“The best time to invest in the market is when you have the money.”

– Sir John Templeton

Over the years we have had many conversations with investors about investment timing, in an attempt to tackle the question of when is the optimal time to put new money to work in portfolios. Timing is one area of investing that challenges most investors. Whether one uses a fundamental approach or looks at markets from a technical perspective, there is a degree of apprehension that exists across these decisions—the fear that one could be investing new money into the markets at the absolute wrong time.

We have spent much time pondering how to best guide investors through the challenge of consistently adding new money to their portfolios, and we always come back to Sir John Templeton’s maxim at the beginning of this article. We believe there is a great deal of wisdom in this approach because it does not profess to take a view on timing. To help illustrate this point, we have created a simple scenario which helps to explain that the fear of mistiming the markets is largely misplaced.

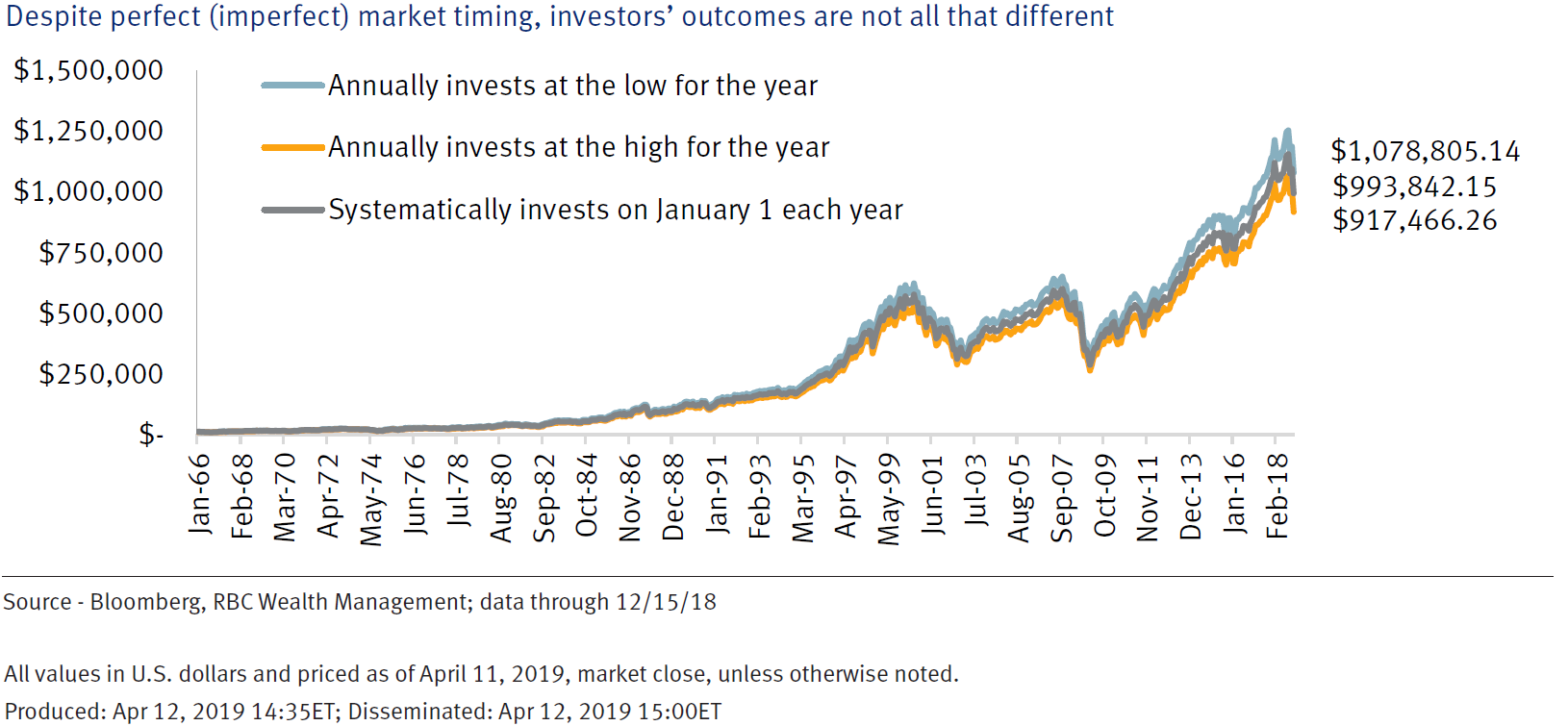

The chart depicts the returns of the S&P 500 going back to 1966 for three investors. Each investor started with an initial deposit of $10,000 and after that contributed $1,200 annually. The difference between these three investors is as follows: One was highly skilled and able to perfectly time her annual entry point to corresponding with the S&P 500’s annual low (blue line). The second investor timed his investment such that the annual contribution corresponded with the annual high (orange line). Finally, the third investor took a systematic approach, adding $1,200 at the beginning of each year (grey line).

The first thing that jumps out is how relatively small the difference is among the three portfolio ending values. The difference between the investor that executed perfect market timing compared to the one that perfectly mistimed the market isn’t that much. More specifically, there is a 17.6% difference, which may seem like a lot but this is over 52 years. On an annualized basis, this translates into a 0.3% difference each year. Also, keep in mind that this scenario illustrates the worst case possible. In practice, it’s virtually impossible that an investor would ever be able to perfectly time or mistime the market over 52 years. And the variance between perfect market timing and the systematic approach is even smaller at 8.4%, or 0.16% annualized.

Why does market timing not really matter?

The results shake out this way because of the power of compounding returns over a long period. Mathematically, compounding is a much more meaningful determinant of long-term returns than timing decisions. In the short term, the market is going to do what it is going to do. Over the long term, having a seat at the table (i.e., being invested) is what matters.

Some parting thoughts

The concept that “time in the market” matters more than “timing into the market” is well founded. In the short term, there may be circumstances when putting new money to work may prove to be the wrong course of action in hindsight. But in the long term, ultimately it is the time in the market that matters most. We also acknowledge that there can be unique circumstances in which it could make sense to discuss taking a more measured approach to becoming fully invested. However, we believe the majority of the time we are likely doing more of a disservice to our long-term returns by waiting for an “opportunistic time” to invest. Remember, to truly invest on a pullback assumes that we will (1) be able to call the timing of the pullback, (2) recognize when the time comes, and (3) have the fortitude to execute when the time arrives. In our opinion, that’s a fairly tall order that’s too tall to ask of anyone.

To learn more, register for our next retirement income seminar or give us a call at 905-895-4102.

This article is supplied by Connor Ryan, an Investment Advisor with RBC Dominion Securities Inc. Member–Canadian Investor Protection Fund.