...tranquility and new-found optimism that have accompanied these gains makes them feel like even more of a treat. With financial markets being the fickle, forward-looking beasts that they are though, the rather discontented question that naturally arises from the recent gains is: “Okay, so now what?”

In the immediate term, there is little impactful news barring a major change in the well-telegraphed Phase One trade deal (and presumably the simultaneous delay of List 5 tariffs that are scheduled to begin on December 15). Early Black Friday sales data looks positive – especially for online sales – and arguably US employment data this Friday could also be of interest; but aside from trade, there is little expected news of consequence until late January when year-end reporting and 2020 guidance will begin in earnest. Given that institutions remain meaningfully underweight equities, the flow of funds into equity markets by managers fearing year-end underperformance means that there appears to be little to derail the current stock market rally.

Looking beyond the immediate term though, it is clear that valuations are starting to get a little stretched. The S&P 500 is now trading at roughly a 19x forward P/E multiple, which is well below bubble territory (high 20’s), but still solidly above-average. That is particularly true when recalling that there is already 10% growth baked-in to the “forward” earnings denominator of the P/E equation. All of this suggests that while the broad market rally may persist for the balance of 2019, it would be reasonable to expect this to plateau during the first few months of the coming year and be replaced with more dispersion among sectors and individual equities.

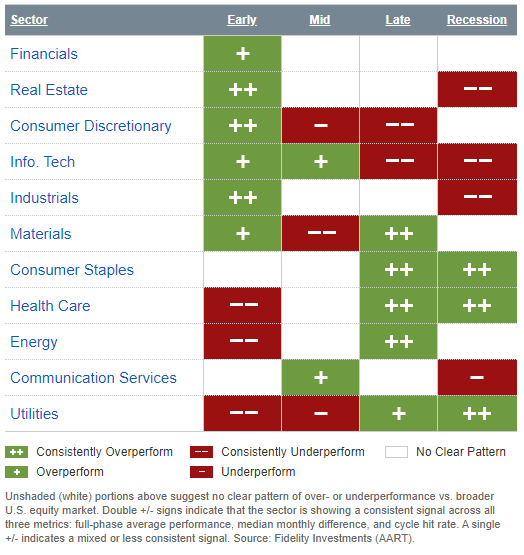

On that note, I find it interesting that a phrase we are very frequently hearing and reading in our communication with portfolio managers and corporate executives is that “the economy is clearly now late-cycle”. While I wouldn’t fully agree with that assessment, it appears close enough to a consensus view at the moment that it merits attention – particularly because late-cycle economies have historically exhibited a clear pattern of winning and losing equity sectors.

Sector Performance by Business Cycle Phase

If the market consensus is that we are late-cycle and if valuations are somewhat stretched, it wouldn’t be unreasonable expect equity managers to use the above framework as a guideline for where to deploy funds in 2020. While defensive sectors like Consumer Staples and Utilities have already meaningfully outperformed in 2019 with interest rates falling, inflation sensitive sectors like Energy have done the exact opposite. Further, the Fed has made clear that they intend to keep rates low even if/when the economy shows signs of acceleration, targeting “average inflation” of 2% rather than that level at a single point in time. If US oil production growth decelerates this year – which is mathematically highly probable – the narrative on the energy sector could quickly change from that of a dying industry to one that remains necessary for now – even if not forever – and that is both inexpensive and well positioned for this point in the economic cycle.

Separately, this week RBC published our house-view of what lies ahead for various investment markets in the coming year. The 31-page report is titled Global Insights 2020 Outlook (click title to view). For the remainder of this year though, equity market look well positioned to continue enjoying the festive spirit.