| Good day everyone. September was not only an unusually warm month but it also turned out to be quite a strong month in equity markets as well. This was a little unusual, as from a seasonal perspective September on average is the weakest month of the year. Why did this happen? Following a similar theme as outlined in the August newsletter, equity markets continue to climb the ‘wall of worry’ due to strong earnings growth, supportive central banks in Canada and the US as they continue to lower interest rates, and the view that the Canadian and US economies continue to grow (slowly) and look to be well positioned to avoid a recession in the near term. Artificial Intelligence Another major contributor to the recent strength in the US market is the massive spending and investing into artificial intelligence (AI) technology, from chip manufacturing, data storage centers, and the huge demand on electricity to power these technologies. For example, there are now $40 billion worth of US data centers under construction, up +400% since 2022, and it has been estimated that to meet demand, $500 billion will need to be invested in data centers each year until 2030 (The Kobeissi Letter). The major investors here are the large US tech companies such as Nvidia, Microsoft, and Meta, for example. I’m not an expert in AI, but what I’ve come to understand from those in the know is that we are now just at the beginning stage of major shift towards AI (Mark Schmehl, manager of Fidelity Global Innovators fund). Further, AI is expected to have a significant impact on society in the long term, with comparisons to the impact of other foundational technologies such as electricity and the internet (Jensen Huang, CEO of Nvidia). From a portfolio management perspective, if you have exposure to US equities then you are participating in this growth. When discussing this topic I’m often asked if we are in a tech bubble similar to 1999? We don’t think so, as many of those tech companies at that time were not profitable and had zero earning growth, and their valuations were based on little except hype. Today, the large US tech companies as noted above are quite profitable and have exceptional earning growth and huge cash reserves. While this is all exciting and new, and perhaps a bit scary, we remain disciplined in regards to our portfolio management approach. Specifically, being well diversified across many sectors and geographies is fundamental as it provide portfolios with defensive characteristics and risk management. Bull Market & Economic Health Switching gears, Ryan Detrick from Carson Investment Research, regularly provides great charts and commentary on the status of the US market and economy, and has been someone who I’ve followed for several years now . Let’s look at what he has to say most recently. ‘The bull market turns three this Sunday. Since WWII, there have been 11 other bull markets and only once did a bull market make it this far and not get to it's fourth birthday. Just a reminder that the five previous bull markets (going back the past 50 years) that made it this far kept going. Shortest was five years, the average was 8 years, and two made it to double digits… I’ve said many times that bull markets are like cruise ships—once they get moving they are very hard to stop, and very hard to turn around.’ (see the chart below on this).

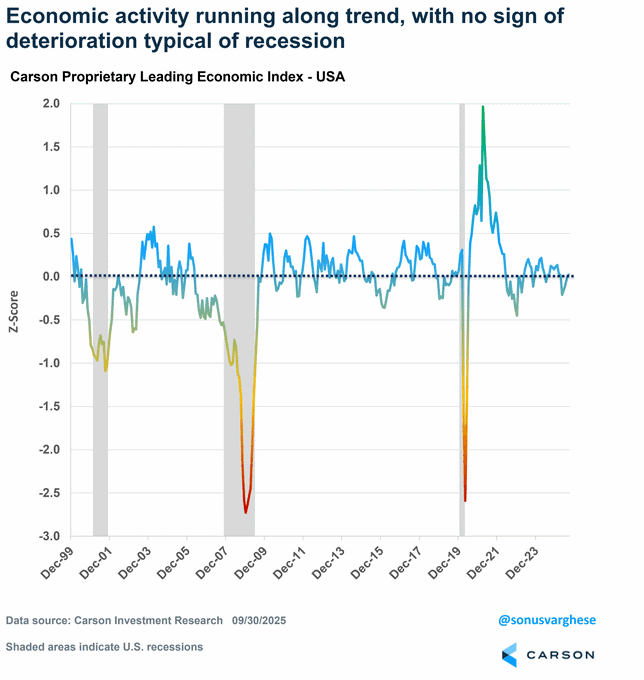

Further, Ryan provides some commentary on the state of the US economy. ‘Our proprietary @CarsonResearch LEI continues to suggest the economy isn't anywhere near a recession, in fact, it has been improving as of late.’ (see chart below)

Office Community Giving You may like to know that our office and staff donate their time and money on a regular basis to several local community groups, such as the Central Alberta Child Advocacy Center, the Red Deer Food Bank, and the Central Alberta Humaine Society just to name a few. We’ve also done a fair number of volunteer hours and have donated a good amount of clothing. Tracy in fact plays a lead role in many of the volunteer and donation initiatives in our office year around. I know many of you are quite active with volunteering and donating to your local communities, and it is admittedly quite fun and can be really informative to work a few hours at the Mustard Seed or the Food Bank to see how these organizations work.

|

| As always, please do not hesitate to reach out to me should you have any questions or concerns.

All the best, Evan

Evan Thompson | Senior Investment & Wealth Advisor Thompson Wealth Management | RBC Wealth Management | RBC Dominion Securities Inc. T. 403-341-8884 | T. 1-800-663-6087| F. 403-341-8887 | www.thompsonwealthmanagement.ca | 300, 4900 - 50 Street, Red Deer, AB T4N 1X7

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2025 RBC Dominion Securities Inc. All rights reserved.

|