We began 2024 with no real idea as to when interest rates would start declining. Even after the first cut in June, the uncertainty created a scenario where markets remained somewhat range-bound (but still positive). Then came August and it was as though the lights turned on and a flurry of buying commenced, both here and in the US.

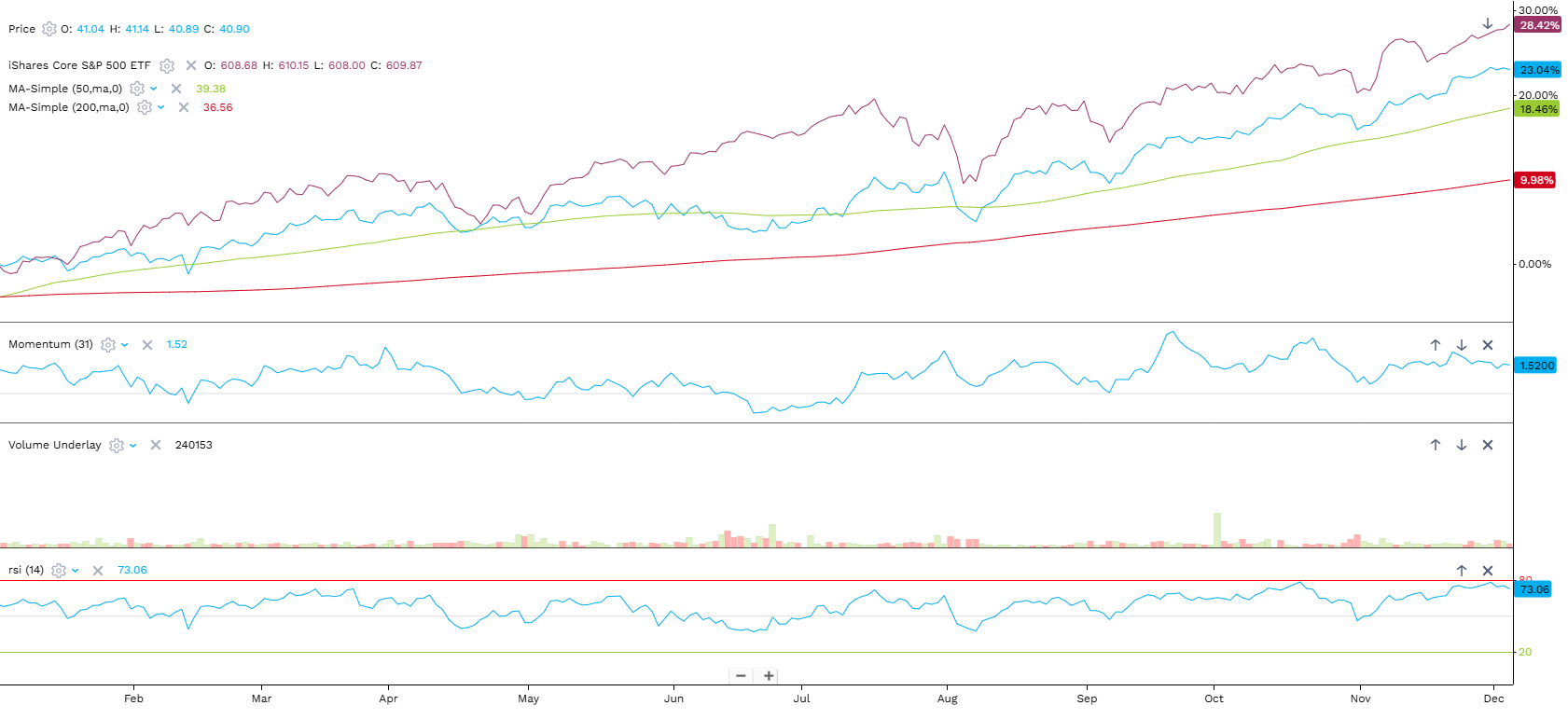

To illustrate just how remarkable this year has been (especially the past four months), I’ve included below, the year-to-date performance for both the TSX (Canada – blue line) & the S&P500 (US – maroon line). As of this writing, the Canadian broader market is up +25% ytd & US +29%.

*Source FactSet

Next week the Bank of Canada may cut rates again, and if they do, we can likely expect further upside for many of our larger dividend-paying companies. Next year, the BOC may very well continue easing, but this will largely depend on inflation and other pertinent data.

Interestingly, with markets up significantly this year, one might expect celebrating and high-fives all around. I’ve come to realize however, for many, there appears to be a general unwillingness to get too excited for fear it will all go “poof”. When having discussions with clients who lean in this direction, I’ve taken to reminding them that we have banked very strong returns over many years, and therefore can afford to have a rocky year once in a while. It is after all, a natural cycle for all markets.

As much as we inherently understand the value of living in the moment, the constant flashing of headlines, in whichever format one choses to consume “news”, can be detrimental to our basic need for a feeling of safety and stability. It is my greatest hope, for this holiday season and beyond, that we allow ourselves the gift of self-examination when it comes to how we absorb headline information. Why not consider doing an audit on yourself to determine if your method of news consumption is adding, or subtracting from your overall well-being? If it’s the latter, consider deleting the app(s), the constant pop-ups, the newspapers or whatever it might be. Simply ask yourselves, what is triggering and therefore takes me away from the things that matter most to me?

As the year comes to a close, once again, I am beyond grateful to my clients for entrusting me with the management of their hard-earned wealth. It is a responsibility and honour I do not take lightly.

May your holiday season be filled with laughter and peace all around.

Libby

The strategies and advice in this communication are provided for general guidance. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2022 RBC Dominion Securities Inc. All rights reserved.