An Individual Pension Plan (IPP) is a defined benefit pension plan established by an incorporated company to provide enhanced retirement benefits and essential tax advantages for business owners and key employees.

Reasons to consider an IPP

- Substantially higher retirement savings compared to an RRSP

- Higher annual contributions than an RRSP for individuals over age 40

- IPP investments grow on a tax-deferred basis

- Assets within an IPP are protected from creditors

- Contributions and IPP-related expenses are tax-deductible for the sponsoring company

- Possible to make contributions for past years of employment

- Additional lump-sum contribution permitted at retirement

- Able to compensate for investment and funding shortfalls through additional contributions

- Several options at retirement

- At death, the remaining value goes to surviving spouse or estate

Suitable candidates

- Individuals over the age of 40 who earn a T4 income

- Incorporated business owners and family members

- Incorporated professionals

- Senior executives

- Small businesses with sufficient cash flow to fund the IPP

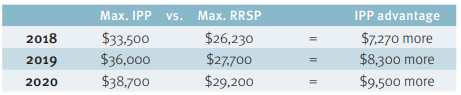

Annual contributions

If you’re over the age of 40, an IPP allows higher annual contributions compared to your traditional RRSP, regardless of income:

Summary illustration for IPP:

A 50-year-old client with 23 years of service

Projected accumulations:

An IPP can allow you to significantly improve your tax-assisted retirement savings compared to an RRSP – up to 46% more assuming a 7.5% rate of return.

Funding an IPP with excess cash from your business

If returns in the IPP account are below the prescribed rate (i.e., 7.5% in the above example), there will be a deficit that must be funded by the corporation. This provides a planning opportunity if the objective is to move excess cash from the business into the IPP account, as a conservative investment strategy can be used to create intentional deficits and allow additional deductible employer contributions to the IPP.

Please note that the actual surplus or deficit in the plan needs to be determined by the actuary, and takes into account economic and actuarial factors such as inflation and indexation, to calculate the required rate of return. The above is just an example using the prescribed rate, but the actual required may vary from one evaluation period to another.

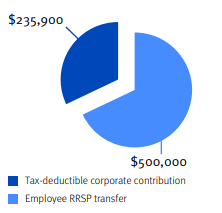

Accumulate more IPP savings by recognizing years of past service

A client with $500,000 in their current RRSP.

It is possible to increase the contribution room in your IPP by recognizing the years of past service you have had with the sponsoring company

To do so requires:

- The transfer of all or a portion of your RRSP savings.

- A tax-deductible contribution from the company can be made as a lump sum contribution. It can also be amortized over several years.

Make it easy – IPPs from RBC Wealth Management

Establishing an IPP early can greatly enhance retirement benefits, but it can be complicated. That’s where our team of professionals can help – by making it easy to establish an IPP that’s right for you. To learn more, contact me at connor.ryan@rbc.com, or by phone at 905-895-4102.