Good day everyone,

I hope you are all doing well!

With the RRSP season now behind us, let’s take a look at where we are in the market cycle with some help from our technical strategist Robert Sluymer.

4 -Year Cycle

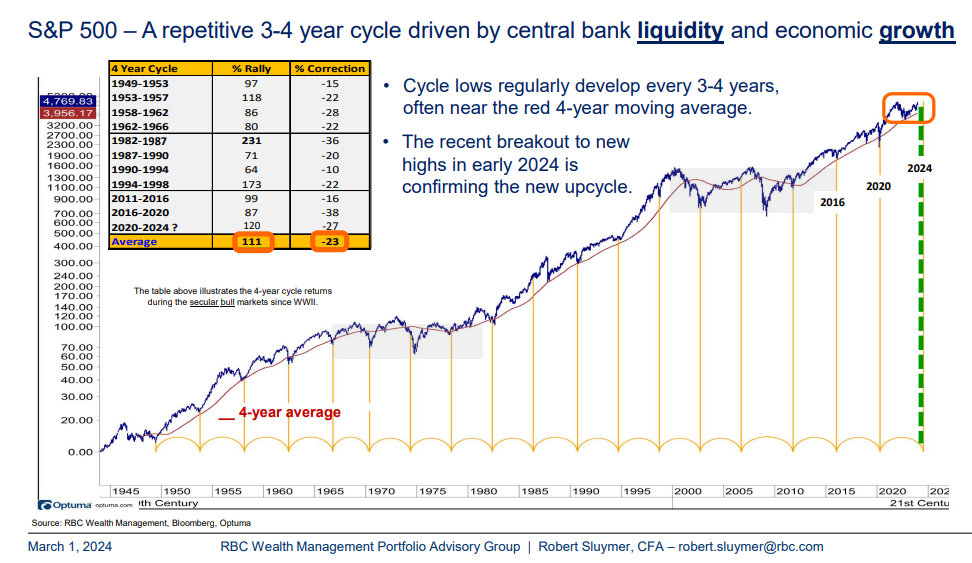

One of the things that I find to be quite helpful when trying to understand the ebb and flow of equity markets, is to view the market as a series of three to four year repetitive cycles (see chart below). These cycles are driven primarily by central bank liquidity, as they raise and lower interest rates, as well as economic growth.

For example if we look at the 2020-2023 year cycle, Robert highlights that the lows which occurred in 2022 continue to define the low point for that cycle. More recently in 2024, with US markets exhibiting ongoing strength and breaking out to new highs, this confirms in Robert’s opinion that a new market cycle continues to emerge. While technology and mega-cap growth stocks have dominated market leadership, we are also beginning to see evidence that participation is broadening out to other areas of the market, with more cyclical sectors (economically sensitive business such as industrials, financials and consumer discretionary) now participating in new early upcycles.

So where are we now? Our short term view is that following with the recent strength in markets over of the last few months, we would not be surprised to see markets take a pause or pullback in March and/or into the second quarter (April-June). Rather than viewing a pending pullback as a major concern, we view near term pullbacks as normal, healthy pauses within an emerging bull cycle, with the overall technical behavior of global equity markets to be consistent with a broader cycle recovery.

Recession or Soft Landing?

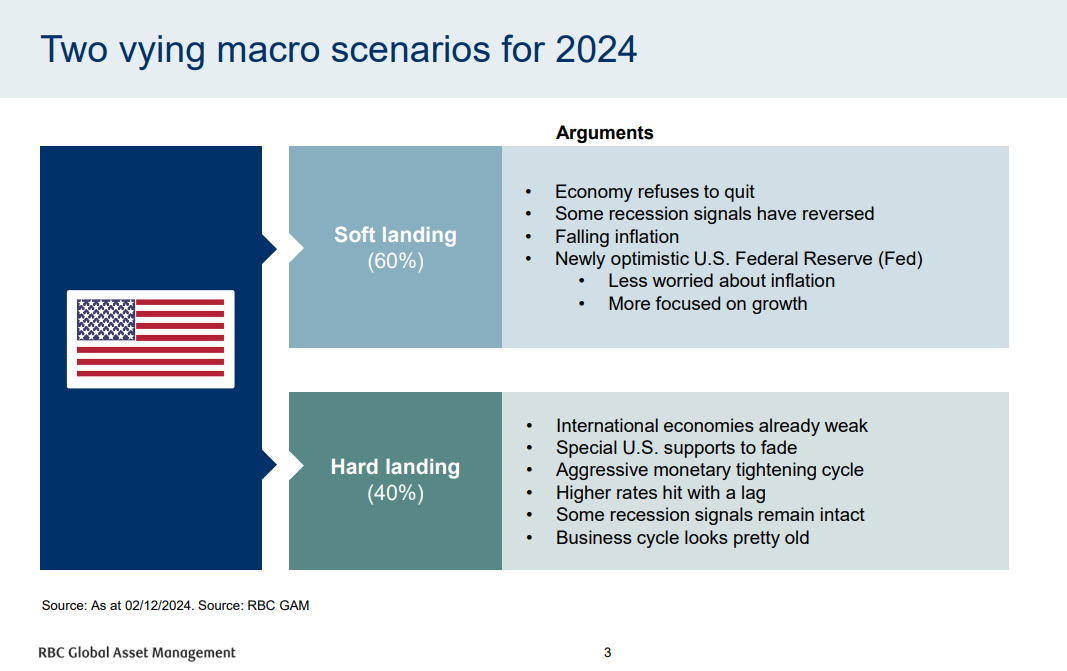

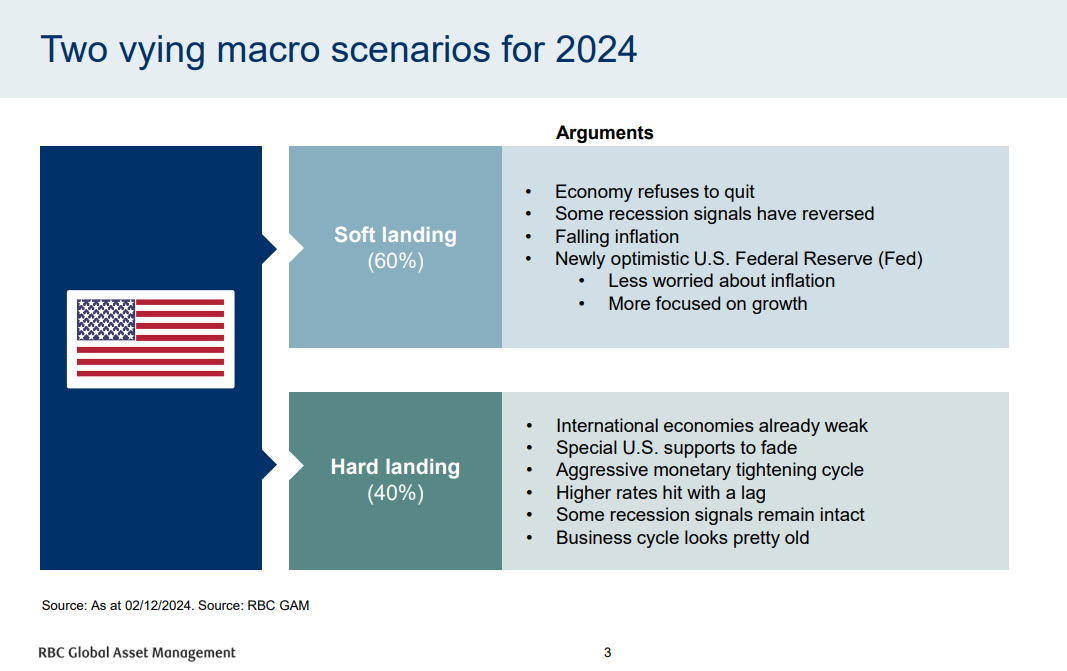

The only thing I can tell you for sure is that nobody knows the future, and the best we can do when it comes to this kind of stuff is talk in terms of probabilities. A few months ago our view on the odds of achieving a soft landing, which I would define as slowing the economy just enough to cool down inflation, verses a hard landing or a recession, was about 35% in favor for a soft landing and 65% in favor of a recession.

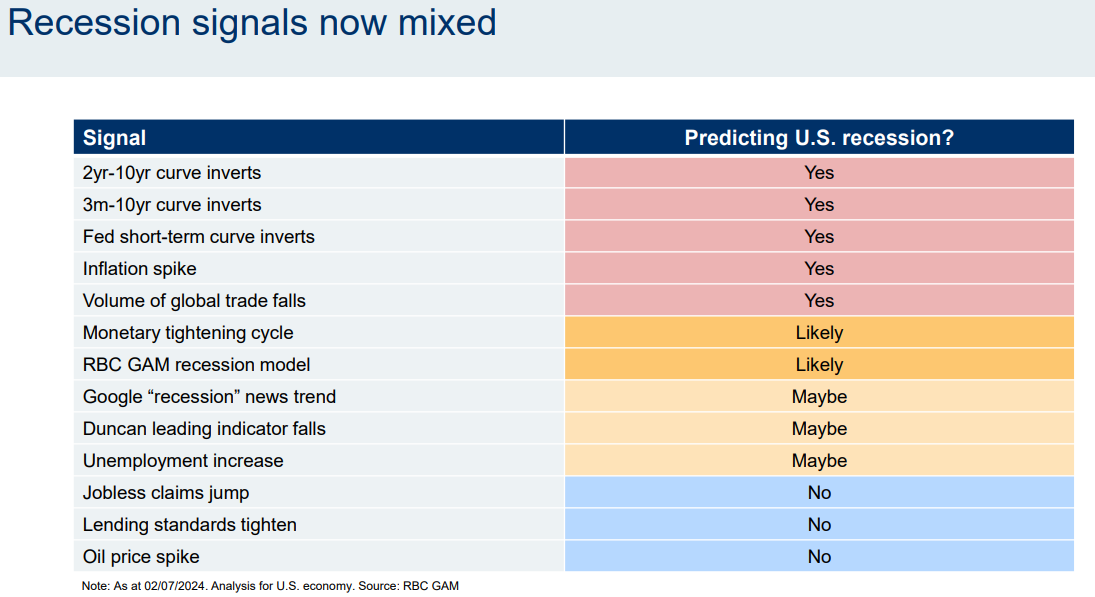

Fast forward to today, it appears that the odds have changed places with the probability now in favor of the US economy actually being able to pull off a soft landing and avoid a recession/hard landing, see first the picture below. This is a result of the US economy continuing to exceed expectations and demonstrate impressive resiliency. Just to make things even less clear, our recession scorecard is showing mixed signals (second picture below), with several indicators actually improving over the last few months

US Elections

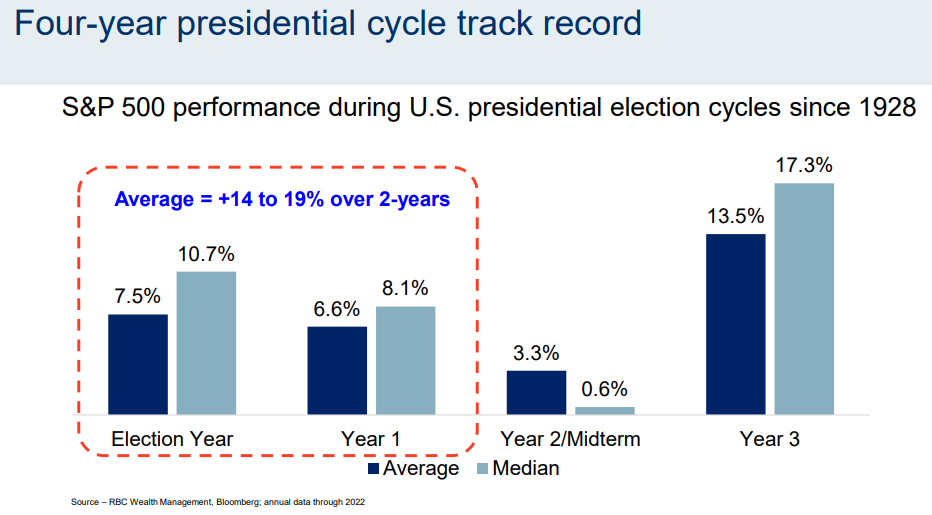

I’m often asked questions about the implications of US election on markets. In the long term markets are driven more so by macroeconomics, consumer spending, interest rates, GPD, and corporate earnings for example, than they are from changes in government. However in the short term, markets do tend to display some volatility around election time which I think relates more to a sense of uncertainty rather than any sudden change in the macroeconomic environment, in my opinion.

Of course there is no shortage of data when it comes to market performance and US elections, and if we break out the data in terms of each election year, we can see that there are some years that tend to do better than others, see the chart below.

Putting It All Together

I do not hesitate to describe myself as a persistently stubborn optimist, and I practice this same view when it comes to investing in equity markets over the long term. I have yet to find a better alternative. Nonetheless, given the mixed although improving recession signals, the recent strong run in markets over the last 4 months, along with central banks still in a ‘wait and see’ posture as they watch for an optimal time to initiate interest rate cuts, I think it is reasonable to be somewhat cautious over the next few months. For any new money, I would encourage a monthly dollar-cost-averaging approach which allows investors to gradually step into markets, especially throughout the summer months which tend to be seasonally weaker, and be ready to participate in hopefully a resumption growth through the final months of the year.

As always, If you have any questions or concerns or anything we can help with please don’t hesitate to call in or drop us a quick email.

All the best, Evan