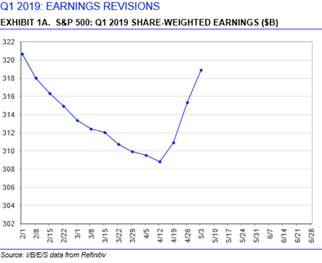

After a flurry of updates during the past two weeks, 75% of S&P 500 companies have now reported and a much-better-than-feared Q1 earnings season is fading in the rear-view mirror. The nature of the results is captured well in the chart below, which shows the weekly evolution of analysts’ S&P earnings estimates:

On the other hand, equity markets feel increasingly like they have entered a range-bound phase. While the S&P gained 2% over the period, most of that happened on the first day followed by only minor changes thereafter; meanwhile the TSX and most global markets were flat, and the VIX drifted back below 13.

It is difficult to see clear, near-term catalysts that can push the market in either direction from here. Central banks are on hold indefinitely, the White House appears pot-committed on a trade deal with China, new earnings data will not be available for 2-3 months…even the Section 232 review decision (due any day) seems unlikely to cause anything but localized fireworks in the auto sector. With equity valuations only moderately elevated, the Spring / Summer season seems set up for a non-directional tug-or-war between a “Don’t fight the Fed” upward drift versus “Sell in May…” despondency.