I hope everyone is enjoying the summer weather. The first 6 months of 2023 have been interesting with interest rates still rising. Inflation has decelerated into the 2-3% range, but it will likely be sticky from there. Equity markets were mildly positive, but market leadership was quite narrow.

Strategy Update Highlights

- The Inflation rate has started to drop but the Bank of Canada and the US Federal Reserve (FED) will likely raise interest rates a bit further to get inflation down to the low 2% range. This will be tough on borrowers.

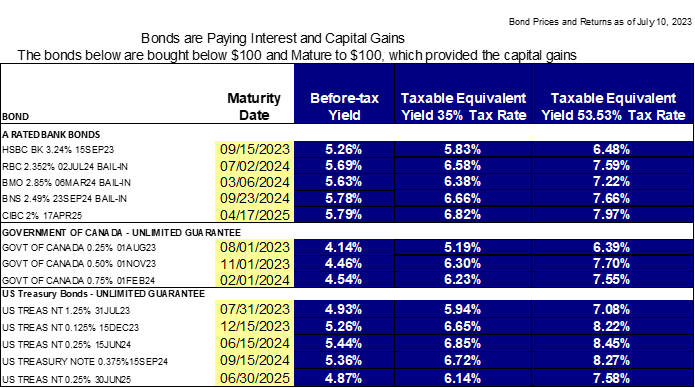

- Most of our fixed income positions are 2-14-month bonds with yields to maturity over 5.78%. I have included a bond chart below that shows interest equivalent yields at various tax rates as of July 10, 2023. We started moving back into fixed income alternative mutual funds and ETF's but then temporarily paused as rates continued to rise.

- Depending on the country, equity markets were mildly positive with the tech sector rallying back from its large 2022 drop. We are now looking for entry points back into equities as we constantly assess potential recessionary forces.

Fixed Income:

Over the last 18+ months we have rolled over $290 million dollars in direct bond holdings. We had anticipated rolling much of our maturing bonds into bond ETF's, Funds, and Indexes earlier this year, however as we started to tip toe back into these holdings, I put the brakes on. Instead, I continued buying short term bonds mostly maturing within 14 months. We did this because we have been

getting short term yields and interest equivalent yields that have not been seen in decades. Since the Canadian and US Central Banks are still raising rates, it still poses some risk to fixed income alternative mutual fund and ETF values. Please remember that prices and yields move inversely – i.e., interest rate increases cause bond price drops.

Please see the chart below for what bonds were paying as of July 10, 2023, which are higher than what various interest rates were in January 2023. They are also significantly higher than GIC rates with the same maturities as of the end of July 10, 2023. For taxable accounts, the after-tax interest equivalent was even higher.

After the next one or two 0.25% Canadian and US Central Bank rate hikes, the short-term bond yields listed above are not likely to rise significantly more. While I did pause moving back into indexes and actively managed bond portfolios, I do believe that over the next 1-3 quarters bond managers will be able to generate higher bond returns in some areas. In addition to buying bonds directly, we anticipate the portfolios will restart buying back into specialized bond funds and fixed income ETF's as well.

Equities:

Our equity portfolio is still underweight relative to target. We are actively looking for entry points and now, unlike over the past 15 years, you are being paid quite well to wait. Again, please refer to the interest rate chart above. Our financials (banks and insurance companies) along with energy, telecom, and transportation detracted from the equity portfolio performance in the first half of 2023. We expect some of those areas to add to performance in the second half of 2023. Additionally, I added some small protection/insurance to our Canadian equity exposure until mid-August and I am assessing adding more Canadian and US protection.

As I said above, bond returns are looking much better going forward but its equity exposure that provides the growth for longer term inflation protection. While parts of the technology sector have rallied (due to being oversold as well as the artificial intelligence boom happening) we are now beginning to see price recovery in other sectors as well. This recent equity recovery is in part due to many corporations dramatically lowering their earnings estimates and subsequently beating those estimates.

Conclusion:

Our team will continue following our conservative investment process as we navigate the ever-changing equity markets, interest rates changes, inflation, and the geopolitical environment.

As always, we appreciate and value your trust. Please do not hesitate to contact us if you need anything. We are currently available to meet by phone, WebEx, or in person.

** Here’s the fine print and there’s a lot of it…

Currency can add return when the Canadian dollar goes down but reduce returns when the Canadian dollar goes up for non-currency hedged US and international investments. Also, please remember that your US accounts report values in US dollars.

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this strategy update is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. Options, and other strategies mentioned, may not be suitable for all investors. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own Portfolio Manager or in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Portfolio Manager. The commentary, opinions, and conclusions, if any, included in this newsletter represent the personal and subjective view of Daniel Kelly who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. Investment Trust Units are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with Investment Trust investments. Please read the prospectus before investing. Investment Trusts are not guaranteed, their values change frequently, and past performance may not be repeated. (Keep reading, there’s only 7 more sentences to go.) This commentary is based on information that is believed to be accurate at the time of writing and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under license. ©2023 Royal Bank of Canada. All rights reserved.

Investment portfolios are not guaranteed, and past performance is no indication of future returns. In addition to these portfolios not being a guaranteed investment, there can also be significant fluctuations in the value of the portfolio. Did anyone read this far?