What do you do with your investment portfolio when you hear the infamous “R” word – recession? It’s easy. Just follow the three Rs: Review, rebalance and relax.

Recession: A nasty nine-letter word

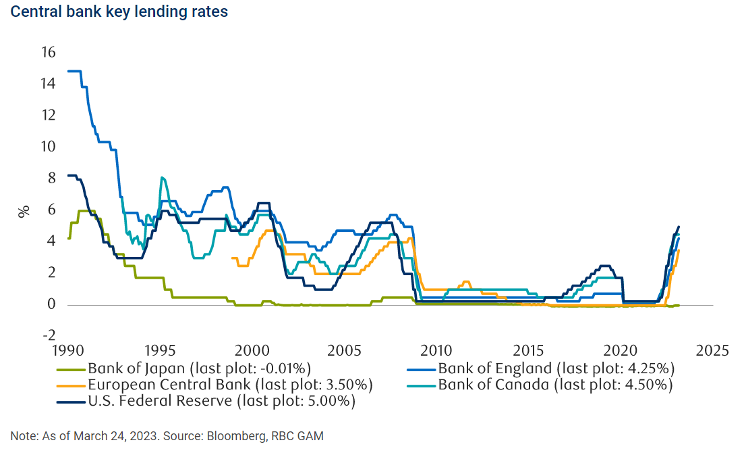

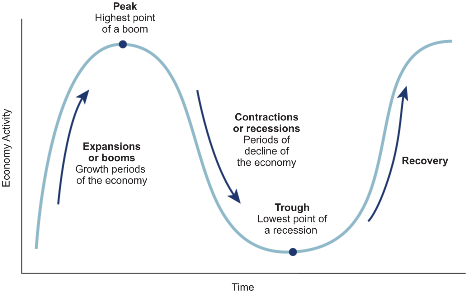

The strong post-pandemic economic boom – combined with global supply chain issues and massive increases in energy prices – has caused a surge in inflation over the last year-and-a-half to levels not seen since the 1980s. In response, almost every major central bank the world over has scrambled to increase interest rates to tamp down demand and regain control over prices. So much so, in fact, that the Governor of the Bank of Canada (BoC) recently stated that it was better for our long-term economic well-being to use restrictive monetary policy to induce a recession – where the economy ceases to grow or even contracts for two consecutive quarters or more – than risk allowing inflation to continue to ravage consumers, government and businesses.

To fight inflation, the BoC has raised its benchmark rate eight times, lifting it from 0.25% back in the spring of last year to 4.5% today. While the rise has been sharp and rapid, it appears that recent economic conditions have weakened enough to allow the BoC to pause, or perhaps even end, its tightening course.

However, unfortunately most economists now agree that sharply higher rates, while working to bring down inflation from its peak of over 8% in February 2022 to today’s 5% level, a recession is likely to be inevitable. Whether that recession is mild or severe is still open to debate, but increasingly the consensus appears to be that a “soft landing” – where the economy slows but doesn’t enter a recession – has become increasing unlikely.*

“R”-proofing your portfolio

Already suffering from rising interest rates, and now anticipating a recession, both bond and equity markets turned negative and volatile in 2022, reflecting the uncertain and bumpy road ahead. While 2023 started off on a positive footing, equity markets have largely given back this year’s gains (fortunately, bond markets have done better as interest rate increases have stabilized).

Volatile markets often generate strong emotional reactions in investors, sometimes prompting them to veer off course from their investment plans. This can lead to common pitfalls like taking inappropriate and ill-advised risks, buying high and selling low, and moving to “the sidelines” (i.e. cash) to avoid losses, thereby missing out when markets recover.

Similarly, reacting to the “R” by altering your investment plan is rarely the right move. Instead, investors would be well served to follow the three Rs:

- Review: Volatility can spur some difficult-to-manage emotions, and to questioning one’s goals and the plan to achieve them. Does your investment plan still align with your goals? Is your risk profile still accurate? These are important questions and concerns to review with your Investment Counsellor if your financial or personal circumstances have changed.

- Rebalance: Your portfolio should be balanced in a way that maximizes your investing efforts to help achieve your goals, while reflecting your appropriate risk profile.

- Relax: Once you’ve reviewed and rebalanced, if and as necessary, you can relax with confidence that you are on the right track to your goals.

It’s important to keep in mind that recessions are usually short-lived events, and that your portfolio is designed to achieve long-term goals – like retirement – that are in the future and that stretch over many years. So changing your long-term plan as a result of short-term challenges is rarely advisable.

*Canadian economy unlikely to dodge a downturn despite early-2023 resilience. RBC Economics (March 15, 2023).

Past performance is not indicative of future results. Counsellor Quarterly has been prepared for use by RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC). The information in this document is based on data that we believe is accurate, but we do not represent that it is accurate or complete and it should not be relied upon as such. Persons or publications quoted do not necessarily represent the corporate opinion of RBC PH&N IC. This information is not investment advice and should only be used in conjunction with a discussion with your RBC PH&N IC Investment Counsellor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest information available. Neither RBC PH&N IC, nor any of its affiliates, nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. This document is for information purposes only and should not be construed as offering tax or legal advice. Individuals should consult with qualified tax and legal advisors before taking any action based upon the information contained in this document. Some of the products or services mentioned may not be available from RBC PH&N IC; however, they may be offered through RBC partners. Contact your Investment Counsellor if you would like a referral to one of our RBC partners that offers the products or services discussed. RBC PH&N IC, RBC Global Asset Management Inc., RBC Private Counsel (USA) Inc., Royal Trust Corporation of Canada, The Royal Trust Company, RBC Dominion Securities Inc. and Royal Bank of Canada are all separate corporate entities that are affiliated. Members of the RBC Wealth Management Services Team are employees of RBC Dominion Securities Inc. RBC PH&N IC is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. RBC, RBC Wealth Management and RBC Dominion Securities are registered trademarks of Royal Bank of Canada. Used under licence. © RBC Phillips, Hager & North Investment Counsel Inc. 2023. All rights reserved.