…while at the same time, the collateral damage to stock market indexes and the economy at large had been virtually non-existent.

Fast forward 30 days and that popping has gotten downright aggressive: many hyper-growth stocks, crypto assets, and meme stocks are now down 40% - 75% from their highs. Given the severity, it isn’t so surprising that some of this sentiment has seeped out into the broader market. For example, the S&P 500 is down 7% from its highs and the TSX is down 4%.

It is always good in moments like this to refresh context. The chart below will look familiar to regular readers: it shows the annual return for the TSX in each of the past 20 years (blue bars) together with the worst sell-off experienced in that same year (gold dots):

S&P TSX annual total return (bars) and largest annual decline (dots): 2002 - 2022

Source: RBC GAM, Bloomberg, Morningstar

While the S&P 500 would be a preferable measure to the TSX, this chart still makes the point: focus on the gold dots and you’ll note that the current decline we’re experiencing is just regular, run-of-the-mill volatility that comes as a standard part of being an equity investor in any given year. In fact, in Canada the current decline is on the gentle side.

What is remarkable is that this modest drawdown has occurred while interest rates have risen sharply – and note the use of past-tense. There are now five (5!) Fed rate hikes priced into US interest rate futures market for this year, along with at least a couple more for next year. The last time this many rate increases occurred in a single year was back in 2004.

Interestingly though, while bond markets now have a batch of rate hikes priced-in for the coming 18 months, after that the yield curve really flattens out. Despite the dramatic change in short-term rates, 10-year Treasuries are still yielding only 1.75% which is close to unchanged from the spring of last year. Said differently, a market that is far larger and more liquid than the stock market is of the opinion that the heavy lifting on higher interest rates is over: rates are going up to 1.50% over the next 18 months, and then moving up only marginally afterward. It implies that the Fed’s actions over the next year or so will now simply formalize what the market already expects.

Now, if you accept the idea that emergency interest rates of 0% are no longer required in an economy that has just grown at its fastest rate in four decades, then the idea of normalizing rates back 1.50%-ish shouldn’t seem too frightening. Heck, even 2% would pass the sniff test with me.

What could and should alarm you, though, is if you primarily own investments that trade at such rich valuations that they require very high rates of growth to continue unchecked for years and years to come. There are some companies that will achieve exactly that, but they are rare. Their rarity becomes more evident when central banks tap the brakes and remind financial markets that a sustainable growth rate for the economy is slower than the current pace. With that context, it arguably appears that the Fed is gracefully threading the needle here: its recent messaging about rates has popped a growing bubble before it caused widespread harm, while simultaneously providing a more stable foundation for future growth in the economy at large.

Of course, a reasonable concern is that central banks might overshoot by continuing to raise interest rates beyond what is already priced into markets AND beyond what is appropriate for a still-growing economy. Qualitatively, that concern seems a tad premature given that both the Fed and the Bank of Canada have only talked about increases at this point. Their policy rates remain effectively at 0% today. Running the idea to ground, though, the obvious culprit that could cause a central bank overshoot would be persistently high inflation.

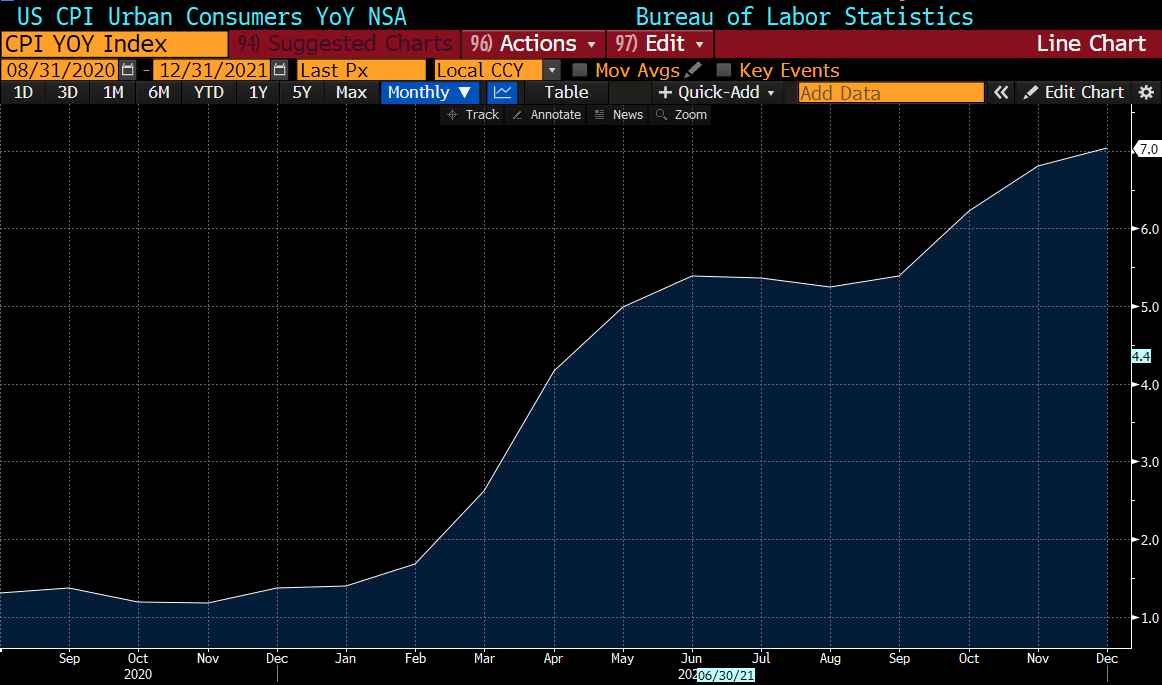

On that topic, we are approaching a very interesting inflection point. Recall that March of 2021 was when CPI really began rocket upward: vaccines rates in the US were rapidly rising, the economy was beginning to reopen as a result, energy prices responded by shooting higher and supply chains showed signs of not being able to keep up.

US CPI year-over-year % change, NSA: Aug 2020 - Dec 2021

Source: Bloomberg, BLS

Looking ahead, some simple mean-reversion of inflation growth is virtually certain to occur this summer as we begin to lap the uniquely high figures from last year. For example, used car prices were up 35% last year; even if supply chains remain tight through much of this year, it is reasonable to expect that the price of used cars will go up additional 35% this year?

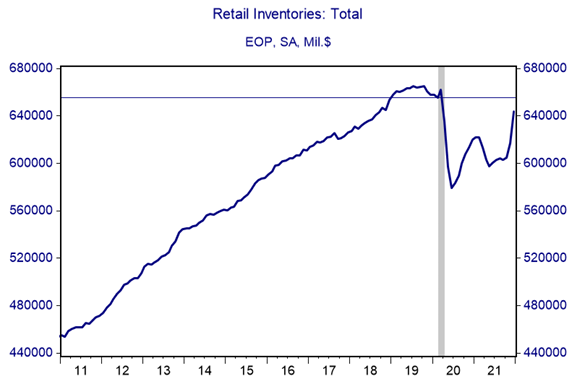

Of equal importance, businesses are dynamic entities that respond to changes in inflation and supply chain issues. As evidence, look at the charts of US retail inventories below. There is no need to squint at the actual numbers, it is simply the shape of the lines that matter. On the left-hand side you can see that after steadily growing for 10 years, US retail inventories contracted sharply in 2020 and have now almost recovered to pre-pandemic levels. However, the right-hand side shows that if you take that exact same graph but exclude the inventories of vehicle retailers, then those of the rest of the economy are in fact wildly above pre-pandemic levels. What do you do when your business is having supply chain issues and prices might rise? Stockpile when given the chance! As the global supply chain continues to normalize through this year and next, the resulting destocking that will need to occur from this important swath of the economy will provide another disinflationary impulse.

US Retail Inventories, Total & Total ex-autos & auto parts: Jan 2011 - Dec 2021

Source: RBCCM US Economics, Census Bureau, Haver Analytics

In fairness, spending on services should somewhat offset this decline if COVID continues to move towards being endemic this year, but disinflation from the peak levels of 2021 will nevertheless occur.

All of that paints a picture for this summer where the Fed will be increasing interest rates as expected, inflation begins falling noticeably, and the economy is decelerating but still growing at a solid pace. That narrative would be very different from today and should be warmly received by markets.

If we are correct that the Fed is threading the needle by cooling the economy to a Goldilocks level, then owning equities should remain a priority for investors…growth equities in particular. Value stocks tend to be inexpensive because of the low growth rates of their underlying businesses, so when a powerful economic expansion emerges after a recession, the rising tide floats even those dilapidated boats. By the middle of an economic cycle when interest rates begin to rise in order to temper growth – the period we have just entered – better quality companies that don’t need to rely on the tailwind of a red-hot economy tend to outperform.

Circling back to where this update began, that rotation is exactly what appears to have started occurring in equity markets over the past two weeks. We are in the middle of quarterly earnings season, with about 60% of S&P 500 companies having recently reported Q4 results. As the negative sentiment from bubble stocks being popped has spread, resiliency for the S&P 500 has come from money flowing out of lower-quality companies and into the stocks of those that are once again posting stellar earnings growth because they operate in structurally growing markets. Looking ahead, it seems very plausible that we will see a time later this year when the sting of the bubble has passed, inflation is moderating, the economy is still growing and current interest rate levels seem reasonable. That sounds similar to much of the last decade, which was a pretty darned good one for investment returns.