Dividends paid from publicly listed companies have proven to be an important component to investors’ success in growing their wealth over time. Investors can benefit from dividends’ steady income, their portfolio-stabilizing affects in volatile times, and their tax efficiency when held in a non-registered portfolio – all of which make dividend-paying stocks a nice “cup” of benefits for investors.

From disappointment to hope – markets begin their recovery from the ravages of the bear market

Since their post-pandemic surges petered out in early 2022, global equity markets have tested the patience of investors with their high levels of volatility and almost two years of disappointing returns.

But with mere weeks to go in 2023, markets surged, as investors’ spirits were lifted on hopes that, not only did it appear that interest rates were not going any higher, but that they would in fact be cut in and through 2024. Central banks in Canada, the U.S., Great Britain and across Europe all seemed to share the view that inflation was receding enough to bring down rates in the coming months; and, to add to the suddenly rosy outlook, that key global economic engines like the U.S. would likely skirt a serious economic slowdown or, more importantly, a full out recession.

"When in disgrace with Fortune and [investors’] eyes...” – Dividend-paying stocks look for redemption

High interest rates and bond yields, coupled with worries over a slowing economy, took a heavy toll on dividend-paying stocks over the last few years. As interest rates and bond yields rose through 2022 and 2023, dividend-paying stocks lost out on a comparative value basis with investors when compared to bonds and even GICs. As the latter two’s yields and rates rose, investors bet that a bond or GIC was less risky than a dividend-paying stock but suddenly paid as well if not better.

As well, from a risk perspective, many dividend-paying stocks are in capital-intensive industries like infrastructure and utilities, and as rates rose, so did financing and debt costs for these companies, risking a reduction in their ability to increase or, in some cases, even pay dividends. The same is true on the debt side, as companies such as REITs with typically high debt levels suddenly looked riskier in light of sharply higher financing costs.

Fast forward to today, and the situation is quickly improving for dividend-payers. As bond yields have come down significantly from their most recent highs and interest rates look set to follow as central banks begin to cut their trend-setting rates in the months ahead, this naturally reverses many of the things that have turned investors away from dividend-paying stocks. As well, an improving outlook for the North American economy sets up this type of investment for better days ahead.

The first “Double”: key portfolio management benefits of dividend-paying stocks

If it makes sense based on your portfolio goals and your risk profile, dividend-paying stocks – and, importantly, companies that increase their dividend payments to shareholders consistently over time – can offer some excellent benefits:

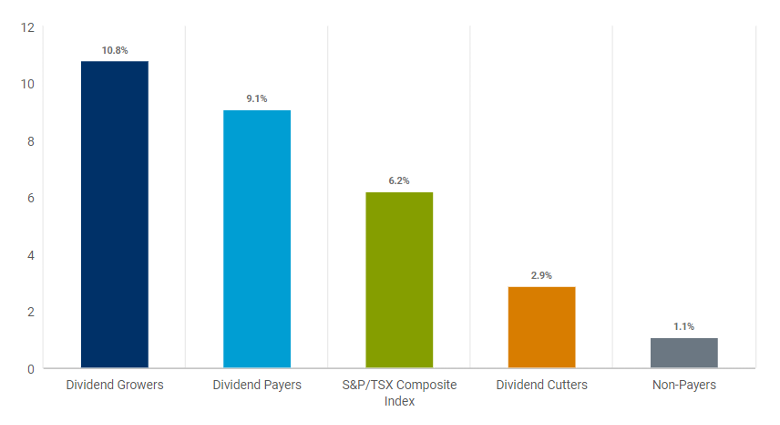

1) Dividend-payers have outperformed the market over time: Dividend-paying stocks – and especially dividend growers – have historically offered better returns than the broader market, as companies that are able to pay dividends to their shareholders are usually financially strong and successful businesses with healthy earnings and cashflows.

Compound annual total returns (1986 - 2022)

Performance from October 1986 – December 2022. Equal Weighted Equity Only Total Return Indexes. Dividend Growers, Payers, Cutters and Non-Payers are determined annually. Growers had a positive 12-month change in dividends paid; Payers paid dividends; Cutters had a negative 12-month change in dividends paid; Non-payers did not pay a dividend.

Source: RBC Capital Markets Quantitative Research, RBC GAM. An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results.

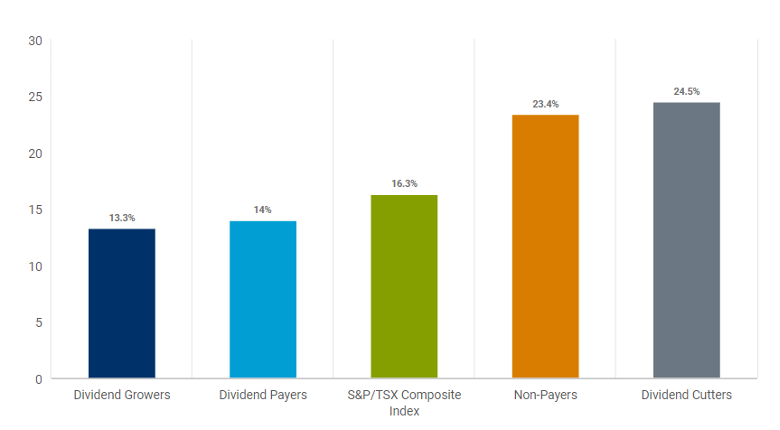

2) Dividend-payers have experienced less volatility over time: Dividend payouts can help make their stocks less susceptible to sharp price changes. This is primarily for two reasons: one, less of the return of a stock is dependent on price appreciation, as the regular flow of income (usually) on a quarterly basis provides a good portion of the total return of the stock; and, as per Point #1, companies that can afford to pay out dividends are usually ones that are cash rich and creating more in profits than the company can reasonable reinvest back into the company. This “signals” to investors that these companies are stable and in a strong financial position. Of note, over the last 50 years, dividends have represented fully one-third of the S&P/TSX Composite Index’s return.

Annualized volatility (1986-2022)

Performance from October 1986 – December 2022. Equal Weighted Equity Only Total Return Indexes. Source: RBC Capital Markets Quantitative Research, RBC GAM. An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results.

Standard deviation is a commonly used measure of risk and is applied to the annual rate of return of an investment to measure the investment’s volatility. Standard deviation shows how much the return on an investment is deviating from expected normal returns. A higher standard deviation indicates a greater variability in investment performance.

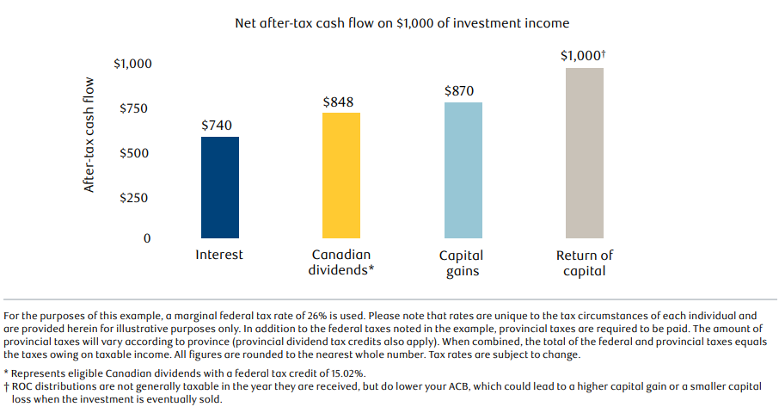

The second “Double”: Tax benefits of dividend-paying stocks

Beyond their notable investment and portfolio management benefits, dividends also have tax benefits for investors who may be holding stocks outside of a tax-sheltered plan such as a Registered Retirement Savings Plan (RRSP) or a Tax-Free Savings Account (TFSA):

1) Effective tax investing: Individuals who receive eligible dividends from Canadian companies can claim the Dividend Tax Credit (DTC), a federal tax credit (a provincial dividend tax credit may also apply) to reflect the fact that the company paying the dividend has already paid Canadian tax on its profits. The DTC can significantly reduce the taxable amount of dividend income, a real boon for those seeking income and who are in higher tax brackets.

2) “Less tax? I’m in!”: Because of the tax benefits associated with dividend-paying stocks, they are even further in demand by investors who require tax-effective income, especially retirees looking to create cashflow in their golden years. The benefit to this is that it tends to further contribute to stable stock performance over time, as investors seek the regular flow of dividends from their issuers and not just capital gains as provided by non-dividend payers, reducing the need to sell their positions to generate gains or to minimize losses – especially when volatility hits.

We can help fill up your portfolio with the sweet “Double Double” benefits of dividends

If you are looking to leverage the multiple benefits offered by dividend-paying stocks for your portfolio, and it makes sense given your risk profile and goals, talk to us today – we can help.

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license.