...there have been few pre-announcements indicating that investor expectations were already adequately reset earlier this year. With this backdrop, North American markets gained yet another 1% over the past two weeks.

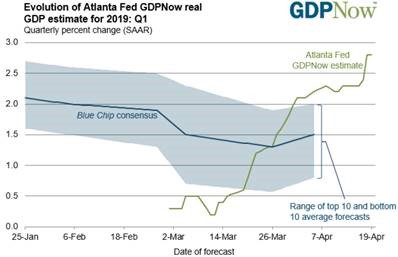

At the same time, increasingly positive global economic data continues roll in, particularly from China where the government’s fiscal stimulus appears have decisively taken hold. Of course, a reasonable case can be made that China fabricates its economic data – yet to the extent that the fate of the current cycle is based on business confidence returning, veracity arguably does not actually matter (for now). US data has also continued to improve, with minor data point reports all exceeding expectations which is perhaps best reflected in the Atlanta Fed’s real-time GDP predictor.

Source: Federal Reserve Bank of Atlanta

All of the above feel-good developments notwithstanding, the S&P’s valuation as measured by the forward 12-month P/E is now above its five-year average. Interest rates remaining low along with a full economic recovery this year would make the current level look cheap; but for now, 2019 earnings estimates remain very back-half heavy and we are only just beginning to see Q1 results. There is a long stretch of time left before we’ll have real proof of an earnings recovery, and that is an uncomfortable situation when investing in the fickle and impatient world of public equities. I suggest that the warm glow of Q1 adequacy may keep equities rising in the near-term, but that by mid-May we’ll be into a period of volatility around plateaued equity prices. Some catalysts during that period will include the White House’s Section 238 response (i.e. possibly imposing tariffs on European autos ahead of next year’s Presidential elections) and the USD starting to weaken.