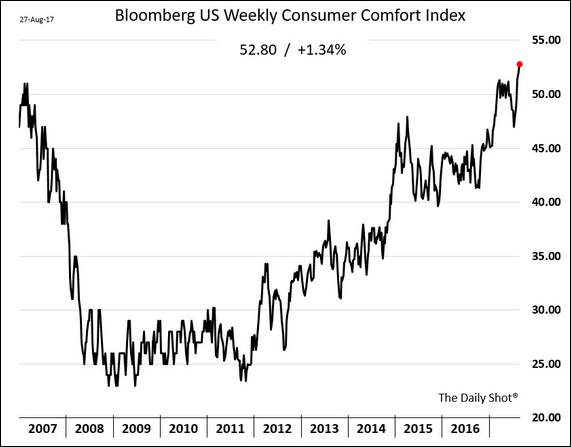

Employment levels and consumer confidence are reaching new highs (see below 10-year chart). Consumer spending is up 3.3% .

The Global View

Strong and accelerating economic fundamentals are global in nature (i.e. inclusive of Europe, China, Japan and the emerging world).

This, combined with continuing low long term interest rates, provides a strong positive dynamic which, historically, has proven more powerful than interim worries.

In fact, RBC Dominion Securities’ current forecast is for no recession before 2019 (at the earliest).

August 25, 2017

MARKET PERSPECTIVES

We are in the deepest part of the summer doldrums with little corporate news and little change in the markets.

A small, but significant news item, was the purchase of Calpine Corporation by the Canadian Pension Plan Investment Board (CPPIB).

Calpine is a major private US power producer (generating enough electricity from natural gas and geothermal heat to heat about 20 million homes in Texas and northern California)

The CPPIB is the investment body that manages the multibillion savings of all Canadians through their Canada Pension Plan contributions.

In many significant ways, we have a similar long term objective ( providing sustainable retirement income) as the CPP. Naturally, we use many similar strategies.

For example, to meet this essential objective, we both invest in real assets (e.g. operating real estate, power generation, other utilities and infrastructure) which provide highly reliable and efficient income. This income can then be redistributed as the foundation of a public or “private” pension plan..

Given its huge size, the CPPIB can invest $750 million (US) to participate as part of a $5.6-billion cash deal to privatize Calpine Corp.

Our investment accounts, of course, do not have the size for such purchases.

However, by owning shares of publicly traded power generators (also with major operations in the US) then private investors can benefit from exactly the same, intelligent economics (and solid cash flows) as those used by the major public sector plans.

Long time clients may recall that, several years ago, we did own shares of high yielding Calpine Power when it was publicly listed.

Unfortunately for us, we were obligated to sell the shares back to the parent company (at a considerable profit to our investors) when it privatized itself.

Ironically, several years later, the CPPIB has come to see the same benefits that we did, and, is buying the entire company (for the benefit of all Canadian current and future pensioners).

If nothing else, this confirms we’re all “on the same page”.

August 18, 2017

MARKET ENVIRONMENT

Income Inequality, Inflation, Interest Rates (Part I)

Inflation can only take hold if consumers can pay inflated prices.

However, if consumer buying power is not growing, then inflation will not happen. Similarly, there will be little pressure to raise interest rates significantly.

Consumer buying power, of course, depends mostly on higher employee wages.

But wage growth has generally been weak.

As per the below chart, since the late 1970s, the benefits of growing economic productivity (dark blue line) have not accrued to the workers (alias consumers) (light blue line). Instead these benefits went to investors, managers and a select group of highly skilled professionals (the 1%”).

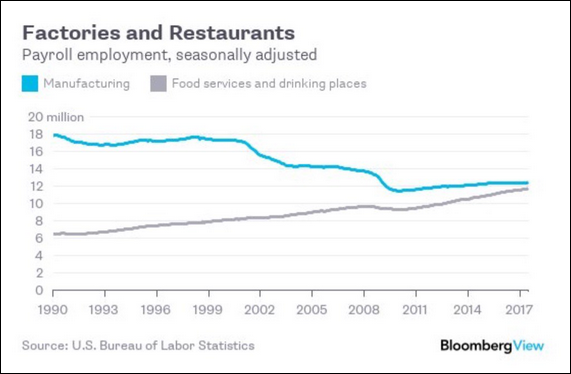

The below chart illustrates the changing workforce. Large number of high paying manufacturing jobs (dark blue line) were lost - to be replaced by less favourable food service jobs (gray line).

Employment statistics do not differentiate between types of jobs so this factor is relatively unnoticed.

This leads to concentrating income power in the investor/manager/professional group.

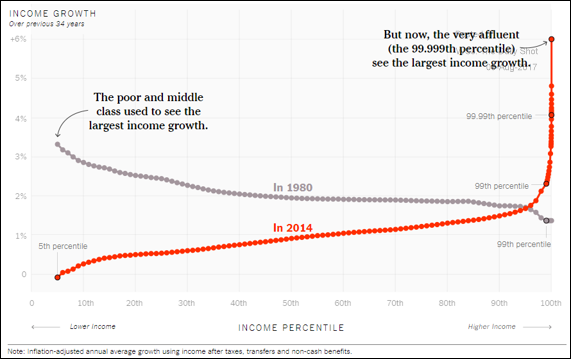

In the below chart, in 1980, the lower and middle income groups (gray line) received the highest income growth.

By 2014 (orange line) almost all of the income growth accrued to the “1%” (actually the “0.1%).

As more workers (consumers) have been constrained in their incomes so has their ability to spend.

Of course, products and services expressly desired by the high earning 1% (i.e. private and “Ivy League” education and art collectables) are experiencing inflation. However, for the vast majority (the 99%) of the population there is little prospect of significant wage gains and therefore of broad-based inflation or significant interest rate increases.

So, despite continuous speculation about rising rates, 10-year rates today are the same as four years ago.

As a reminder, the lower rates are generally supportive of equity markets

Income Inequality, Inflation, Interest Rates (Part II)

Will this pattern change in the foreseeable future?

Certainly the forces which have led to the relative decline of the industrial middle class (foreign outsourcing, replacement by robots, artificial intelligence, etc.) continue.

There is much discussion of technology start-ups and their ability to create jobs and wealth.

It is true that a handful of giant technology companies are making major economic and economic gains.

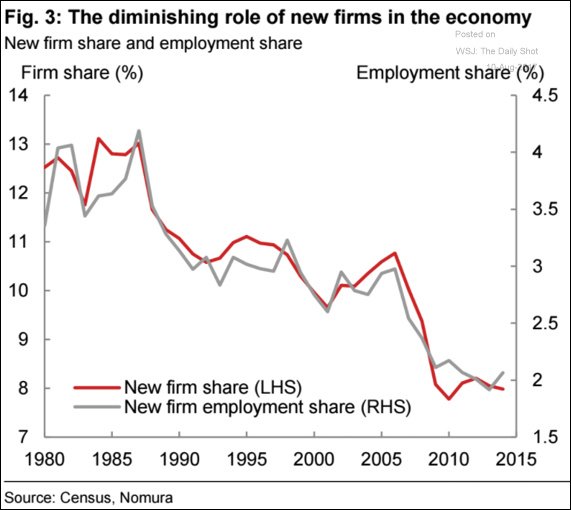

As per the below chart, start-ups are adding an increasingly shrinking contribution to the workforce.

Ironically, there is a dearth of talent to fill quality jobs which are currently available.

As per the below chart, only 10% of available work is unfilled due to lack of skilled applicants.

In fact, lack of skilled workers is now considered the main problem of small business (ranked a much higher concern than taxes or revenues).

Anecdotally, many applicants are being rejected, not only for poor education, but also for poor work attitudes, sloppy appearance and for drug use.

August 11, 2017

MARKET ENVIRONMENT

The Return of Volatility

Markets usually pull back an average of 5% about twice a year.

Such pull backs are certainly irritating to investors but, they are useful to washing out frivolous speculation and therefore, providing a firmer foundation for further growth.

However, until this week, investors have enjoyed an exceptionally long period of low volatility- with no decline larger than 3% in over a year.

However, this exceptional market calm may be coming to end based largely on events in North Korea. The market has declined a little as have long term interest rates.

But, how significant are upsetting geo-political events to long term investment programs?

Not very.

Over the past century (and longer) the markets have been tested by two world wars, a lengthy cold war, near-wars (Cuban Missile Crisis), regional wars (Iraq, Israel) other acts of mass destruction (9/11), presidential assassinations (JFK) etc.

These major global events have had immaterial economic impact. People still go to work, buy groceries, check out Facebook, drive their cars, visit friends, etc.

Corporate revenues and profits are not affected and there is no change to investment income.

However, while the real world is little affected, trading speculation typically cycles through three stages:

- Immediate (overwrought) fears lead to short-term selling of equities and purchase of safe haven assets (i.e. fixed income).

- Once the feared event either happens (or disappears) there is an immediate relief rally. Previously over-sold assets are bought at good value.

- Over the longer term, speculation about the specific geo-political drama fades and underlying economic and market fundamentals reassert themselves. Strong markets resume their upward trend; vice versa for bear markets.

We remain in a long term bull market.

August 04, 2017

MARKET ENVIRONMENT

Summer Doldrums

We are now in the heart of summer (and vacation season) and there is little significant movement in the markets.

The TSX is at about the same level as a week ago as is the S&P 500.

The Dow Jones Industrial Average (DJIA) did rise by 1.4% and crossed the 22,000 line (creating much media attention to this relative non-event).

The DJIA is composed of 30 huge US companies, all of which receive major revenues and profits from their international operations. The declining US dollar (i.e. equivalent to the rising Canadian dollar, Euro, Yen, Yuan, Pound, Shekel, etc.) has made American export products cheaper to foreign buyers. As well, these foreign revenues are in appreciated currencies and translate higher in the financial reporting of US multinationals.

The rising Canadian dollar (CAD) is shown on the left, the rising Euro (EUR) on the right.

Ironically, the DJIA’s strong performance in US dollar terms is due largely to the relative underperformance of the domestic US economy.

Global economic GDP growth is estimated at 3.5% and rising. On the other hand, US GDP growth is estimated at 2.1% and falling.

Business and consumers outside the US are growing their spending power faster than their American counterparts (and becoming bigger clients of US firms). Moreover, the international currencies used to buy the products of the US multinationals have significantly increased in value.

Ironically, the success of US large cap markets (“Wall Street”) would seem alien to the daily experience of the average American (“Main Street”).

Caution is fine …

Many investors do not trust this bull market.

In the US, the fastest growing asset class for investment remains fixed income (not equities).

In fact, over $355 billion USD was invested in fixed income products in the first five months of 2017 alone. This almost exceeds the $375 billion similarly invested in 2016.

As well, many investment strategist are cautious about further market gains.

Ironically, this is good news for long term investors.

Although fundamental, economic and corporate conditions are fine (and central banks remain supportive) this high degree of skepticism provides assurance that markets are nowhere near the stage of euphoria that precedes a bear market.

July 28, 2017

MARKET ENVIRONMENT

Corporate Earnings Season

This week is the busiest week of the second quarter corporate earnings season in the US.

As of today, almost one-half of S&P 500 companies have reported their quarterly results and beat earnings estimates 73% of the time.

In fact, revenue growth at blue-chip US companies (such as Visa), are beating analyst expectations at the best rate in nearly a decade.

In other words, the often pessimistic views of the news media and investment analysts have once again been proven incorrect, or at least, too conservative.

The Fall of the US Dollar

As per last week’s blog, general disappointment with the inability of the US to execute on its proposed economic agenda, and the growing strength in other international economies has weakened the dollar considerably.

As part of the currency realignment, the Canadian currency (CAD) is up 10% since May and has passed the $0.80 level. This week’s episode of repeated failure of the US government to move forward on the repeal of ObamaCare has further impressed investors with the expected futility of their reform agenda in other areas.

The rapid rise of CAD (the inverse of the fall of the USD) was accelerated due to the many foolish US traders who had bet heavily against the CAD in hopes of benefiting from an imagined collapse of the Canadian housing markets (and of the Canadian banking system as well).

The initial signs of the rise of the Canadian currency forced these traders to cover their bets (reverse their short positions) by buying back the CAD. Of course, this buying pressure added to quick rise of the Canadian currency.

Now that these traders have taken their losses and exited their negative trade on Canada, the foreign exchange (CAD-USD) markets are basically in balance at current levels. This new range of the currency may persist for a while.

Of course, almost all other international currencies also rose as compared to the US dollar (USD).

As per the below chart, the lower US Dollar (the pink line) has been a major support for the profit and market performance of US companies (represented by the grey line), especially those who sell their products internationally.

In Canada, the opposite has been true, with exporters experiencing a slowdown in international orders. This will potentially be another self-limiting factor for the further appreciation of the Loonie (and other currencies).

Market Outlook

Short-Term

Most companies are performing well with strong revenue and profit growth, low "cost of capital” (i.e. interest rates on corporate debt are still low) and continuing to benefit from the constrained costs of labour and technology.

Notwithstanding fundamental strength, there can be market volatility at any time, with August-September being a historically more volatile period.

Given the positive economic and market environment, any market pullback should be viewed as a rare “Buy Low” opportunity.

Mid and Long-Term

According to many technical analysts (including those in RBC), most major global equity markets remain in the relatively early phase of a long-term secular bull market.

Such markets, characterized by:

(i) rapid rotation of sectors in and out of investor favour; and by

(ii) a general mood of investor caution

can often continue for years into the future.

Once again, long-term bull markets are inevitably (and uncomfortably) accompanied by periods of short-term volatility, and while unpleasant, these periods would be best viewed as buying opportunities.

July 21, 2017

MARKET ENVIRONMENT

Currency Changes

Perhaps the greatest market surprize this year was the rapid decline of the US dollar (USD) relative to all other developed world currencies including the Canadian dollar (CAD).

The USD ended 2016 with strong gains (and this was expected to continue in 2017) based on expected arrival of the economic agenda proposed by the new US administration. It was expected that this accelerated growth would also increase inflation and then interest rates.

In fact, the opposite has occurred.

There is little progress on new US economic programs and inflation is falling.

The 10-year bond rates in the US has actually decreased this year (from 2.44% to 2.24%) reflecting low expectations for accelerated growth.

The US Federal Reserve did hike short rates twice this year as a precaution for their perceived risk of runaway inflation. However, they now seem to be on hold for the immediate future.

On the other hand, international economies i.e Canada, Europe, China, Japan, Israel are experiencing higher economic growth than the US.

The central banks of those countries are now giving early indications of increasing their rates (or at least reducing their own stimulus programs). In fact, Canada was the first country to actually begin rate increases.

As a result, their currencies are rising relative to the USD.

For example:

- The Canadian dollar is at a 2-year high (up 7.2% this year) including a sharp 11% rise since May

- The Euro is at a 2-year high up 10.9% against the US currency

(Israeli readers should note that the shekel was similarly up over 10% against the USD; however this pattern is reversing and the price has declined by 2.5% in July).

The market now doubts that the US administration can implement their economic agenda based on their recent failure to move forward on their high priority health care change agenda. Also, the current high profile Congressional investigations of the Trump campaign also do not add confidence.

What are the impacts of these FX changes on investment returns?

Currency factors are invisible to resident Americans who are invested in US currency investments.

However, they are quite visible to international investors (i.e. Canadians) who have traditionally invested significantly in US equities (i.e. for currency diversification, for direct investment in the major US growth companies).

The decline of the USD leads naturally to an equal decline in the value of the US investments i.e. from the perpective of the Canadian dollar

So, for example, while the major US technology companies (Amazon, Facebook, etc.) remain highly successful companies and are achieving all time highs (in USD), the currency factor makes their performance less strong from the CAD perspective.

For a CAD portfolio with a 30% allocation to US equities, the recent (3-month) 10% drop in the US dollar has created a 3% (30% x 10%) drag on performance from the Canadian perspective.

What next?

There is a considerable range of foreign exchange (FX) forecasts. And, FX markets are famous for their changeability – as we have seen.

As shown in above chart, the USD increase based on the election of the new US President has now all been elimnated.

It would take some extraordinary changes to rekindle the initial enthusiasm.

On the other hand, US economics are still solid and prospects for certain market-positive tax changes remain reasonable.

Assuming that the majority of the bad news has already been anticipated in the FX markets:

- The more drastic currency exchange changes likely have already occurred and, in the future, may stay in the current trading range. The sharp rate of FX change will not continue at the same pace.

- The portfolio drag for international investors holding US investments may be ending

- US companies may benefit from their lower currency since (i) their products will be more price-competitive internationally and (ii) their profit for international operation will seem much higher when translated back into USD. Conversely Canadian and other international companies which operate and/or sell into the US will be disadvantaged.

In other words, the recent FX changes will self-correct over time.

We will be constantly monitoring the currency situation and keeping readers informed.

July 14, 2017

MARKET ENVIRONMENT

Higher short rates for Canada …

As expected, based on solid growth in the domestic economy, the Bank of Canada raised its short-term (“overnight”) rate by 0.25% this week.

All Canadian banks immediately raised their prime rates by the same amount (to 2.95%) causing commensurate increases in the credit costs for adjustable rate loans and home equity lines of credit.

This first rate increase in seven years has created a flurry of media excitement but is actually relatively quite small (see below 10-year chart)

What is more important is the path for future rate increases.

Currently, the consensus forecast is for a second 0.25% rate hike (in October) and, likely, another two more sometime in 2018.

Looking into the hazy future, some forecasters suggest a total of six rate increases over the next few years.

This could translate into a prime rate of about 4.20%. While this is considerably higher than the rate for the past two years (2.70%), it does not reach the levels of 10 years ago.

Admittedly, these forecasts will be revised over time However, rising short-term rates have become a financial reality for the first time in years.

While the US is on pause …

The US has already raised short rates three times over the past three quarters (3 x 0.25%) but now seems to be pausing while assessing the economic impact.

In her semi-annual testimony before Congress this week, Janet Yellen stressed yet again that any future rate increases would be only “gradual” and did not signal immediate urgency to do more in the near future.

Markets now assume that US rates would not be raised soon (i.e. not before December), and made some quick adjustments:

- The US dollar fell relative to other currencies (i.e. since other countries are expected to raise rates in the interim);

- Bond rates declined (i.e. since there would be little upward pressure from rising short rates)

- The equity markets generally increased. (i.e. since there would be little threat of higher long term rates)

But there is little change in long term interest rates …

The above changes in short term rates are best viewed as the end of an extraordinary period of central bank administered financial support after the Great Financial Crisis (2008 – 09). It is not a great surprise that these extraordinary supports can begin the process of winding down.

Gradual, and well-communicated, rate changes of 0.25% should be easily absorbed by a healthy economy and would be of worry only to those who are severely overly indebted.

Notwithstanding the rise in short rates, there was been only minor change in longer term rates (i. e. 10+ years).

These rates, set by the markets and not by the central banks, remain very low (2.32% in the US and 1.89% in Canada).

These are at the same levels as 2011 and reflect continued expectations for low inflation for many years into the future. In fact, inflation over the next 30 years is estimated at only 1.86% annually.

July 7, 2017

MARKET ENVIRONMENT

“Happy Canada Day” to our Canadian readers; “Happy Fourth” to our American readers.

Looking forward to “H2"

As we enter H2 (i.e. the second half of this year), let’s review the major economic expectations.

The North American economies continue their multi-year moderate expansion - growth to expand at about 2% in real (inflation-adjusted) terms i.e. almost 4% in nominal terms.

This essentially continues the “Goldilocks” scenario of (a) strong enough growth to expand employment and consumer spending but (b) without the high velocity which could create sharply higher rates or an excited boom-and-bust sequence.

Post-US election expectations of accelerated growth from a promised agenda of deregulation, tax reform and infrastructure have now faded away.

Nevertheless, the economics look fine with the (US) unemployment numbers down to that of 1991.

Central banks are pulling back their financial stimulus.

Despite little sign of inflation, central bankers remain worried that their continued high levels of (post-crisis) financial stimulus (i.e. mostly via low rates) could create future inflation or a financial bubble. They seem to doubt their own economic forecasting talents (i.e. they entirely failed to predict the 2000-02 and 2008-09 bubbles) and so are extremely (perhaps excessively) vigilant.

The US has already raised rates twice this year. Their next steps are likely to be:

- In September, starting to decrease the reinvestment of maturing bonds that they already own. This would remove a major buyer from the longer term bond market and could lead indirectly to higher long rates.

- Later in the fall, perhaps add another 0.25% rise.

Canada, which dropped short-term rates twice in 2015 (to offset the impact of falling oil prices on the western provinces) is now worried about potential bubbles in certain housing markets as well as consumer debt.

Although Canadians can easily afford to service such debt and maintain very low default rates, this does not assuage the fears of the Bank of Canada

As a result, Canada is broadly forecast to raise short rates by 0.25% as early as next week (July 12) and again in October. The thought is that this would restore the rate cuts of 2015. In 2018, more rate rises could occur.

Note that the central banks are moving very cautiously (a 0.25% rate rise is not inherently cataclysmic) and are using a series of public speeches to signal their thoughts well advance of their actions. They want to make sure that equity and bond markets are comforted by their careful and gradual changes.

Forecasters believe that the gentle and cautious patterns of short-term rate rises will help push up longer rates in Canada and the US.

Perhaps.

Higher rates have been forecast continuously since at least 2000; however long rates have continued to decline.

Apparently the stronger disinflationary forces of technology, globalization and demographics are stronger than the inherent optimism of economic forecasters.

Any rate, once again in 2017, the higher rate forecasts have proved backward; long rates have declined again this year. Of course, none of this has stopped the dire media warnings of the possible damage of the imagined higher rates.

There is little sign of imminent recession. Goldman Sachs suggests only a 25% chance over the next two years. The several leading economic indicators used to predict economic cycles are universally pointing to continued growth.

The New York branch of the US Federal Reserve has been an excellent predictor of recession. As per the below chart, they consider recessions risks over the next 12-months to be only 10%.

Equities are expected to do moderately well based continued increases in corporate revenues and profits. The first half of the year (H1) produced good returns and the general expectation is for positive but quieter returns to finish off the year.

That said, the markets in the short term are dominated by very active traders (and their computer algorithms) and so the cautious intent of the central banks could be misinterpreted.

There will likely be a moderate increase in volatility across the different sectors and geographies as the markets adjust to any whiff of pullback of the high level of financial stimulus.

The Canadian dollar (and most other international currencies) is expected to continue to gain against the US dollar (USD). This is also likely true for the euro, shekel etc.

This is because, these other countries seem now ready to start raising rates and this would make their currencies relatively more attractive than the USD. On the other hand, the first-moving USD has stalled while their central bank has delayed further increases while they re-evaluate their next steps.

In fact, the USD has declined about 5.6% against a basket of currencies in H1 - with the same amount of decline vis-a-vis the Canadian currency.

If Canadian short rates continue to rise (as expected) while US short rates stand still (as expected) then the Canadian dollar will continue to rise - at least over the short term.

June 30, 2017

MARKET ENVIRONMENT

This week’s market macro analysis, written by Patrick Fisher of our team, provides a comprehensive view of our perspectives.

This week Stephen Poloz, governor of the Bank of Canada, was quite clear that an interest rate increase, as early as July, is now on the table.

In his view, with the economy improving, inflationary pressures may be just around the corner.

In reality, in spite of a relatively robust economy and improving employment, inflation remains muted in most of the world.

An ideal inflation rate of 2% has been the target of most central banks in the western world (i.e. the Bank of Canada, the US Fed etc.).

Academically, economists agree that when the average price for most goods and services increases at an annual rate of 2%, it is reflective of a healthy economy.

Despite years of various policy measures (i.e. ultra-low interest rates and quantitative easing) from the central banks, inflation remains low and, if anything, maybe in secular decline.

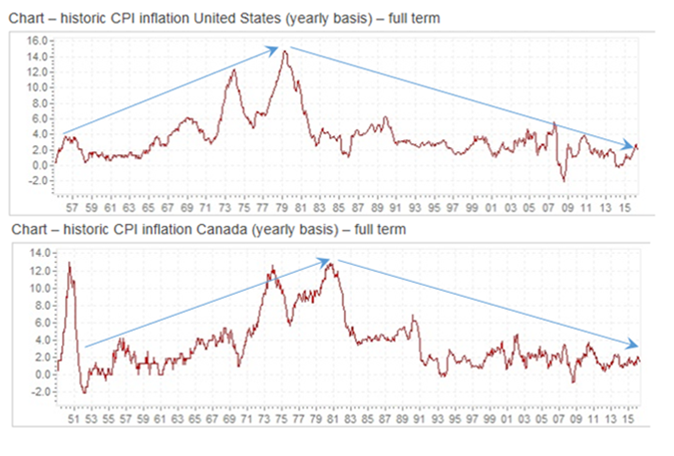

To highlight this, below are long-term charts of the US and Canadian inflation rates since in the 1950s.

Generally, we can see rising inflation from the 1950s peaking in the 1980s (this broadly tracks the inflationary pressures of the baby boom generation).

However since the peak in the early 80s, it is clear that long-term inflation trends are either a) stable at levels below 2% or potentially b) in secular decline.

One cause of stubbornly low inflation is certainly aging demographics. Older consumers tend to spend less.

Globalization, enabling international price and wage competition, further lowers domestic consumer prices and domestic wage expectations.

Also, technological innovation has broadly and profoundly kept a lid on inflation, but in often subtle ways.

For example, this week was the 10th anniversary of the introduction of Apple iPhone to the public (i.e. the beginning of the smart phone revolution).

Here’s a list of things that the iPhone has replaced in the last 10 years:

- DVD & CD players,

- PC computers,

- Flashlights,

- Cameras,

- Land line telephones,

- Maps,

- Books,

- And maybe even your wallet.

In other words, one consumer product has replaced many others (and counting). This is disinflationary.

Last week Jeff’s blog described how oil extraction technology has led to price disinflation (and its various secondary impacts) in energy prices.

But that’s not all. Below are a few more ways that technology is (or will be) generating more disinflation in our lives either directly or by way of secondary impact:

- Amazon’s purchase of grocer Whole Foods will certainly lead to further price competition in groceries;

- Elon Musk’s company Space X is now using reusable rockets to launch satellites (a single satellite launch used to cost $61 million, a reusable rocket launch costs $7 million);

- The technology industry, almost in unison, is now focused on disrupting the auto industry through the introduction of autonomous and/or electric cars and ride sharing which is sure to continue to put downward pressure on prices.