Plan - don't predict.

After a restful summer we are back to share more ideas and thoughts on the market and wealth planning. We'll likely be reducing the cadence and possibly re-titling the letter to David's monthly.

In this week's letter:

- Navigating your portfolio options as we continue through rate cuts.

- Simple Solutions to investing in bonds.

- Business Owners: What's your business worth?

We've been tracking the interest rate story for the last couple of years through this letter, providing ideas on how to take advantage of some of the extreme pricing and rapid change we've witnessed since COVID hit. Although we are now into the rate cutting cycle in Canada and expect a number of changes to follow in bond pricing, the basic rules of investing are the same in any part of the cycle and for any security type. Here are the eternal questions to consider:

- what is your investment time horizon?

- what is your risk tolerance?

- what return to you require to achieve your goals?

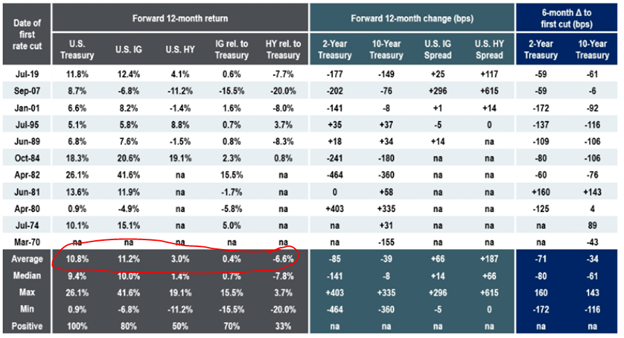

The answer to these questions is of course dependent on each investor's situation and plans. However, let's have a look at what typically happens through rate cutting cycles and how that impacts the markets. In this case, we'll consider how Fed cuts impacted the various fixed income options over the time of 1970 to 2019.

Notably, investment grade corporate bonds, the kind we focus on when investing for clients, on average rallied 11.2% while risk free Treasuries rallied 10.8%. In other words, while we can become enamoured with stock market returns when rates are lower, the risk / reward for the bond market has historically been very attractive at this time. The highlighted averages below also show how the riskier part of the fixed income market, high yield or "junk" bonds tend to be less attractive with average returns in the 3% range.

Bonds after the first Fed Rate Cut - 1974 - 2019

Source: RBC Dominion Securities

Simple Solutions to investing in bonds.

Because the fixed income market provides a broad pallet of risk / return and time horizon options, and because the timing of the cycles is impossible to predict, we support the idea of a diversified bond solution. The latter would be designed to emphasized the best opportunities as they arise while diversifying against the least attractive options. Get in touch to talk about how a diversified bond portfolio might be an option suitable for your own needs.

Using a car analogy, think of this simple solution as an all-weather/all-terrain vehicle rather than a specialized off-road or track car. For most of us, we need to have a way to get around that can cover many different situations, rather than having a conveyance that only shines when the road is very rocky - off road - or perfectly smooth - on a race track.

Business Owners: What's your business worth?

It's been a somewhat challenging time for business owners looking to sell their businesses and many have gone to the sidelines. This can be attributed to the challenges of financing the purchase of a business given the very high rates we've been experiencing. It's a cyclical tale. When rates fall, business prices will be supported as borrowing becomes easier for both buyers and sellers. However, regardless of when you might want to sell your business, valuation techniques, like investing rules, are much the same.

Qualitative Factors

When valuing a business, there are a couple of approaches. The first is to determine the business value based on the assets on the balance sheet, less liabilities. The second is based on a multiple of earnings. Generally, the value is the greater of those two approaches.

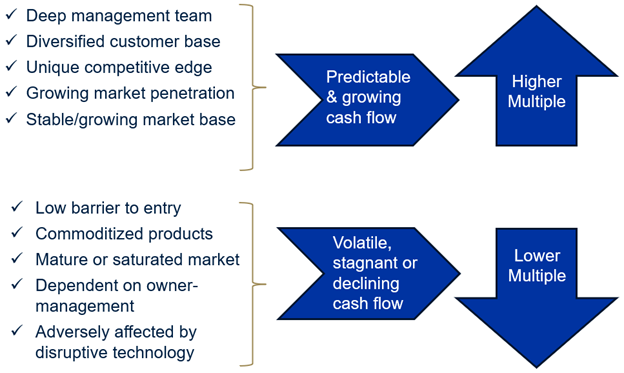

Factors affecting the multiple

When helping business owners with their succession planning, we encourage them to get started on their plans as early as possible because often there can be weak areas that are in fact crucial to the valuation multiple. The process of business succession can take years and go through many iterations including the valuation of the business itself which is based on a specific moment in time.

Factors affecting a business valuation multiple.

Source: RBC Dominion Securities Family Office Services

Using some of the examples above, a business with many sources of revenue, a strong team of experienced managers, and a product or service that is difficult to replicate will likely have a higher multiple to a comparable business that has just one large customer, depends on a limited management team without backup, and has a product or service that can easily be reverse engineered.

When we work with our clients, these are some of the key areas we discuss as part of a multi-year plan to prepare for the sale of the business. To discuss how to maximize the value of your own business, get in touch.

And with that, we'll wrap as always with this week's global insight.

In this week's issue...

Big bang: After biding its time, the Fed finally kicked off its monetary easing cycle with a strong start out of the rate cut gates. While investors may harbor some concerns the Fed is getting ahead of itself and that more aggressive cuts could reignite inflationary pressures, we highlight why we are encouraged by the Fed’s proactive move.

Regional developments: Headline Canadian CPI growth falls to 2.0% target for first time since 2021; Equity rotation continues as Magnificent 7 trade loses steam; Bank of England in wait and see mode; Asian equities rally after Fed rate cut

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.