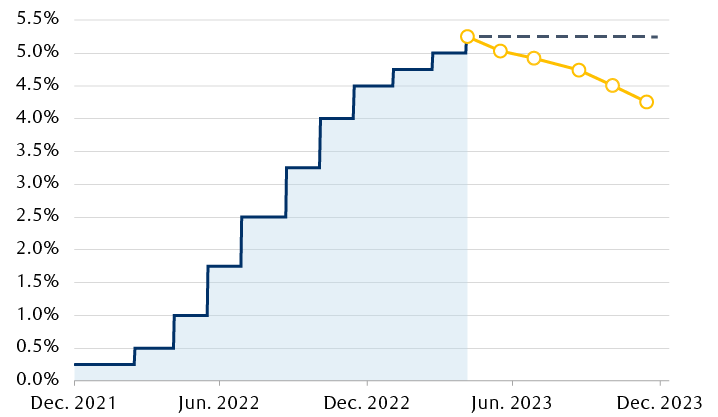

As the market widely expected, the Federal Reserve raised rates by another 25 basis points (bps) to bring the target policy range to 5.00 percent to 5.25 percent, equal to its 2023 projection from the March quarterly meeting. Updated language in the official policy statement also signaled a pause is now looming as “… the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments” in determining the extent to which any further policy tightening is warranted.

It’s just that it should have taken those things into account before raising rates this week, in our view.

After its latest—and likely last—rate hike, how long until the Fed takes it back?

Line chart showing that with the Fed's latest rate hike to 5.25%, it now equals the Fed's projection for the rest of 2023. However, markets continue to believe the Fed will need to pivot to rate cuts sooner rather than later, with rates ending the year closer to 4.25%.

Source - RBC Wealth Management, Bloomberg; Fed rate projections as of the March 2023 Federal Open Market Committee meeting, market-implied path based on fed funds futures data

Break the rules

According to our Wikipedia research and one or two high school art classes, “… early Impressionists violated the rules of academic painting. They constructed their pictures from freely brushed colors that took precedence over lines and contours.” The Fed might have been well-served by a similar break from tradition.

Policymakers have been singularly focused on inflation to this point of the rate hike cycle, and understandably so, in our opinion. Inflation is still high, the lines and contours of which we believe still clearly argue for raising rates. But at the later stages of any rate hike cycle, and certainly after the 500 bps of policy rate tightening delivered in barely a year, a freer form of painting could be to the benefit of policymakers’ ultimate goals.

To wit, what harm would there have been in taking a pass at this meeting? The Fed’s own forecasts would have kept another rate hike on the table, while giving policymakers another six weeks to assess markets, economic data, and the impact of a looming U.S. debt ceiling deadline that will likely arrive before their next scheduled meeting on June 13–14.

The Fed has been clear that it hopes to raise rates and to leave them at elevated levels until inflation is well and truly and unquestionably on the path to the two percent objective. But by pushing forward with a rate hike this week, policymakers might have actually put that goal in jeopardy, seen most clearly in markets which now expect a rate cut as early as July with more to follow.

But that’s neither here nor there. What happens now?

Read the room

It was already a rough week for markets ahead of the Fed and European Central Bank policy meetings this week, and we believe it has only gotten more troublesome since.

In the U.S., the roiling regional bank crisis is entering a new phase with regional bank indexes down nearly 10 percent on the week compared to the S&P 500 down about two percent, with certain regional banks seeing their equity valuations decline by half.

The 2-year Treasury yield—a proxy for Fed policy rate expectations—has dropped by close to 50 bps this week alone to just 3.67 percent, having traded north of five percent in March. The 10-year Treasury note yield—a barometer of economic growth and inflation expectations—has also fallen precipitously to just 3.30 percent, it too on the cusp of the lowest levels seen since last summer.

On the economic data front, we think markets will be left wanting for a respite in the coming days. In the U.S., economists surveyed expect the April jobs report data, scheduled to be released on May 5, to show a slowing in the pace of hiring and an uptick in unemployment. This is coming on the back of job openings data released on May 2 that showed jobs are down 20 percent from the highs of March 2022, a magnitude on par with past recessions as employers pull back on hiring plans.

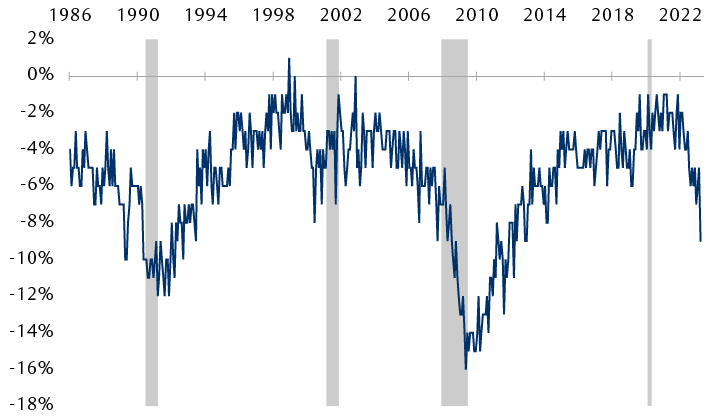

Next week, the long-awaited first look at the impact of bank stress on bank lending will come in the form of the Fed’s Q1 Senior Loan Officer Opinion Survey. While we think markets will be looking for the extent to which banking stress has caused banks to tighten lending standards, the latest small business survey for March has already shown investors that credit availability is at the lowest levels in a decade, as shown by the chart.

U.S. small businesses already seeing deterioration in lending conditions

Line chart showing the net percentage of small businesses surveyed that are seeing a lower availability of credit, a key driver of economic growth, which is now at levels consistent with past recessions.

Source - RBC Wealth Management, Bloomberg, NFIB Small Business Survey for March; shows net percentage of respondents seeing greater availability of credit

That’s to say nothing of next week’s Consumer Price Index report and a May 9 debt ceiling meeting of Biden administration officials and congressional leaders ahead of a potential early June breach of the statutory debt limit. The early market reaction suggests to us that the Fed may have indeed just hiked itself into a corner.

Last call

From a fixed income perspective, we have spent the better part of the past six months highlighting the need to get money to work to lock in elevated yields. With the last rate hike likely behind us, and perhaps only cuts ahead, we would only put one final emphasis on that point.

For markets broadly, risk assets are likely to remain under pressure and highly volatile. A resolution of the debt ceiling—something that we believe should be done soon and without question—and further acquiescence by Fed policymakers to the risks emanating from the recent “economic and financial developments” that they claim to be watching may help to soothe some fears, but even still would be no panacea at this stage, in our opinion.

As a result, we would dial back risk exposure in both equity and fixed income portfolios, moving in search of more defensive positions.