Plan - don't predict

There's a great book called "Let's Get Real or Let's Not Play" that we'd recommend because it offers excellent lessons in the discovery process and optimizing conversations between sales people and their prospects. One of the fundamental tenets of the book is to "roll away from the solution and focus on the problem." I'm sure we've all had the experience of being "sold" something by an animated salesperson who has not yet asked what it is we need but are very excited to sell what's on the lot.

Have I got a deal for you!

When it comes to investing and the markets, the idea of moving off the solution is particularly applicable because of the frequent desire in the industry to focus on products and not on clients' actual objectives. So, we'll spend some time today talking about what we feel is the right approach.

Moving the goal posts - forecasts vs planning

Too often when we meet with investors, the conversation quickly moves to discussions about what the market has done and what it will do. But with markets being essentially unpredictable, the value of prognostication has been shown to be minimal, particularly in the short term. Trading day in and day out for 20 years has helped us to understand that guessing which stock or which index is poised to lead the market in the next 5 second, minutes, days, weeks or months is not a strategy.

However, there are some stunningly consistent truths about the market over the long term. One of those is the growth of share prices vs earnings. On the longer time frame, the correlation between operating earnings per share and the S&P500 Index is amazingly tight. Over a very long time frame, we can see these two lines is clear.

Since 1945, both stocks and earnings have risen by an average of 7.3% per annum

S&P500 performance vs operating earnings per share

Source: RBC Wealth Management, S&P, annual data using logarithmic scale

The above underpins our long-term view on how to construct portfolios and build a foundation for a financial plan while avoiding the trap of basing your success on the ability to predict what will happen next.

Plan - don't predict - not just a catch phrase

But given the fact that we are poor at predicting what happens next, particularly in the short time frame, why all the talk and emphasis on the best funds, managers, stocks, indexes and asset classes and so little talk on factors we can influence?

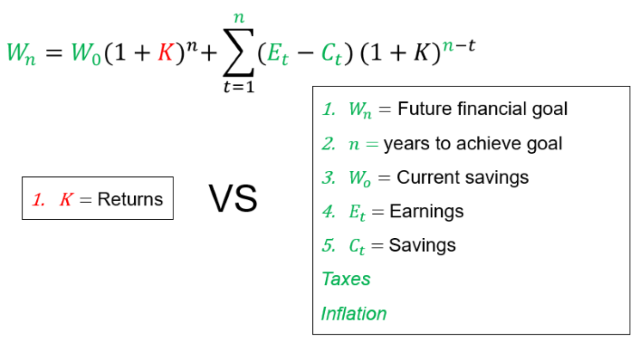

For those looking to built solid plans for the future rather than predict market outcomes, the right tack is to focus on what you can control. Here, in a nutshell, is our approach to managing a plan meant to achieve specific objectives. For readers who's eyes reflexively glaze over at the sight of an equation, this is more straightforward than you might realize.

When we work with clients, we first determine what their financial goals might be. A future financial goal, W, n years from now is simply the funds you start with today, W at year zero, multiplied by the compounded rate of return, K. (For example, if K is about 7%, your investments would double in 10 years.) You then add what you save each year - your earnings - which are nothing more than what your earn, Et, less your expenses, Ct. We then also grow that by the same return for the balance of the remaining years (n-t). Of course, we account for taxes and inflation.

So, while many focus on K, the one thing you cannot control, we focus on what we can control - time frames, spending, and saving. We combine that with tax planning so that you pay your taxes in full but not one penny more.

When it comes to K, we do the opposite of many.

Don't predict K: back it out of the variables we can control

By determining one's ability to save and estimating future spending amounts and dates, we back out the value of K to determine if it is a reasonable target and how it might be achieved. Note that as return, K, increases, so too do the ups and downs in the portfolio.

This is what we call goals-based portfolio construction.

What happens if K is too big for one's risk tolerance? Again, you focus on what you can control, and that is timing, spending, and earnings. Sometimes that means pushing a retirement goal out or perhaps reducing the budget on a home. If K is a return that's lower than you desire, there's no problem. The target K can be increased to the extent that the the risk is tolerable and appropriate.

If this sounds like a logical approach to investing, we'd love to share some ideas on how to put these ideas to work for your own future. Please get in touch to learn more.

As always, we'll wrap with this week's global insight. Enjoy

In this week’s issue:

The push and the pull: U.S. earnings have brought a mix of highlights and lowlights. We examine these opposing forces, how the Magnificent 7 narrative may change in coming quarters, and how to calibrate equity exposure in this unique period.

Regional developments: Canadian dollar range-bound for now; U.S. bond investors await key inflation news; Bank of England comments have dovish undertones; bank consolidation in Spain?; Sentiment towards China and Hong Kong equities continues to improve

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.