March Update – Coronavirus Concerns

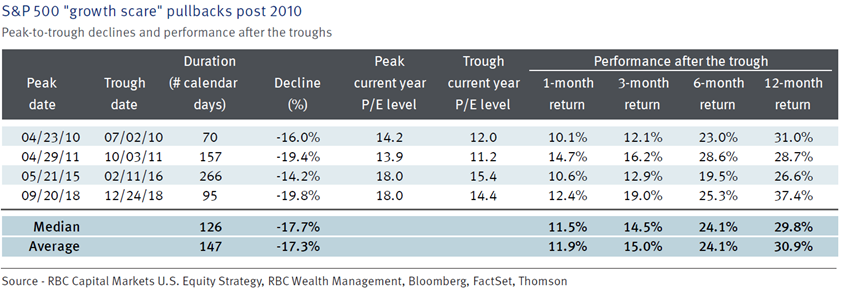

The coronavirus has caused quite a scare in the global stock market over the last two weeks and sparked concerns about global growth going forward. In response, the Bank of Canada and the U.S. Federal Reserve cut interest rates this past week by 0.5% to support the falling stock market. Now, this is not the first time concerns about economic growth have occurred in the last decade. In 2010, 2011, 2015 and 2018, the S&P 500 dropped by an average of 17.3%. Following these growth scares because a recession did not materialize and the economic expansion persisted, the S&P 500 more than recouped the losses in six or twelve months after reaching the bottom, as the table below shows:

Before the coronavirus outbreak, the global economy was on a positive trajectory with phase 1 of the U.S.-China trade deal in place. The markets over the last two weeks have reacted based upon fear and guesswork. It is important to recognize that the coronavirus is a public health crisis, not a financial crisis. Nobel laureate Professor Robert Shiller described it best when he said: “The level of anxiety, rather than the actual information, will dictate the market response, and that means that the market will be driven by crowd psychology.” Epidemic scares such as a viral outbreak, have a long history of short-term fluctuations as people react to the worst hypothetical outcome. Market scares like this one is why we invest part of your money in bonds. Our bond investments have gone up in value since the coronavirus outbreak. These investments enable us with an excellent opportunity to move money from bonds back into the stock market to take advantage of the eventual rebound. Sticking with our long-term investment plan is the best course of action moving forward.