Plan - don't predict

Good afternoon, readers. We hope you have had a good month since the last issue. So much has happened. We have had many discussions about the market as it relates to the new US administration. We are having many discussions with business owners on holdcos and how they fit into their planning, and we will talk about both latter issues below.

We are officially moving to a monthly cadence on the letter as we are finding the balance between time spent writing and time spent having useful follow up conversations with readers.

Announcement: Essential Business Owner Planning Strategies

Note: we are running an information seminar for business owners at the end of November and will be covering essential planning strategies. This private in-person event will cover tax, investment, risk management, Estate, and succession planning strategies for business owners. Please contact us with your interest in attending. There will be limited seating as it will remain an exclusive event meant focused on encouraging comfortable conversations.

Returns under Republican and Democratic Administrations

The most frequent question we've heard over the last few weeks relates to speculation on how markets are affected by different American administrations. We've put together some numbers below to provide some answers.

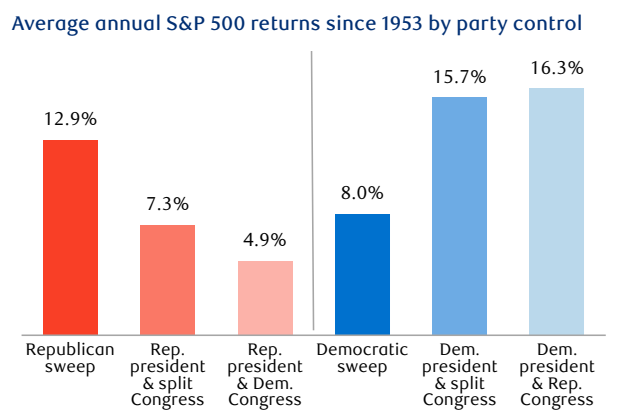

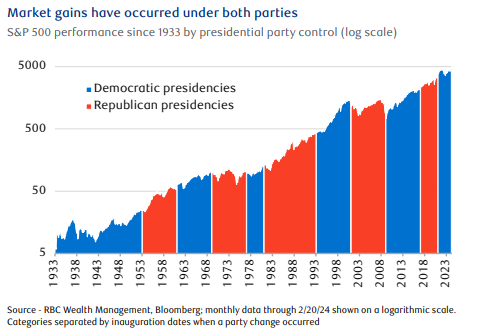

In a nutshell, investors win regardless of which party wins elections. And although Republicans believe in smaller government and fiscal conservatism, Democrats have had the highest overall returns. Surprisingly, the strongest Republican returns happen in the case of a sweep which we have just witnessed. (See red bar on the left.) For the Democrats, the best performance - far right - occurs when with a Democratic president and a Republican Congress.

Source - RBC Wealth Management, Bloomberg; data through 12/31/23; data based on price returns (does not include dividends)

However, both parties historically preside over positive returns.

Will the "Trump Trades” hold their momentum. History says no.

Regular readers know we frown on attempts to time the market. In fact, we believe that perfectly timing the market is nigh on impossible. However, investment managers DO in fact time the markets reasonably well if they can correctly determine which part of the market cycle that we are in.

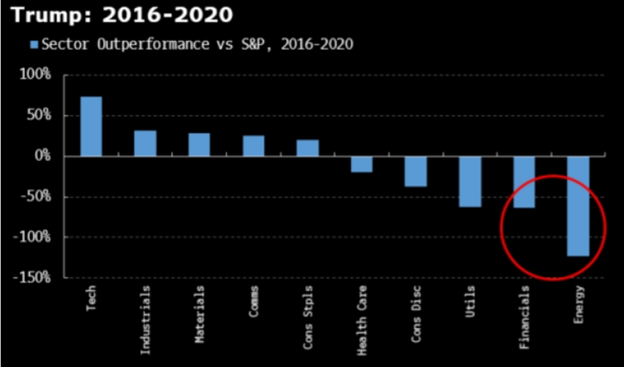

In terms of elections-triggered trading opportunities, Donald Trump's recent election win triggered gains across large and small caps and with crypto jumping biggly. But during Trump's first round in the White House, many of the "Trump trades" did not work out as expected. For example, many investors expected energy and financials to perform very well. And they should have. However, COVID happened. Unknown unknowns can play a big part in market performance. In the end, financials, and energy were the worst performers under the last Trump Administration. Sometimes, the things you are the surest of are what you actually get wrong.

Trump Momentum Trade from the last Administration: What worked and what did not.

Source: Bloomberg

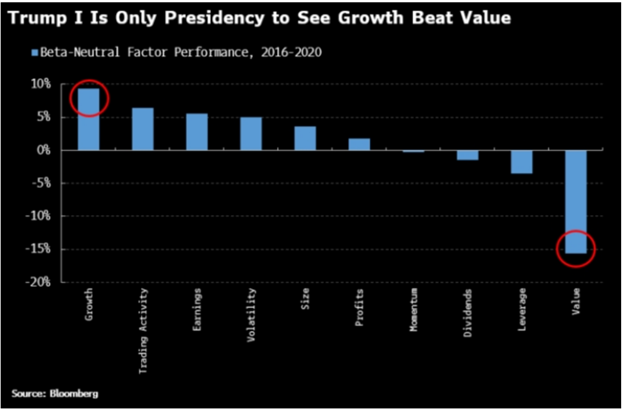

The Trump Value Trade Fails

Another interesting example that bucks historical trends relates to the same 2016-2020 election cycle. In every presidency since 2000, value stocks generally outperformed growth. However, Trumps MAGA and "America First" policies, although seemingly favouring growth stocks, did not pan out as expected. Instead, we saw the value trade get crushed and those who stuck to growth - read " Magnificent 7" - doing the crushing.

Source: Bloomberg

In summary, when investing, temporary spikes related to election-triggered speculation often fades. What really counts amongst other things is how the business cycle evolves, the quantity of innovation and productivity growth, and Fed policy.

Business Owners - Should you build your nest egg in a holdco?

Working with business owners, we are always in the midst of discussions about the possible uses of holdcos which can be implemented to support many planning strategies. Some of the different purposes of holdcos include creditor protection, a location to hold company shares and real assets and as part of an estate freeze strategy, and, in some cases, tax planning.

The government of Canada harmonized the taxing of personal and corporately held assets so that there is little difference from that perspective. So, is it worth it to open a holdco to grow your investment portfolio? For the aforementioned strategies, certainly. However, for tax purposes, generally its worse to invest in a holdco.

A common family trust/holdco structure allowing estate freezing and "sprinkling" of income.

Personal vs Corporate Taxes:

If your portfolio generates income, dividend, or capital gains, you simply declare that income and pay personal taxes. Income is the least tax-efficient way of growing wealth while dividends are tax more advantageously and capital gains the most efficiently. Keep in mind that the personal capital gains inclusion rate moved from 50% to 66% for realized gains greater than $250,000.

In a corporate portfolio, all income is taxed at the highest tax bracket, unlike personal income. Dividends are about equally taxed. Capital gains in your holdco are taxes at two-thirds inclusion rate. However, once those funds are paid out to shareholders, after being tax at the lower, corporate tax rate, they are then taxed in the shareholders’ hands at their personal tax rates.

In the end, regardless of which province your business is based, your corporate portfolio will not benefit from lower overall tax rates than your personal portfolio.

And with that, we will wind up as always with this week's Global Insight. Please reach out if you have any questions about today's letter or your own business owner planning needs.

In this week’s issue:

Fed rate cuts for what?

The Fed faces a conundrum. It has cut policy rates by 75 basis points since September only to see longer-term Treasury yields and mortgage rates increase by the same degree. We look at what may be driving this divergence and the potential implications for lenders, borrowers, and the economy.

Regional developments: Housing activity in Canada beginning to move higher; U.S. equities marked a new high-water mark propelled by hopes for post-election deregulation; German snap elections in February could bring a more functional government; China’s latest stimulus package doesn’t meet investor expectations.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.