We’ve all come to agree that if you invest your hard-earned dollars in the stock market, it’s understood there’s an element of risk and uncertainty that goes along with it. The reason most of us accept this is that we know from past experience, over a number of years, the stock market outperforms most fixed income vehicles and cash, not to mention inflation and tax considerations in this latter category.

Why is it then, that many still find themselves circling the drain of worry when it comes to the future performance of their investments? I would argue it boils down to two important factors – implied volatility and investor fatigue.

Below I’ve included the CBOE (Chicago Board Options Exchange) Volatility Index (the VIX for short), going back 35 years. This is often referred to as the fear index. In a nutshell, the VIX measures the S&P500 options prices for the 30 days following the measurement date. In the world of trading, it’s an important index because it provides a quantifiable measure of market risk and investor sentiment. The general rule-of-thumb is that the VIX generally rises when stock prices fall, and drops when prices rise. In the illustration below, it’s easy to spot the absolute “peaks of fear” in 2008 (world financial crisis) and March 2020 (onset of Covid-19).

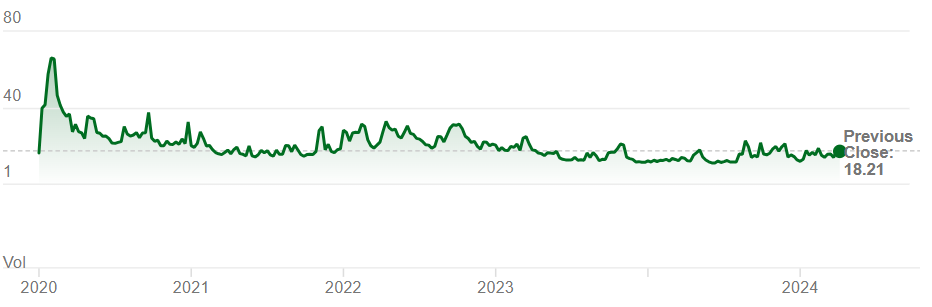

Now, let’s take a look below at the VIX over the last 5 year period. Given everything that gets thrown at us in the press and online (if you dare to go there), you wouldn’t be faulted for assuming we’re at very elevated levels right now. However, the index has been remarkably stable for over a year (and longer), despite all of the mania floating around out there. This is just another example of perception versus reality.

*Chart data courtesy Refinitiv

So, what is investor fatigue? I believe it’s a combination of what seems like never-ending bad news, sharp stock market spikes up and down and the overall feeling that investing isn’t as fun as it used to be… We live in a world where instantaneous information amplifies the effect of volatility on the investor psyche because every fluctuation in our holdings is readily accessible on a smartphone, tablet or computer. I’ve heard this called, “media by the second” and it’s extremely addictive and dare I say damaging.

If you’ve worked with me for a long-time or even just this past year, you will know my views on the tendency some have for over-consumption of news. While I certainly respect each individual’s right to read/watch whatever the heck they want, if you know inherently that over-consumption is having a detrimental effect on your psyche – please consider taking one small step toward removing even just one news outlet from your life. I can guarantee you won’t miss it!

A big part of my job in managing your wealth, is being there for you when you’re feeling uncertain. Therefore I want to remind you, if you have concerns or just want to talk, please contact me. I’m not going anywhere.

Libby

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc.* nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2004. All rights reserved.

* All rates, yields and prices are subject to change