Plan - don't predict.

Interest rate changes and your portfolio - the recent impacts

We're jumping in to cover a couple of topics while resting up for the writing season in the fall. A couple of items keeps coming up in discussions with friends and colleagues at the various business-owner-centric events we frequent over the summer. And those are:

1) what will happen with rates going forward?

2) what are expected market returns as rates are cut and then going further forward?

3) could you just buy ETFs to fulfill your investment needs?

Rates: too far one way then too far the other: how do you plan for market swings and cycles?

Trading desk discussions over the last 25 years would frequently dwell on the fact that Americans in general, and policy makers in particular, tend to go way too far one way and then way too far the other way.

Our friend David Rosenberg, the Canadian financial pundit who has predicted 8 out of the last 2 recessions, is dovish on rates. He predicts, using a similar pendulum analogy, that the BoC did go too far and will "need to bring borrowing costs down to pre-pandemic levels to avoid a deflationary scenario".

He’s not alone as Professor Jeremy Siegel of Wharton School of Business also feels we’re behind the curve and notes, “the Fed funds rate is far too high and I do not want the Fed to repeat the policy mistake it made three years ago being way, way too late on raising rates”.

A good financial plan will survive these inevitable swings. We focus on planning to account for multiple scenarios rather than building financial plans on a speculative foundation. If we were speculators and not planners, our bet – and we’re speaking personally - would be aligned with those of the above gentlemen. We often stated this during the rate hike cycle. But our answer to the first question above is: we don't and can't know what the exact path and timing of rates going forward. No one does.

In general, what are expected market returns as rates are cut?

As a country with a high percentage of home ownership, lower rates will support the growth of home equity in Canada, as in the past. It will also NOT hurt, to say the least, the stock market. If pre-COVID rates return, we will appear to be back to the secular downtrend of rates that we've experienced for the last 40 years. Lower population growth and aging societies do seem to be associated with lower rates. Just look at Japan.

Looking back at our thinking at the end of 2023, 2024 expected returns for traditional equities equally weighted across Canada, US, International and Emerging Markets were about 6.5%. Looking further ahead, we were expecting returns for the US and Canadian equity markets over the next 5-10 years to be about 8.5% and 5.5%, respectively.

Looking at the S&P500, the market already hit its target after 6 months, as SPY peaked out in a 12% rally from the end of 2023. This doesn't mean there's no further upside but does add some context to one's portfolio expectations. The recent drastic tech pullback is healthy and couldn’t have come too soon. When sell offs happen, it’s the time to start writing blue (buy) tickets, not pink (sell) tickets.

The risk for many is trying to time the market and that, as we all know, is impossible to achieve consistently over the long-term. Attempting to do so will likely untether your portfolio from your plans. Better to let the market take you where you need to go.

Finally, planning based on low probabilities occurrences such as worst-case financial scenarios will leave little room to grow your wealth, something which requires risk taking.

S&P500 6 months

Source: Yahoo finance

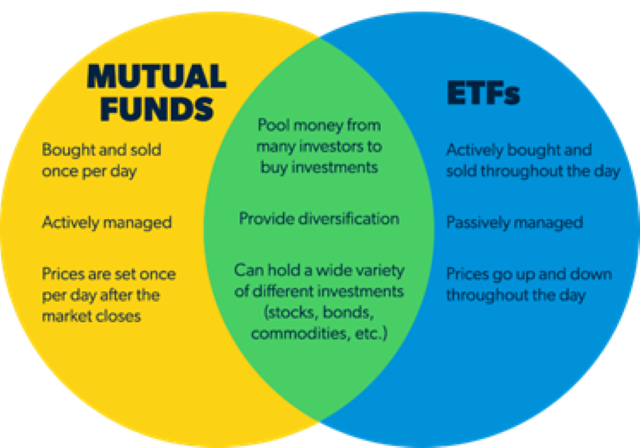

Could you build a portfolio solely using ETFs?

The short answer is yes. There is an ongoing and likely never-ending debate about the value of passive (ETF) vs mutual fund (active) investing. There is a great deal of truth in the statement that most investors and many professionals CANNOT outperform the market - i.e., the indexes - over the long term. In our view, the ratio of those who CAN outperform the market to those that can’t is one in a thousand. This isn't based on scientific analysis but solely on the experience of having traded professionally for so long.

Source: Ramsey Solutions

So why spend the extra money on mutual funds with active management?

Skilled portfolio managers can in fact add value and many do so for decades, allowing investors to outperform the market even accounting for fees. In some other cases, active management can have a different mandate such as a focus on lower-volatility or higher dividends than an index. In both cases, these portfolio managers can in fact beat indexes regularly so that investors with these kinds of needs can achieve their goals.

One approach to thinking about active vs passive management is to consider the opportunity set. When the markets are steady and performing well leaving little on the table to capture through intelligent security selection or by having a different conviction about the markets than the crowd has. In these cases, it can make sense to move more assets into passive indexes and stay close to shore. However, when the market churns and we see dislocations, as in the past few years, active managers can come into their own.

So, when thinking about ETFs vs mutual funds, it's different horses for different courses. Both have value and can often work extremely synergistically within the same portfolio.

And with that, we'll wind up with a longer-format version of the Global Insight. We'll continue to publish on an intermittent basis and return to a regular schedule in the fall.

2024 Midyear Outlook

Please enjoy the firm's latest views

- Global equity: Trees don’t grow to the sky - We don’t believe markets are finished moving higher. But thinking about risk appetite and having a plan for becoming more defensive when conditions dictate are things to contemplate in coming months. With stocks no longer compellingly cheap and investor sentiment increasingly complacent, we favor a cautious, watchful approach.

- U.S. debt dilemma: no quick fixes and no catastrophes - Commentators frequently conflate the federal government’s debt with the nation’s—a critical mistake, in our view. We dig into how investors should be thinking about fiscal policy and the debt and discuss why neither catastrophes nor quick fixes are likely.

- U.S. Recession Scorecard: Clouding over - Our U.S. Recession Scorecard saw an important negative shift in May when a third leading indicator was re-rated to recessionary red. A fourth may undergo a similar shift in the next couple of months. Equity investors should be aware that risks of the U.S. economy slipping into recession in the coming months are rising.

- Global fixed income: The only certainty is uncertainty - The global monetary policy easing cycle has finally commenced. But how far it will run and for how long remain unclear. Regardless of the timing, or scope, of rate cuts, it’s clear to us that we have reached the point where yields are now likely to trend lower. We explain what we think the next step should be for investors heading into the second half of the year.

- Regional commentary - Our regional analysts present their views of equity and fixed income markets, currencies, and commodities, as well as how to position portfolios.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.