...to celebrate my birthday with family and friends, and to also breathe a sigh of relief together that my office building hadn’t had the wrong address. The plane was medium sized, one that could probably hold 200 or so passengers in normal times, but given the circumstances there were barely more than ten of us on it.

As we circled over Toronto and the crew prepared ahead of the final descent, the plane hit wake turbulence and immediately flipped on its side. It was so sudden and violent that anyone not wearing a seatbelt – which mostly meant the crew at that point – was thrown up over top of the seats and against the wall of the plane. For the terrifying and surreal next minute or so, we all held our breath as the giant machine seesawed back-and-forth, in an agonizingly slow attempt to regain equilibrium.

Obviously the plane did regain it, otherwise I couldn’t be writing this. But aside from not crashing, the bright side of that experience has been that ever since, rough flights from bad weather haven’t bothered me in the least. Instead of wondering if a stomach-dropping bump might mean that there is a problem, I now know that it will be 100% crystal clear if there is a problem that is genuinely worth worrying about. For anything less severe…well, just buckle up and enjoy the ride.

So – interesting story, but why mention it in a market update? Because it strikes me that there is an intriguing parallel between it and financial markets at the moment. For example, we have all experienced the investing world’s equivalent of wake turbulence fairly recently, which of course was during the onset of the pandemic last March. Depending on your vintage as an investor, you may have in fact experienced such turbulence a few times now: the Financial Crisis, the Tech Bubble, etc.

In contrast, the current bout of handwringing by equity market investors feels more like plain old rough weather. The S&P 500 dropped almost 5% last month and October looks to be off to a bumpy start as well. Excluding the pandemic, September’s decline was the worst one-month performance since way back in May 2019, when a presidential Twitter-bomb unexpectedly escalated the US-China trade war.

Now, in fairness, the current patch of rough weather is real enough. The mains causes can roughly be summarized as:

1. Ongoing supply chain struggles, which are not only now going to impact sales through the holiday season, but are also causing price inflation and pressure on earnings due to soaring shipping costs;

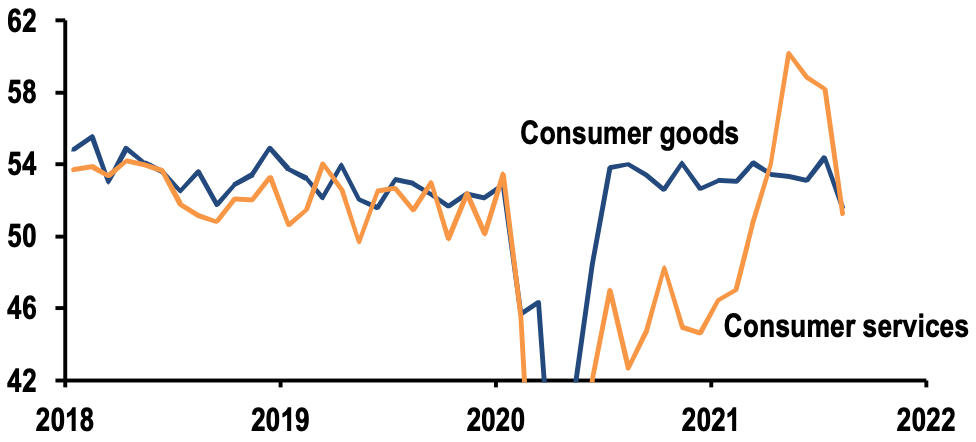

2. Increasing evidence that a smooth hand-off from spending-on-goods to spending-on-services as the key driver of economic growth has been interrupted. The former has been cut short by the supply chain issues mentioned above (auto sales have had the largest impact, now on track to decline by an eye-popping 25%), while delta has temporarily hit the pause button on the latter;

Global output PMI (above 50 = expansion; below = contraction): 2018 - Present

Source: J.P Morgan, Markit

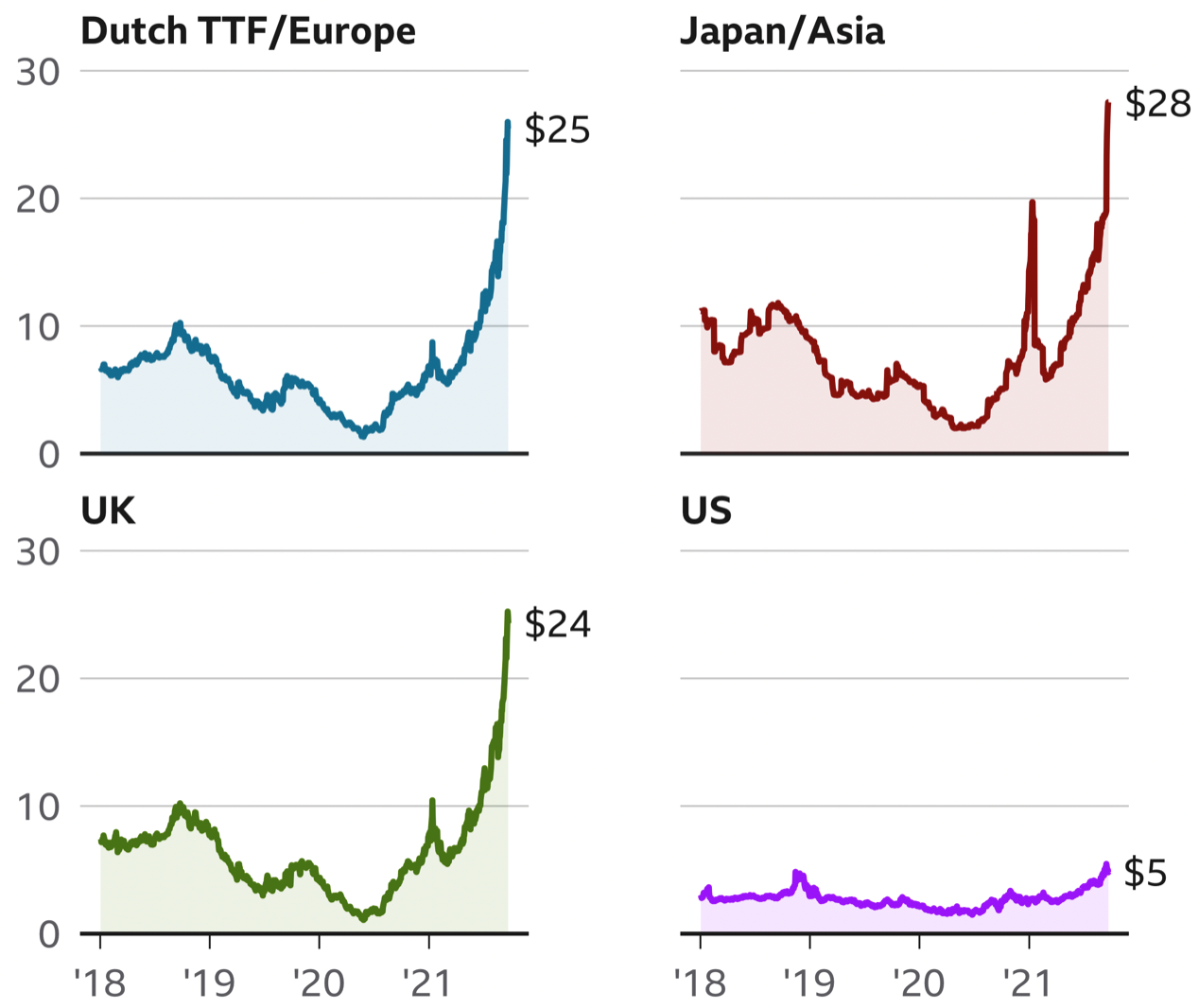

3. Less importantly, three separate energy shortages in China, the UK, and Europe have emerged – all of which are solvable, but that in the meantime have lumped another log onto the fire of inflation fears, causing interest rates to begin rising again.

Spot natural gas prices at major market hubs: 2018 - Present

Source: Bloomberg, BBC

While those are arguably the main causes of the current rough patch, other events that should prove less consequential are also getting air-time, such as the Fed’s approaching taper, China’s Evergrande situation, and the strange, annual political show that is the US debt ceiling.

However, the stock market is not the economy. The bigger companies that comprise the S&P 500 and other major global indices have far more clout within their supply chains and have more sophisticated levers to pull on in order to cope with (presumably) temporary cost increases. Even more importantly, the challenges themselves are ultimately being created by a very “high class problem” for any economy: demand far outstripping supply as a result of the exceptional financial health of both consumers and businesses.

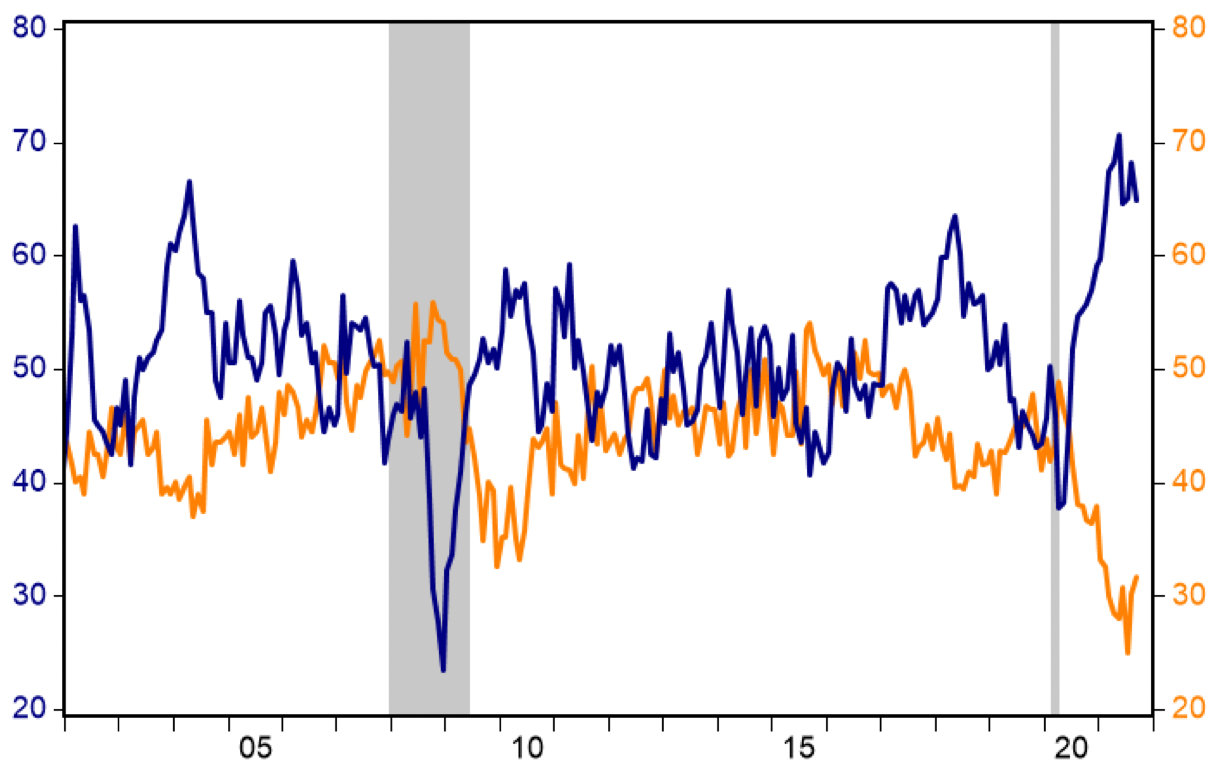

ISM Manufacturing Index: order backlog (blue) vs. inventories (orange): 2000 - Present

Source: Institute for Supply Mgmt, Haver Analytics, RBC Capital Markets

As flagged in last month’s update, S&P earnings estimates remain poised for upward revisions, suggesting that the start of Q3 earnings season later this month may mark the end of the rough patch for equity markets. In the meantime, the far larger global market for corporate bonds continues to signal a high degree of comfort, with a record number of new bond issues being absorbed last month even as prices continued to rise. Perhaps that should serve as a good reminder of context for investors – stock market returns may be bumpy at the moment, but if there is a real problem in financial markets, you’ll recognize the feeling and it is a lot different than this.