...is Wall Street completely oblivious to what is happening on Main Street? RBC’s equity strategists have reported versions of this as the most frequent question from institutional portfolio managers in April; we have heard it in almost all of our recent client conversations; and a quick scan of financial media easily shows it to be a dominant theme.

It would be easy to say that the current consensus view is very skeptical the recent equity market rally. Yet, public markets by their nature reflect a true consensus as measured by the actions – not the words – of tens of millions of participants. Those markets are holding onto their gains implying that the “closet consensus” of the investor community is different than what is being mused aloud.

In an effort to be where the puck is going, Wall Street tends to focus on rates of change in data rather than the actual data themselves. And as it turns out, despite looking dismal in absolute terms the data are in fact beginning to show an improving rate of change. Part of that is a function of “if you set the bar low enough then anything looks better”, but improvement is still improvement. Jobless claims are now decelerating for example, credit card transaction data are showing a modest increase, Google has reported a slight rise in purchase-related searches, and of course investor imagination has been stirred by the likelihood of all of this continuing moderately as states, provinces and countries (in Europe) are now beginning to very gently ease restrictions.

This matters because equity markets historically have rebounded one to two quarters ahead of an economic trough. If an economic recovery is beginning to form now in mid-Q2, then Q3 is likely show actual growth – even if off of a very low base – which implies that market rebound since March has been mostly a textbook recovery trade in three ways. From RBC’s Head of US Equity Strategy, Lori Calvasina:

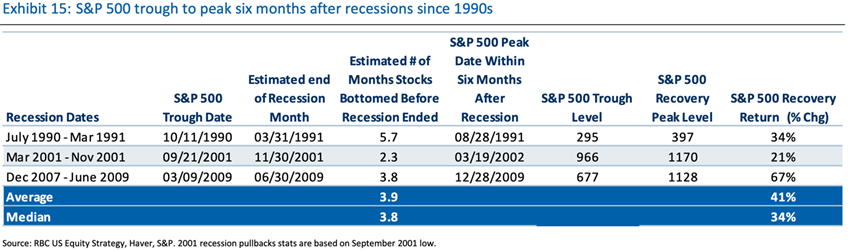

“First, if the economy does begin to climb out of its hole in Q3, history suggests that March 23 is reasonable timing to achieve a low in the stock market. Bottoms in stocks tend to occur shortly before recessions end. The S&P 500 found a floor 2–6 months (4 on average) before the recessions of 1990–91, 2001, and 2008–09 ended [see chart below]. Second, the magnitude of the move conforms with the historical playbook. From the mid-recession trough in the stock market to its six-month high after the recession ended, the S&P 500 posted a median and average rally of 34% and 41%, respectively. So far, the S&P 500 is up 31% from its March 23rd low. Third, the composition of market leadership has also mostly conformed with the historical playbook around recovery trades. Small Caps have started to outperform. Within Large Cap, Consumer Discretionary, Industrials, Materials, low ROE, and high short interest have been among the outperformers while Consumer Staples and Communication Services have lagged. These trends were also seen in past recovery trades.”

Incorporating this together with the themes we explored in the last update, the question for investors then becomes whether a probable economic recovery in Q3 will continue thereafter, or whether it will instead be swamped by a similarly probable second infection wave. One can make a qualitative argument that if a second wave does occur, its economic impact may not be as severe as the first because of a number of factors that will intuitively keep it more contained: a higher base of prior infections, better testing availability, on-going border controls, moderate distancing remaining in place and of course 100% public awareness. Every investor can have their own views on those topics, but ultimately the medium-term path of equity markets comes down to that question: will a likely Q3 recovery be sustained into Q4 and beyond, or will it fizzle? True consensus, apparently, is that there is a reasonable chance it will be sustained even if it isn’t prolific.

Meanwhile, Q1 reporting season has been underway and a majority of companies have now released results. Management teams of course have no better answer to the sustained recovery question than the rest of us, so earnings guidance has been either limited to the next quarter or not given at all, with very few exceptions. The start of 2020 appears to have better than feared however, with revenues on track to be up 1% despite a headwind from the Energy sector. The coming quarter is the one where the real impact will be felt – early reports next week on May 1st rent collection should be an interesting example – but most large companies have announced rapid cost reductions to help preserve liquidity through the trough. Debt markets are also helping liquidity by remaining wide open for business, with record bond issuance in April being capped-off by a remarkably well-received $25B offering from none other than Boeing.