...Q4 earnings were good; expectations for 2019 (especially Q1) have been reset quite low; and after a minor post-earnings surge, equity valuations feel like they are treading water at their historical average while awaiting news on trade or new economic data.

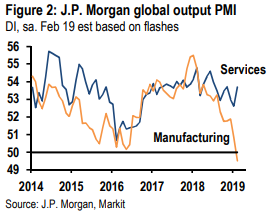

US economic data should resume this week after being unavailable or uninformative since the government shutdown. However, global Flash PMI reports for February have been available and they clearly indicate that the global manufacturing sector is contracting to the lowest levels since the Euro area debt crisis in 2012. Somewhat surprisingly though, this is being more than offset by resilient and robust global services sector data (see attached chart).

This uncomfortable tension is a good representation of the overall environment for investors: on one hand, business around the world have pushed "pause" on their capex spending while awaiting political clarity on trade (and to some extent on Brexit); on the other hand, the environment for a recession is not right, with corporate profits at all-time highs and employment at historic lows. Financial markets are reflecting this, with equity market valuations at equilibrium and with the US yield curve continuing to hover at a level slightly above inverted.

The only apparent resolution for this is clarity on trade. That is probably a later Q2 event, as US-China trade talks seem likely to be extended and as the White House deliberates on the Section 232 autos report. In this environment the equity of companies that can grow independently of the economy are likely to continue doing well, while those with an investment thesis more tied to it seem likely to be range-bound while also exhibiting high volatility.