Market Update March 17th, 2020:

Volatility, COVID19, Bank of Canada, Strategy

Dear clients and friends,

You are more than welcome to forward this email to family and friends should they wish to read. It’s rather lengthy, but worth it. Plus there are some great charts, and who doesn’t love a good chart! I know I do!

and I will be working remotely for the next little while. I may not be in the office physically, my phone is forwarded to my cell phone. The office line is 604-870-7109 and my cell phone is 604-217-5621.

If you would like to schedule a call or Facetime meeting with me please send me a quick note by replying to this email.

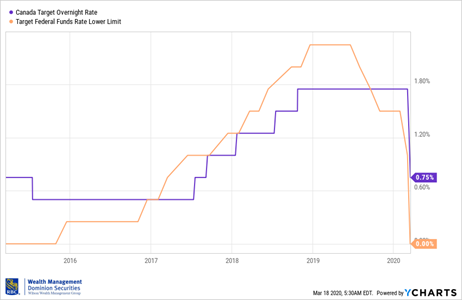

may be difficult to focus on the outlook for financial markets when the welfare of our clients, family, and friends is top of mind. Laura, Bennett, and I are doing our part by social distancing, even from family, which is very hard given they want to see this cute little guy! I’ll say what a time to be born, I will always remember this time in history! I also remember going through 2009 when my father passed away suddenly(remember the financial crisis), it seems like you can’t see light at the end of the tunnel but we as humans have a way of always making it through difficult times. I am keeping an optimistic view on life as always, and especially with Bennett here. We will get through this just like any other period of distress, like what we have done with many other viruses and global issues in recent years: SARS, MERS, Measles, ZIKA, and EBOLA. World events: Brexit, Paris Terrorist Attacks, US-China Trade wars, Tariffs, NAFTA negotiations, US Gov’t Shutdowns, US Debt Ceiling, and the ever exciting US Federal Election in November. Fidelity sent out a great piece this week that I have attached to this email showing we have recovered from every other outbreak. I believe markets will need to see the slowing in the outbreak first before we start to see a recovery, as seen in China where ‘social distancing’ has worked. The reserve banks in North America( Federal Reserve in the US and the Bank of Canada here), have come out with mandate of whatever it takes type of attitude. We’ve seen them both drop interest rates rather quickly .

World Health Organization website is here: www.who.int

A good friend of mine Carl Richards, which many of your who have come into the office have seen the sketches on my wall, has a number of good ones for times like these: https://store.behaviorgap.com/collections/risk

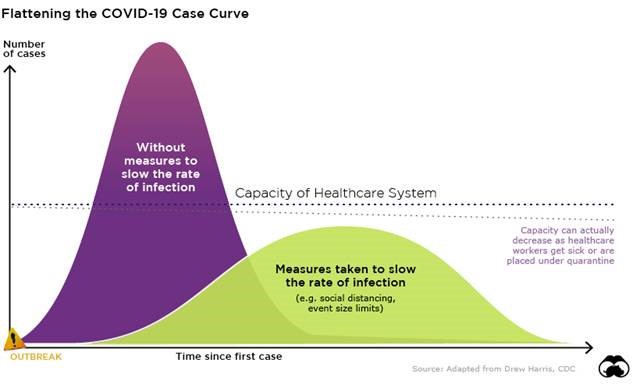

Nevertheless, putting events that affect the markets into perspective is an important responsibility of mine – in good times and bad. As a result, I wanted to share our key thoughts on the current situation and how we intend to approach the days, weeks and months to come. I’ve seen some great minds finally come together and start to combine resources and agree on how to solve this worldwide problem, a rather amazing feat when faced with a situation how the human race can come together to fight a common enemy. There are trial vaccines and medicines being created and tested right now. Before those are rolled out we have an important role to play, flattening the curve. Which means, slowing down the spread of a virus, social distancing, and self-isolation. How ‘flattening the curve’ works. It gives our healthcare system time to deal with incoming cases rather than being flooded with patients and not enough equipment.

I have included some attachments to this email and links below, as well I am adding a section to my website where you can get valuable resources. www.CameronWilson.ca – look for the Market Volatility Tab(should be live Wednesday pending approval).

Volatility

We are currently experiencing some of the sharpest moves – both up and down – in stock prices that we have witnessed in some time. It feels particularly extreme because of where we just came from. It has only been a year or so since we left behind a decade of unusual calm in the markets. The emergence of a pandemic has been the unforeseen catalyst that has driven this bout of heightened volatility. This has been exacerbated by a combination of the velocity of news (particularly via social media), fear and panic, illiquidity in the bond market, and the broad adoption of technology-driven trading.

Coronavirus

The spread of the coronavirus is the key issue. What has become apparent is that the only proven way to slow infection rates is through social isolation and quarantine. It’s been successful in China, South Korea to some extent, and are awaiting results in Italy, which has recently undertaken similar action. Elsewhere, more needs to be done and we expect to see other countries to move in that direction in the days and weeks to come. Ultimately, governments will have to sacrifice their economies to some extent for the sake of society’s welfare.

Energy

Another factor has been the rapid decline in oil prices as a result of a standoff between two of the world’s largest oil producers: Saudi Arabia and Russia. While it’s hard to predict an outcome given its political nature, we expect this could last for a period of months, if not longer. But low oil prices hurt both countries and there is likely some pain threshold, measured in months, at which point negotiations may renew. The implications are important for Canada as any extended period of low oil prices will hurt our economy and our market, both of which depend on the industry. Furthermore, the bond market is watching this closely as investors have justifiably grown concerned about the ability of some companies to repay their loans should prices remain depressed for an extended period.

Governments and central banks

Governments have taken action around the world, but more is needed. In particular, we look for governments in North America and elsewhere to focus on measures to more meaningfully contain the virus and slow its spread, largely via social isolation and mandated closure of events and even businesses. Along with this, we need to see governments help businesses and consumers through this period where they will face lost revenue and cash flow. These were similar tactics used in China and more recently in Italy. Meanwhile, central banks have aggressively lowered interest rates and, more importantly, taken various measures to ensure that businesses have proper access to credit should they need to borrow money.

A wild idea I have that could possibly stimulate the economy and maybe stoke inflation is something called Helicopter Money, where the gov’t gives every citizen over 18 a cash payment. In theory it might work, but giving people money to help paying their rent, mortgage, other bills, and help bridge the gap until they return to work. Let’s see if that’s implemented or not. Like anything it’s a theory for now, weather it works or not time would tell.

Implications

The implications for economic growth over the next few months are negative. But the degree of the fall in stock and corporate bond markets in recent weeks suggests markets were likely reflecting an already-heightened probability of economic recession. The important question now is whether the coming measures taken by governments and central banks are meaningful enough to convince investors that the impact will be a matter of a few months and a mild recession versus something that extends well into the second half of the year and is deeper in nature.

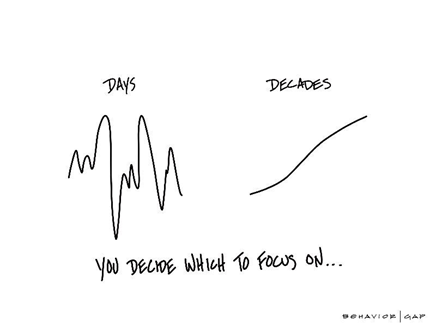

In the near term, we expect these large swings in prices to continue. In our experience, basing investment decisions on extreme scenarios and trying to make large portfolio shifts in today’s environment of big price swings is very challenging. It may be too short-term focused and may do more harm than good given the possibility of government intervention. Past experience reminds us that market declines often end in a climactic fashion. But no one has the ability to accurately predict exactly when that will be. Just like we don’t know the day and time each year of the hottest and coldest day, until that time has passed. We cannot pick absolute tops and bottoms of the stock market either.

Rather, we are committed to remain disciplined in our investment approach. This means: focusing on your long-term objectives and ensuring your portfolio is properly structured to deliver your required long-term outcomes. To accomplish this, a few measures we may undertake in the future include:

- Rebalancing of positions across your portfolio

- Harvesting tax losses where appropriate

- Undertaking due diligence and reviewing all holdings to ensure quality

- Opportunistically adding to existing or new positions that meet our criteria should the prices become excessively cheap

We believe these measures will help us ensure we continue to have the most conviction in your portfolio and its ability to help you achieve your objectives over time.

Should you have any questions or concerns, please feel free to reach out.

You can reach me directly at 604-217-5621.

Great links:

Market Volatility Page on my site: HERE

Eric Lascelles Macro Memo: https://www.rbcgam.com/en/ca/article/macromemo-march-16-march-20-2020/detail

10 Principles for Investing

Crisis or Opportunity

Diversification

Cycle of Emotions

Staying the Course

Risk & You

Cameron Wilson, FCSI, CIM, CPCA, PFP, CIWM

Associate Portfolio Manager, Wealth Advisor, & Financial Planner | Wilson Wealth Management Group

RBC Wealth Management | RBC Dominion Securities

T: 604-870-7109 | M: 604-217-5621 | TF: 800-563-1128 | www.CameronWilson.ca

Cindy Campbell | Associate | Office: 604-870-7225 | Cindy.Campbell@rbc.com