...but are now back on track for 2022. More importantly, though, I’m referring to that stock market correction we experienced at the end of 2021.

What stock market correction? Fair question, given the absence of media headlines and broad-based investor pain. If you missed it, the correction occurred from October through to just before the Holidays and saw shares of companies in the S&P 500 drop 13% on average. Shares of smaller companies in the Russell 2000 were in full-on bear market territory, declining 33% on average.

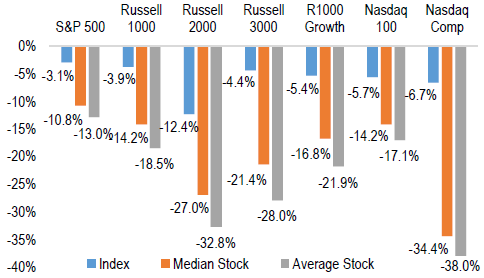

Interestingly though, unless you owned a lot of highly speculative or deeply cyclical stocks (not to worry – we don’t), odds are that you didn’t notice it at all. After all, the index prices themselves only fell by a small fraction of the figures above. Yet the correction did occur…just look at the grey bars below:

Drawdown from 12-month high to Dec 20, 2021 for various US equity indexes

Source: JP Morgan

We’ll talk more about the reason for the sell-off in a moment, but as you can see from the chart above, by December 20th the price of the S&P 500 was down only 3% from its highs (blue bar), while the average stock within the index was actually down 13% over same the period (grey bar). Said differently, an otherwise obvious market correction went undetected because of strong performance by the very largest companies in the index – Apple, Microsoft, etc. Their positive returns swamped the sharply negative performance of many other, smaller companies. That serves to highlight the rather unique moment in financial markets at which we have arrived: the ten largest companies in the S&P 500 now dominate returns to a greater extent than at any point in the last half-century, greater now than even during the Tech Bubble:

Percentage weight of the Top 10 S&P 500 constituents: 1964 to date

Source: JP Morgan, Bloomberg

Now, market concentration itself is not a catalyst for negative returns. But the picture above does illustrate the unusual equity market narrative of the past two years, and therefore the context from which investors begin 2022. Specifically: 1) a stunning increase in concentration occurred during 2020 as investors reacted to the onset of the pandemic by rushing to the largest companies in the index, seeking “safety with some growth”; 2) this was followed by a brief pause last winter as vaccines made higher risk and cyclical stocks seem more appealing; but then, 3) the delta wave and more importantly the prospect of higher interest rates led investors flocking back to the mega-cap companies through late 2021, lifting market concentration to generational highs in the process. As a result, the valuation of the Top 10 stocks in the S&P is approaching a very lofty 30x 2022 P/E, versus a more normal-ish 18x for the rest of the index.

It is important to note that the recent surge in concentration was driven by the fear of central banks raising interest rates too quickly, and not by omnipresent omicron. If the reason was omicron, you would expect to see economically sensitive sectors like Energy and Banks get hit hard along with everything else, just like in March 2020. Instead, those sectors have held in while high valuation and speculative growth stocks, amongst others, have been clobbered.

Percentage returns – Energy and Banks (red & green) vs Goldman “Expensive Software” index (white), IPO ETF (orange) & ARK Innovation ETF (yellow): Nov 1, 2021 to date

Source: Bloomberg

The swift change in messaging from the Federal Reserve, starting in October and culminating at the FOMC meeting on December 16th, caused a stealth market correction. Specifically, by accelerating the timeline for tapering QE, the Fed has signaled that 3 or 4 interest rate increases are very likely in the cards for this year, perhaps starting as early as March. The fact that rates rather than omicron have driven the sell-off was evidenced again yesterday when the Minutes from the Fed's December meeting were released, triggering a 3% drop in the NASDAQ. But let's not forget that this is arguably quite good news: the central bank is taking the steam out of financial markets, particularly in the more speculative parts, while the economy itself continues to grow nicely.

On that note, while omicron is clearly very contagious and is causing a synchronized drop in both consumer spending and mobility around the globe – as evidenced in credit card spending data and Google’s mobility data – financial markets have taken the view this is not only transient, but is perhaps a positive endgame to the virus’ economic impact. In the UK and the US, for example, 6% and 3% of the entire respective populations have been newly infected in the past 60 days; and arguably more given how many cases are no doubt going unreported. Between that and vaccinations, one would think that herd immunity might reasonably be approaching (normal caveat: I’m not an epidemiologist). Meanwhile, even after accounting for a lag, hospitalizations in the UK remain 50% lower than the previous peak and ICU occupancy 80% lower. In the face of such data, financial markets will continue to look through the current wave.

Which brings us back to where we started, with the “hidden” market correction that recently occurred. Share prices of the largest companies in North America have performed extraordinarily well over the past two years, first by serving as a haven in an economic slump, and then by serving as a haven in an economic explosion. The resulting double-pump in their valuations has left the market concentrated in these fairly pricey stocks at a time when the economy is potentially poised to rocket higher again on the back of a true, lasting reopening. It leads to an odd set-up for equity markets – one in which an investor should still very much want to be invested in equities, but where the stalwart market leaders of the past may start to quietly cede ground to the rest of the equity market. In the spirit of the saying attributed to Mark Twain, “History doesn’t repeat itself, but it sure does rhyme”, we may have entered a phase of intra-market rotation similar to what was experienced after the Tech Bubble, but with the popping of sky-high valuations being isolated, as we have seen in October through December, rather than creating a mess for the whole market…and that would be a very good thing for investors.