Plan - don't predict

In this week's letter.

- Planning on buying a home for your children? You might want to consider these factors.

- Inflation in the US - continuing to trend positively to the negative. Time to update your bond portfolio?

Planning on buying a home for your children?

We are currently seeing signs of an impending market imbalance - to the benefit of buyers. There's a funny thing we've witnessed over the last few years about the housing market when rates go up: prices don't fall much but it becomes difficult to actually find a home as the market becomes illiquid.

At price peaks, the market becomes very liquid. This occurred most recently in 2017. When rates rapidly rose, prices softened but the biggest impact was supply as sellers went to the sidelines in wait for the uptrend to resume which it did with a vengeance.

Is this time different?

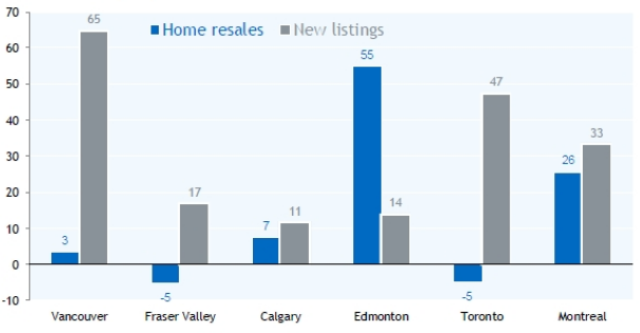

With rates at 20 year highs and prices weakening, we are seeing the kind of environment where sellers usually step away. However, this time we are seeing listings grow significantly. With softer prices and plenty of inventory, we might be witnessing at least a short opportunity for price pressures to turn the market towards buyers. New listing, particularly in Toronto, are jumping while resales are going negative.

Market Activity - Annual % Change, April 2024

Source: REBGV, FVREW, CREB, RAE, TRREB, QPAREB, RBC Economics

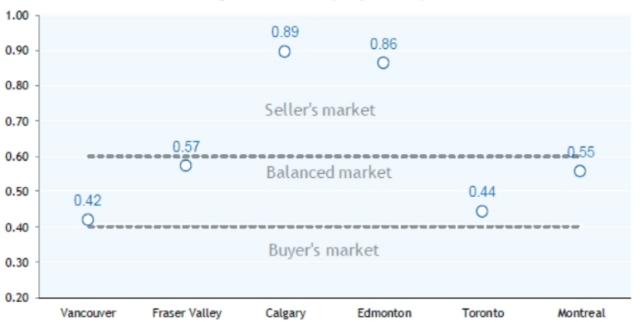

Focusing on Toronto, we can see that it is in fact turning into a buyers market.

Supply/Demand: Estimated sales-to-new listings ratio, seasonally adjusted, April 2024

Source: REBGV, FVREW, CREB, RAE, TRREB, QPAREB, RBC Economics

Housing starts trending lower / Immigration causing a further squeeze

And with nothing worse for prices than tight supply, Canada's housing starts have fallen for a second month with a 0.8% decrease in starts in Ontario and Quebec and BC numbers falling north of 10%. New loans and tax incentives just aren't working yet while Canada experiences one of the highest developed country immigration rates .

Bank of Mom and Dad

High rates and high prices have pushed home ownership out of reach for many young people and this is currently driving our conversations with clients. With adult children starting out their careers, many financially secure families are working beyond retirement to continue earning through their peak years to sock away money for their kids. The biggest question we're fielding is:

how much can we sock away for our kids home purchases without sacrificing our retirement plans?

Under these circumstances there is no substitute for an actual plan. And, despite having fully piggy banks, there is often a finite amount of room that can be applied for a future home purchase. To add to the challenge, families in these fortunate financial circumstances often need to consider estate planning strategies that account for the costs of keeping the family cottage while addressing the eventual tax bill that will arise when both parents have passed.

Can't squeeze water from a rock

The financial plan has a number of variables that can be controlled including spending, saving, tax strategy impacts and retirement ages. Add to that some of the tax-advantages strategies to provide funds to your adult children. It's all about finding a balance between competing needs. Here's what we've found to be most effective

- Update the financial plan to include new expenditures

- Apply last week's formula: update portfolio targets as needed while accounting for for risk tolerance alongside and the potential need for higher returns

- Consider strategies to enhance estate values through bespoke insurance solutions.

- Ensure children are using their FHSA to take full advantage of the unique structure of this sheltered account.

If you're considering strategies to boost your children's options in the future or recognize a significant change in requirements for your nest egg, whether that's for a home down payment or other needs, we'd be happy to set aside some time to share a few ideas and see if we can help out.

Inflation in the US - continuing to trend positively to the negative but we're not there yet. Now's an excellent time to review your portfolio

Source: IMPS

With all this talk about housing and rates, we'll have a quick look at how the US economy is faring and the overall encouraging inflation news.

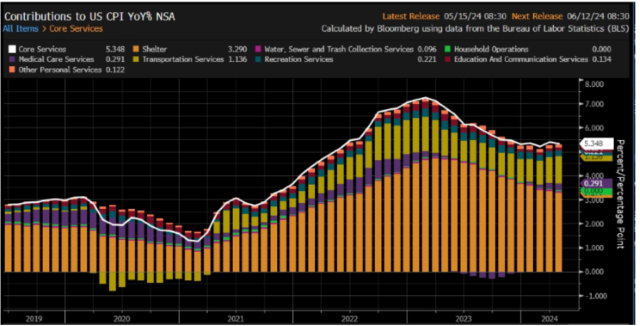

US April CPI Data

Source: Bloomberg

With YoY CPI numbers falling closer to the target 2%, we remain on a bumpy track toward the more recent rate - i.e. the last 10 years - regime. This is not a prediction that rates will start dropping precipitously and for any extended period of time. In fact, we are building in higher rates across all of our planning with a hope for sustainable lower rates but an expectation of higher for longer.

Core Services remain a challenge

Although food and energy prices down south are normalizing, the cost of services remains elevated with shelter a major contributor, similar to the case in Canada.

Source: Bloomberg

Portfolio and Plan Review

While overnight interest rates won't move until a policy change is enacted, the returns of longer-dated maturities will fall. That is, bond prices, under pressure for the last two years, will start rising to the surface again. For many investors, this will require an updated plan and an adjustment of the strategic asset allocation in one's portfolio. This isn't a broad prescription for all portfolios but a recognition that the bond party will be thinning out over the next couple of years and that many financial plans will need to be updating accordingly. To retain higher cash flows, many of our clients are moving towards alternative investments in the private markets including funds specializing in Private Credit. To learn more, get in touch.

As always, we'll wrap with this week's Global Insight. Enjoy.

In this week’s issue:

Gold: More than meets the eye: In a conversation with RBC Capital Markets, LLC Commodity Strategist Christopher Louney, we look at aspects driving the gold rally and explain how world events and policy shifts could impact its prospects. Louney also gives his take on why gold investors should pay close attention to inflation, but not for the reason they may be thinking.

Regional developments: Strong Canadian jobs report masks signs of easing labor market; U.S. equities hit new highs as soft-landing narrative dominates; Banks and commodities support the UK’s FTSE 100; Potential new support for Chinese real estate sector

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.