With only a couple months left in the calendar year you should start talking with your advisor about year-end tax planning. One strategy often considered includes charitable giving, over 84% of Canadians make charitable contributions collectively giving over $10 Billion annually.

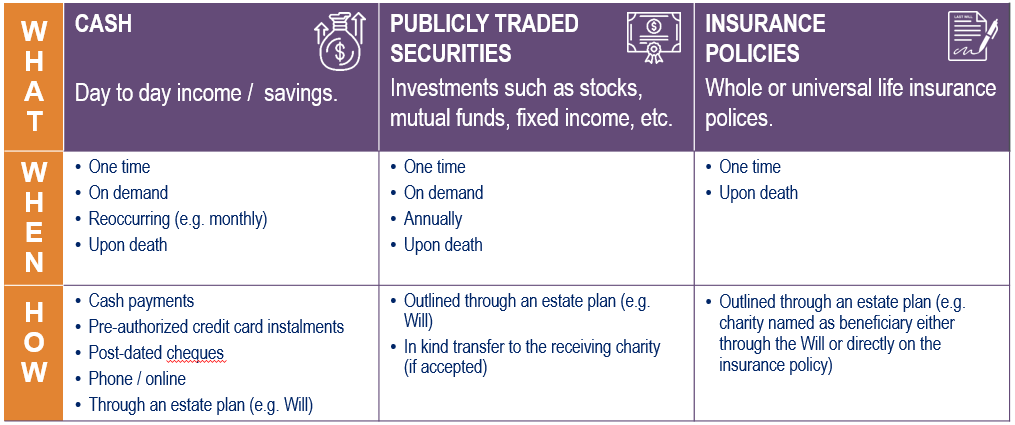

Before stroking a cheque, give some thought to how you intend to support the organization, the impact you wish to accomplish and tax savings you will receive in return.

Financial considerations include will a tax receipt be issued, donating securities with large capital gains or naming a charity as the beneficiary on a life insurance policy.

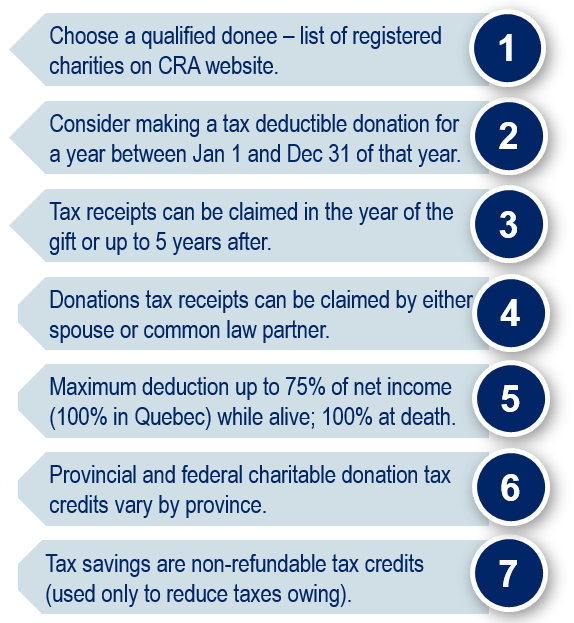

Here are a few general tax rules that apply:

Contact our team to discuss how charitable gifting can be a part of your plan.