“There is no risk-free path for monetary policy.”

– Jerome Powell, Chair of the Federal Reserve of the United States

What a difference a year makes

Cast your mind back to early 2023. The cacophonous consensus call from economists and market strategists was for a recession (i.e., two or more consecutive quarters of negative GDP growth) in the second half to end of last year. And with good reason considering the compelling economic data – specifically leading indicators such as an inverted yield curve (i.e., short-term bond yields are higher than longer-term bond yields) and a negative Conference Board Leading Economic Index. One year on, the resilience of the U.S. economy and markets continue to surprise to the upside. So much so that the original consensus call for a recession in 2023 and into 2024 has increasingly given way to that of a “soft landing” (i.e., the economy shifting to slow-growth mode rather than a full-blown recession). Our very own RBC Global Asset Management Chief Economist, Eric Lascelles, recently raised his estimated probability the U.S. economy will experience a soft landing and avoid a recession to 60% from 40%.

The supporting evidence is compelling. The U.S. economy grew at a lively pace of just over 3% in the fourth quarter of 2023. While this marked a notable deceleration from the previous quarter of just under 5%, it marked the sixth straight quarter in which GDP grew at an annual pace of 2% or more and underscored the sturdiness of the world’s largest economy. Current consensus estimates are penciling in a similar pace of around 2% for 2024. The Consumer Price Index (or CPI, a broad measure of goods and services costs), increased 0.4% for the month of February and 3.2% from a year ago, slightly higher than expected for the second straight month. Similarly, the Producer Price Index (or PPI, which measures businesses’ costs for raw, intermediate, and finished goods), grew at a faster rate than expected. Remarkably, roughly two-thirds of the rise in the headline PPI came from a surge in finished goods prices.

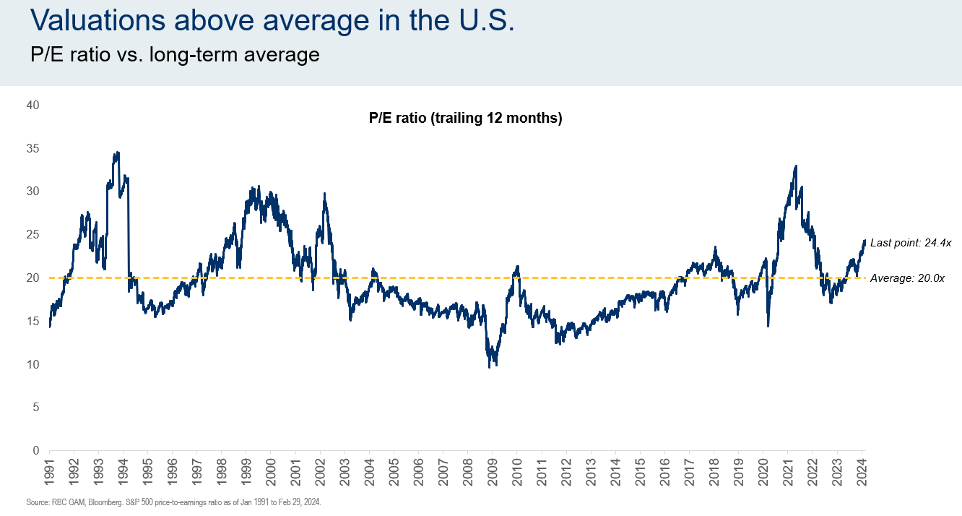

The corporate “earnings season” of the fourth quarter of 2023 delivered better-than-expected results largely across the board, while analysts’ consensus expectations for annual earnings growth in 2024 continue to hover in the low double digits. Wall Street seems to be in step with Main Street, as the S&P 500 Index has rallied in the high single digits year to date to new one-year highs – extending strength from the more than 20% rally in 2023. While that rally was predominantly driven by the Magnificent 7 (i.e., Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia and Tesla), the breadth of the rally seems to be widening to include the rest of the market – a sign of market health. Valuation of the S&P 500 currently sits above its long-term average, again largely because of the higher valuations of the Magnificent 7. Yet richer-than-average valuations are not a precondition for a market downturn.

The corporate “earnings season” of the fourth quarter of 2023 delivered better-than-expected results largely across the board, while analysts’ consensus expectations for annual earnings growth in 2024 continue to hover in the low double digits. Wall Street seems to be in step with Main Street, as the S&P 500 Index has rallied in the high single digits year to date to new one-year highs – extending strength from the more than 20% rally in 2023. While that rally was predominantly driven by the Magnificent 7 (i.e., Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia and Tesla), the breadth of the rally seems to be widening to include the rest of the market – a sign of market health. Valuation of the S&P 500 currently sits above its long-term average, again largely because of the higher valuations of the Magnificent 7. Yet richer-than-average valuations are not a precondition for a market downturn.

Rate cuts: More a question of when rather than if

As the barrage of healthy economic data has fed the soft-landing narrative, analysts’ consensus expectations for the timing of the first rate cut by the U.S. Federal Reserve (the Fed) have shifted considerably since the beginning of the year. In just December of last year, markets anticipated close to seven rate cuts to bring rates from 5.25% to just under 4% by the end of 2024. As the market digests the continued buoyancy of the U.S. economy, rate cut expectations have been recalibrated lower to a relatively modest four cuts this year to bring rates to ~4.5%. Despite the repricing of central bank rate expectations, inflationary pressures continue to diminish, making the path to the Fed’s 2% inflation target unlikely to be a straight line. Consensus is currently building around June for the first Fed rate cut. This is not unreasonable in our view, though based on recent history, we are inclined to believe that the timing, number, and magnitude of rate cuts are all moving targets that could change with the ebb and flow economic data releases over the next few months. For example, there are still three more CPI releases before the Fed’s rate-setting meeting in June.

A fine balance

While the Fed should be credited with reining in inflation meaningfully in the absence of a contemporaneous recession, there is still work to do. Recent comments from Fed officials indicate they remain resolved in driving rates lower this year, notwithstanding the recent “stickiness” in inflation. We expect the Fed to remain hyper focused on evidence that would suggest inflation is not just moving towards its 2% target but doing so in a sustainable fashion. Yet to affect a soft landing (which has proven rare based on past rate-hike cycle precedents), the Fed is tasked with striking a fine balance: cutting rates too quickly could lead to a reignition of inflation and potentially kick-start another rate hike cycle; cutting rates too late runs the risk of leaving them at restrictive levels for too long, and likely increases the probability of a recession.

That said, the recent softening of the labour market backdrop in the U.S. could further buttress expectations for the first Fed rate cut in June. The latest unemployment reading for the month of February clocked in at 3.9% compared to 3.7% last month and 3.6% last year. Over the next few months, should the rate of unemployment increase by a modest amount but on a sustainable basis above 4%, this could provide sufficient ammunition for the Fed to decrease rates sooner rather than later.

Cautious optimism is in order

It’s important to acknowledge that while consensus estimates are increasingly tipping towards a soft-landing scenario, this is hardly a foregone conclusion. Even by Lascelles’ estimates there is still a 40% probability that the U.S. economy will be in a recession in the latter part of this year. The soft-landing narrative runs counter to the argument that historically periods of prolonged tight (i.e., high-interest rate) financial conditions have typically translated into recessions. Based on RBC Global Asset Management’s historical analysis, recessions arrive on average within 27 months of the central bank’s first rate hike. This suggests that we are overdue for an economic downturn, and yet a “late” recession by historic standards is hardly precluded, particularly when one considers the low sensitivity of the U.S. economy to rate hikes and their lagged transmission effects (which take typically 12-18 months to impact the economy). Nor does historical data support the supposition that recessions are unlikely following several quarters of positive GDP growth, as has been the case in the U.S.

While there are grounds for optimism around a soft-landing scenario for the U.S. economy, investors should be prepared for an elevated level of volatility in the months ahead, particularly given the imminent presidential election in the U.S., elevated geopolitical conflict, and the downside risk to above-average consensus earnings estimates. We continue to advocate for a healthy level of tactical defensive posturing within portfolios and view fixed income (specifically government bonds) alongside high-quality dividend-paying equities as attractively valued at this juncture.

Note: All figures and statistics above are sourced and provided by RBC PH&N Investment Counsel Inc, except where otherwise noted.

Past performance is not indicative of future results. Counsellor Quarterly has been prepared for use by RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC). The information in this document is based on data that we believe is accurate, but we do not represent that it is accurate or complete and it should not be relied upon as such. Persons or publications quoted do not necessarily represent the corporate opinion of RBC PH&N IC. This information is not investment advice and should only be used in conjunction with a discussion with your RBC PH&N IC Investment Counsellor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest information available. Neither RBC PH&N IC, nor any of its affiliates, nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. This document is for information purposes only and should not be construed as offering tax or legal advice. Individuals should consult with qualified tax and legal advisors before taking any action based upon the information contained in this document. Some of the products or services mentioned may not be available from RBC PH&N IC; however, they may be offered through RBC partners. Contact your Investment Counsellor if you would like a referral to one of our RBC partners that offers the products or services discussed. RBC PH&N IC, RBC Global Asset Management Inc., RBC Private Counsel (USA) Inc., Royal Trust Corporation of Canada, The Royal Trust Company, RBC Dominion Securities Inc. and Royal Bank of Canada are all separate corporate entities that are affiliated. Members of the RBC Wealth Management Services Team are employees of RBC Dominion Securities Inc. RBC PH&N IC is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. RBC, RBC Wealth Management and RBC Dominion Securities are registered trademarks of Royal Bank of Canada. Used under licence. © RBC Phillips, Hager & North Investment Counsel Inc. 2024. All rights reserved.