SPECIAL INVESTMENT UPDATE

APRIL 29, 2025

STAMPEDE BACK INTO EQUITIES NOW PROVIDES CLARITY IN THE MIDST OF CHAOS

The late great technical analyst, Marty Zweig was a regular panelist on the Wall Street Week television program and author of Winning on Wall Street (published in 1986). After years and years of analysis, he discovered perhaps the most amazing pattern of behaviour in the stock markets. Looking only at basic daily stock market statistics, he realized that when there was heavy selling that suddenly reversed to a 10-day period of heavy buying, it had a 100% accuracy of attractive returns 6 months and 12 months later. That was in 1986. That 100% accuracy rate has continued all the way into 2024! He called it a Breadth Thrust Signal. It is now referred to as the Zweig Breadth Thrust signal or ZBT. Another Breadth Thrust buy signal occurred last Thursday, April 24th.

The astounding feature of this pattern is that it identifies the point in time when the mindset of investors all across the U.S. and perhaps even the world, shift their emotional mindset to viewing the glass as half full instead of half empty. It is like a beacon that suddenly lights up on a hill or like a siren from the rooftops, notifying all who pay attention that confidence is back! This tsunami of cash washing over the stock markets usually happens after a period of great concern and worry. That is the case today.

Some will say it has been accurate in the past, but the U.S. has never had such an unpredictable President before. Well, there have been many other signals when the situation has also been unique and very troubling. For example, a ZBT signal was triggered during the severe U.S. recession and 2- year 50% stock market decline in 1974. The S&P 500 rose 27% a year later and the recession ended 3 months later. Interest rates as high as 20% in 1982 caused stock prices to fall and a recession so bad that 500 U.S. companies were declaring bankruptcy every

week. A ZBT was triggered in August 1982 when it seemed like there was no hope left. The recession ended within 3 months and the S&P 500 was up 44.7% one year later. This was the start of a new 18-year growth cycle for the U.S.

Most readers will remember what seemed like the collapse of the U.S. housing market and financial system in 2008 and 2009. Once again, when it seemed like there was no way out of the mess, a ZBT was triggered by investor behaviour in the marketplace in early March 2009. The S&P 500 was up 46.8% one year later and the recession ended within 3 months. This ended what is now called the Great Financial Crisis. A ZBT occurred right after the Brexit vote in 2016. A slightly different version of the ZBT produced a buy signal in June 2020, 3 months after

Covid swept over the world, prompting the first ever voluntary shutdown of the global economy in June 2020. No one knew how that would turn out but once again, the recession ended within 3 months of the ZBT and the S&P rose more than 30% 12 months later.

Another ZBT signal was produced on March 31, 2023, 2 weeks after 3 U.S. banks failed, creating concern that a repeat of the financial crisis could be just around the corner. Rising interest rates and an inverted yield curve (due to

inflation caused by the Russian invasion of Ukraine) were very reliable indicators that the U.S. economy was almost guaranteed to fall into a recession. The S&P 500 was up 26.8% one year later and the U.S. economy defied all odds by not descending into a recession. It is perhaps one of the only long-term indicators of the U.S. stock market that has never failed since 1943. This has been an incredibly accurate indicator when experts say it is impossible to time the markets.

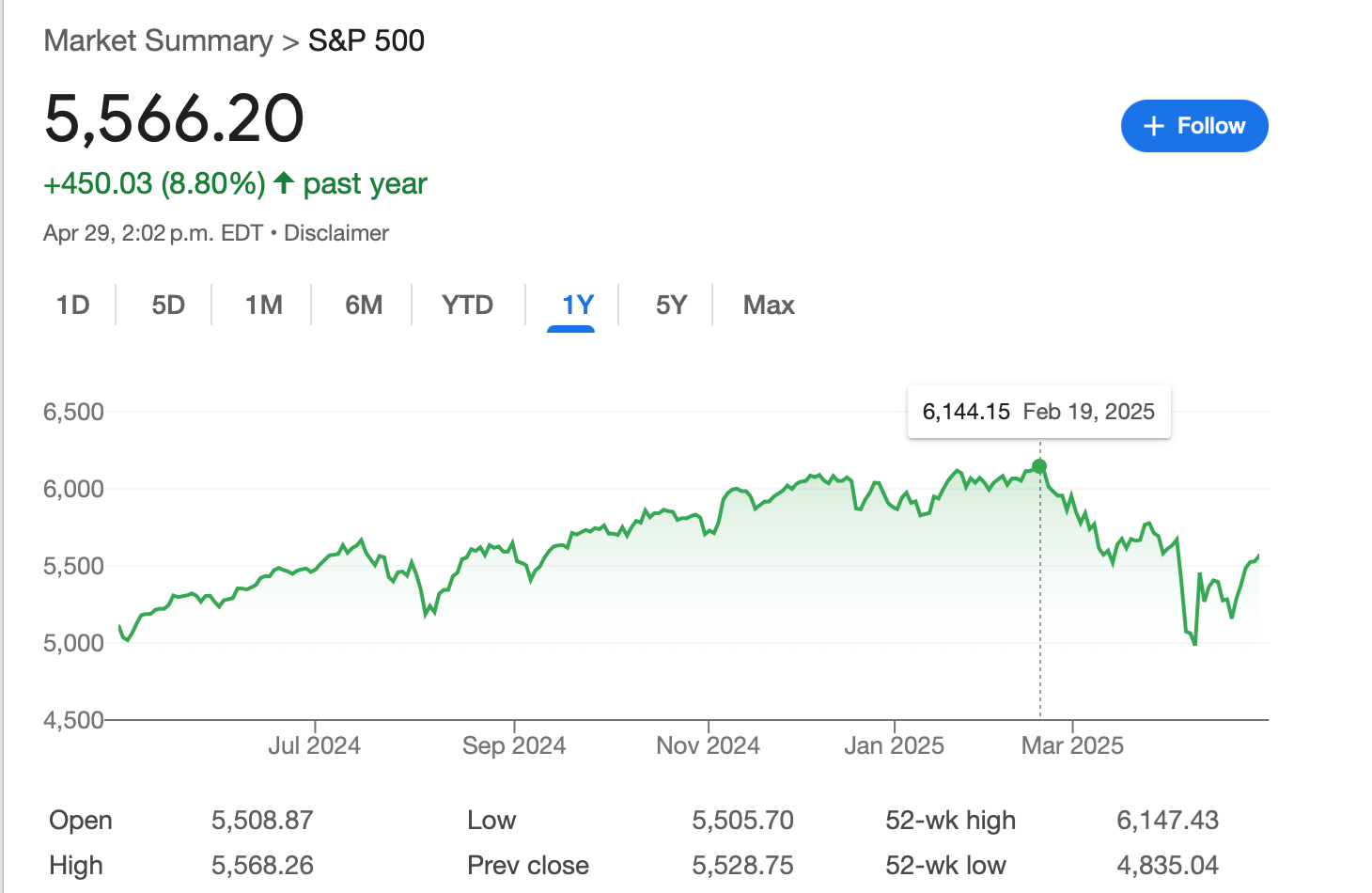

Please see the history of the ZBT since 1943, during WW II. You can see that the S&P 500 was up 100% of the time 6 months and 12 months later with an average 12 month gain of 23.4% and a median gain of 24.8%. Seven ZBT signals have occurred since 2009 with an average gain of 35.25% 12 months later.

The increasing amount of money printed in recent seems to be sloshing around the financial system in more violent moves, creating more of these breadth thrust signals than in the past. There have now been 4 ZBT signals in the last 6 years. This is a good thing! It provides clarity for what is most likely to happen in the economy and stock markets for 12 months into the future, therefore removing much of the uncertainty and anxiety for a 12-month period.

What makes this indicator so accurate is that it shows us when confidence has returned to the mind of investors, business owners and consumers. It may not feel like it at all when the signal is triggered. However, in the past, as time goes on, we slowly see more and more signs of stability and strength in the economy and the stock markets. Since a ZBT was just triggered last Thursday, it suggests that the U.S. economy will not fall into a recession, or if it has, it will end quickly.

A ZBT does not mean that stocks will go straight up for the next 12 months. There will be normal backing and filling, with markets very likely making 3 steps forward and 2 steps back. However, the outlook for the next 12 months has never been better than it has after a ZBT.

Before pagers were invented, fire stations had a big siren on the rooftop to alert firemen that they should hurry to the fire station to get the fire trucks in order to fight a fire. When I was a child, a huge air raid siren was actually installed on a tower 3 blocks away from my house by Central Elementary School to warn the residents that there was likely a nuclear attack coming from Russia over the north pole. These sirens were almost impossible to ignore. These ZBT signals are important for investors just firehalls sirens were most useful for the fireman and those who were experiencing a fire. However, the ZBT signals are easy to ignore because they do not get the attention they deserve. It is amazing how many experts say over and over again that the signal will not be accurate this time in

spite of the accuracy rate in the last 80 years. This is what happens when we let our emotions overrule the rational part of our thinking and decision-making process. What would a computer recommend if the results of the ZBT signals were programmed into it? Please see the next page.

Please see the 1-year chart of the S&P 500 below. It closed at 5,483 on the day the ZBT signal was triggered on April 24, 2025. A 25% gain in 12 months would place it at 6,854 in April 2026, which is 11.5% higher than the record high of 6,147 made 2 months ago in February. A 35% gain would place it at 7,402, which is 22.9% higher than the previous record high. As of today, the S&P 500 is down 9.45% from the high.

In summary, this is when the risk has been as low as it gets and the potential for gains has been as high as it gets. This is the time when the evidence is the strongest that the worst is behind us. It is great news in the midst of chaos! This is the time when investors should be putting money to work, even though there may

be some volatility in the short-term.

SAR Update

It has been busier than usual for this time of year with 6 callouts so far this month and 2 calls in one day. We had an injured women on a hike requiring assistance and a disabled pontoon boat quite a distance up Harrison Lake. We are only there to rescue people but we towed the boat back to the boat launch since leaving it floating in the lake would just result in others reporting a boat adrift.

The boat could also leave a mess if it was bashed against rocks on the shore.

We were called for a broken down boat in the lake at night with 3 adults, no lights and no life jackets. It is very interesting to see that when people are careless or break the rules in one way, it leads to trouble in other ways.

In another incident some time ago, we were called out to the lake where 3 men were in a boat with no lifejackets or oars. It was a hot day so 2 of them decided to go for a swim even though they were very poor swimmers. When you jump off of a boat, the boat gets pushed away from you. The men were yelling for help because they could not get back to the boat and the man in the boat had nothing to help them with. A boat heard the cries for help and rescued one of the men. When they went to get the other man, he had disappeared. What a tragedy!

Our team and other teams were called out to another area in the valley to search for a young autistic child who was missing all night. Thankfully he was found in the late morning, just cold and tired!

We had an ATV accident with 3 injured people which was triggered by an automatic emergency call from an iPhone far up in the boondocks. (A 911 call goes thru when an iPhone has experienced a severe jolt that is often associated with an accident. At first there were many false signals. However, they seem to have done an excellent job of refining the system as we have not had any false calls anymore.) We sent members to the scene in a helicopter since it was so far away and the air ambulance was also dispatched from Vancouver. However, we

were able to see that the people were moving. Eventually we caught up with them and they were not injured severely and were getting a ride back to civilization.

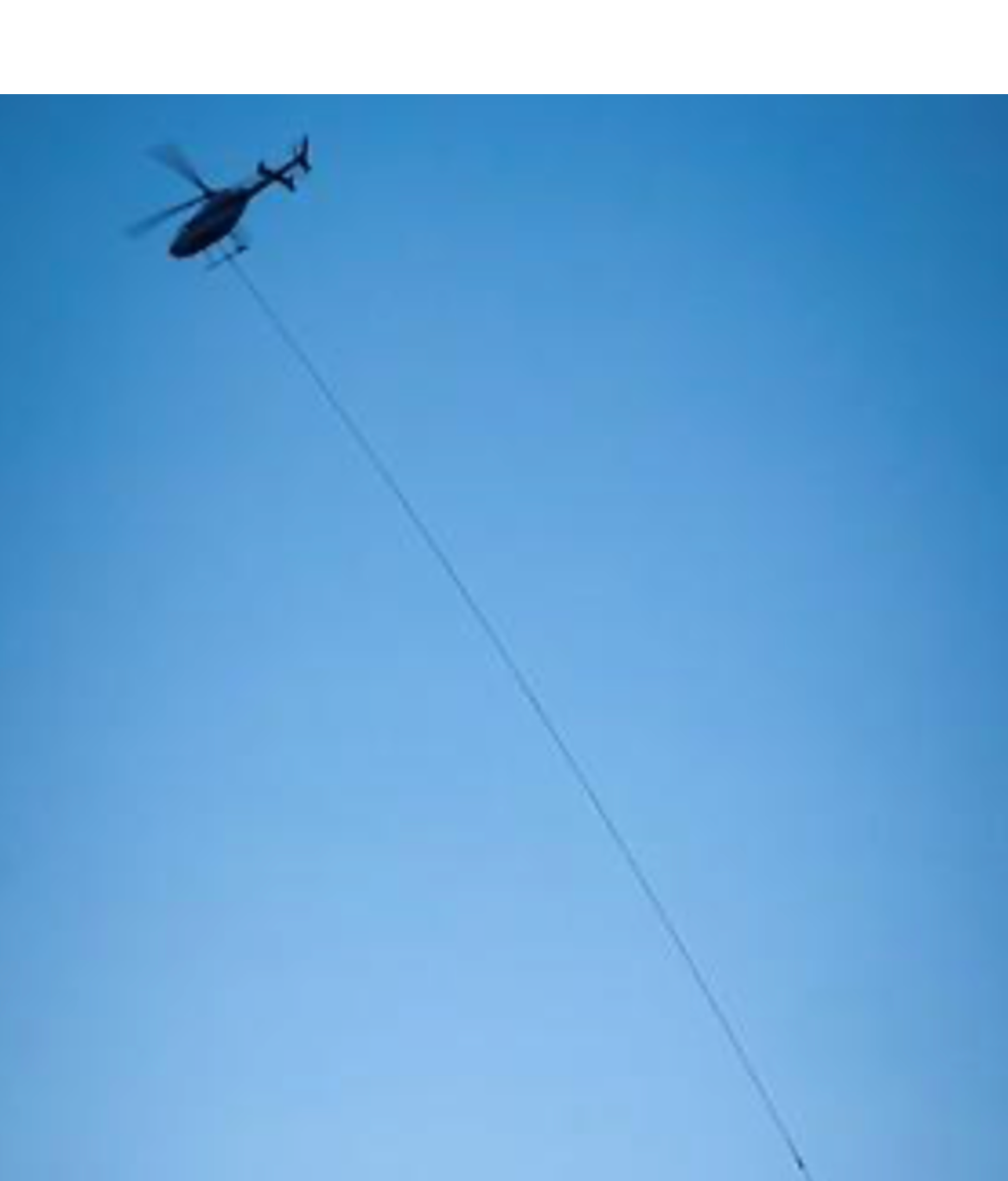

We had another ATV accident where there were injuries to 2 people. One person had to be lifted out of the bush by a helicopter with a 200 foot long line and then taken to an air ambulance that was waiting in a different location. Please see some photos on this page and the next. Stay safe, have your cell phone charged and have a good week my friend!

The pontoon boat we towed to the boat launch. We transported the people in another enclosed boat.

Helicopter with stretcher and attendant hanging 200 feet below. It really stimulates the prayer life when being the attendant!