...Apple’s adjusted earnings were 40% above Street expectations and 12% above pre-pandemic levels; Microsoft’s came in at 10% above expectations and about 30% above pre-pandemic; and Alphabet delivered a whopping 70% above both expectations and pre-pandemic.

Of course, if you had only taken a glance at share prices this week, you’d be forgiven for thinking that these titans must be merely muddling through the economic reopening. Following their earnings reports, their share price performance was -2%, -4% and a not-whopping +3% respectively.

This anti-climactic trend has been most powerfully on display among FANG-ish companies, but it is also been evident more broadly. Over half of S&P 500 companies have now reported Q1 earnings and 86% have beaten analyst estimates, which is to say pretty much everyone. More importantly, a full earnings recovery has now occurred; operating profits for the market as a whole are tracking for about 10% above pre-pandemic levels this quarter.

S&P 500 earnings per share (quarterly): May 2018 – Aug 2023

Green line = today; future dates = consensus estimates

Source: Bloomberg

Yet despite this, the S&P 500 is up only 1% since Q1 reporting season started in mid-April. The obvious culprit is valuations… investors already expected this good news and it is in the price. But as we pointed out in last month’s update, that is just not true: a 10% overshoot in earnings this year will likely bring the S&P 500 down to a very plain-vanilla 18x forward P/E multiple by year-end. Meanwhile, earnings are in fact overshooting by 23% so far…so good news on that front.

To us, the underlying reason for a ho-hum market response feels much more qualitative. After a roller-coaster year that has ultimately delivered very pleasant profits, investor sentiment seems happy but gassed…call it the financial equivalent of runner’s high. That’s an unsatisfyingly subjective explanation, but then, public market investing is a mixture of art (psychology) and science (numbers).

There is at least some data that seems supportive of the idea: retail money flows into to equity markets have meaningfully slowed in recent weeks, for example. The creation of almost one million new jobs in March also suggests that back-to-work is naturally dispersing the Reddit crowd, arguably best evidenced by a 30% drop in call option volumes since late January. More intuitively, there is just the simple distraction of normal life as re-opening hits full stride in the US (and hopefully soon in Canada!). After all, this is what life looks like in America right now, even as their COVID case count continues to fall:

Globe Life Field – Texas Rangers vs Toronto Blue Jays: April 5, 2021

Source: AP/Jeffrey McWhorter; CTV News

If this is true, then while equity markets may be getting less attention at the moment, the economy itself must be booming – and this is exactly what incoming economic data continue to evidence. Interestingly, this creates a bit of an odd, negative narrative for equity markets: really strong economy > interest rates will resume upward trend > higher interest rates are bad for stock prices. As mentioned in the past, that last part is actually false – historically there been a modest, positive correlation between rising interest rates and equity markets. But in the short-term, facts can easily lose out a simple market narrative.

Given all of this, last week we moderately reduced our exposure to equities across all managed portfolios. We have been overweight / fully-invested for a year now, and while the underlying fundamentals remain very good (see first paragraph above) there is no denying the “gassed” feeling. Of equal importance, we just can’t see near-term catalysts that would meaningfully refuel investors’ tanks until earnings ultimately do so later this year. It seems to us that a combination of the negative psychology above together with light trading volumes could reasonably provide a window or two in which to opportunistically redeploy cash back into equities this summer. If our view is correct, then the place to trim exposure is from both speculative companies with very high valuations and from companies that have struggled to grow even if they seem cheap. The equities of those that are showing solid growth but appear modestly expensive should still do well, in our view.

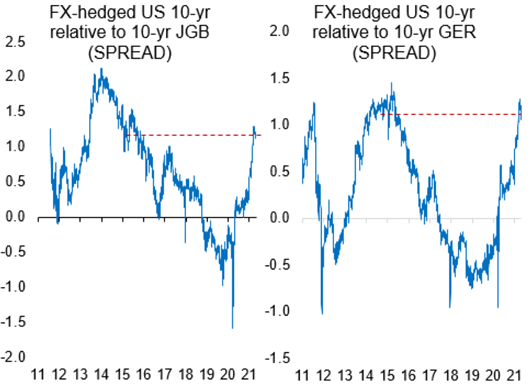

One final, semi-related note is that the response of currency markets to all of the above has seemed quite unusual. The US is leading the developed world in economic growth while simultaneously offering the most attractive interest rates (see chart below). That combination typically leads to notable USD strength. Yet the USD continues to be soggy against most major currencies so far this year, and in particular against CAD. Given that the loonie has historically had a strong, long-term positive correlation with oil prices, and given that OPEC still wants to bring back online around 8 million bbl/d of oil production, it seems like an interesting time for Canadians to be using CAD strength to be looking at assets abroad priced in USD: equities, real estate, art, etc.

Japanese & German investors’ return on US Treasuries, relative to domestic equivalent: 2011 – present

Hedged to investors’ home currency. Currently highest level since 2015 (red line)