From our Team

I’d like to go back to my early days studying finance and markets to focus on a concept that to this day fascinates me, the power of compounding. The younger a person starts to save and invest money the better. The larger the pool of funds becomes, the quicker it compounds. For some people they may not get serious about saving for retirement until their 40’s or even 50’s at which time they only have a couple of decades to allow for compounding. If you can start in your mid-twenties you could have 4 decades of compounding prior to retirement and maybe 6+ decades before life expectancy. That is powerful! Let me show you.

Assumptions:

- 6% rate of return on investment

- All savings allocated to RRSP

- Annual contributions increased by 2% each year

- Marginal tax rate of 35% to illustrate net cost of contributions

Scenario 1:

- Start saving $5,000 per year at age 25 until age 65

Scenario 2:

- Start saving $15,000 per year at age 45 until age 65

- The annual savings amount is double scenario 1 since the 2% increase would have increased the $5,000 at age 25 to $7,884 at age 45

|

| Scenario 1 | Scenario 2 |

| Market Value at age 65 | $1,065,244 | $680,945 |

| Accumulated Net Cost of Contribution (after tax deductions received) | $196,306 | $236,899 |

In summary you can see that in scenario 2 the cost of contribution is actually higher but total market value is substantially less. The annual savings amount in scenario 2 would actually have to increase to $24,000 per year to achieve the same portfolio value. Let’s adjust the figures and take a look.

|

| Scenario 1 | Scenario 2 |

| Market Value at age 65 | $1,065,244 | $1,089,512 |

| Accumulated Net Cost of Contribution (after tax deductions received) | $196,306 | $379,039 |

If at age 45 you started to save $24,000 per year the total accumulated cost of contributions is $379,039 or $182,733 more than if you started saving $5,000 per year at age 25. Your total cost of contributions is almost double to get the same results.

That’s the power of compounding! Now share this with your kids & grandkids and tell them to start investing. They may not hear you out so tell them to read this and contact our office.

From RBC Portfolio Advisory Group & RBC Wealth Management

How will conflict in Ukraine impact European equities article.

A must read on the market, earnings and the economy from 10,000 feet by Jim Allworth.

Audio Commentary on events and factors impacting markets.

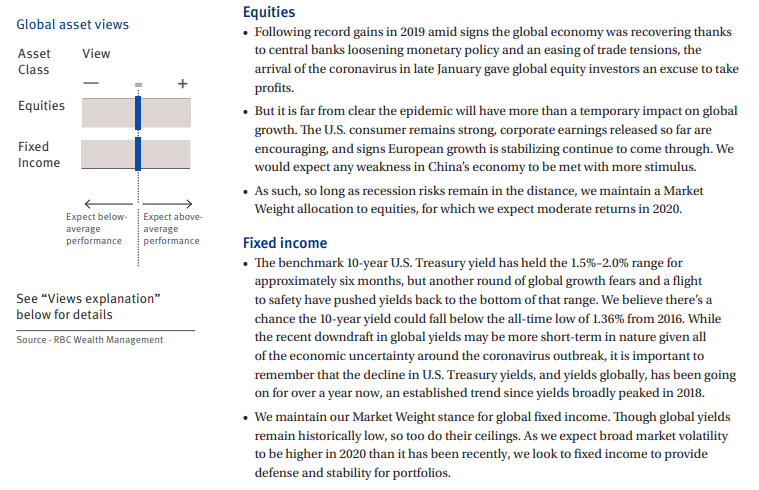

RBC’s Investment Stance

Global Insight Monthly Link

Something of Interest

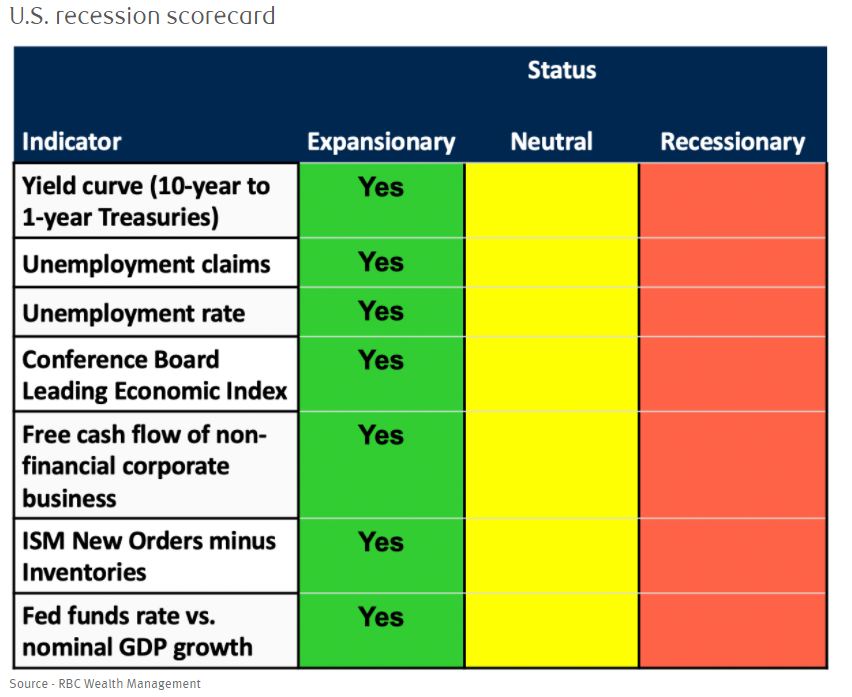

The U.S. recession scorecard looks at several leading indicators to help determine the state of US economy which at this time is showing no weakness. More details can be found in the must read indicated above written by Jim Allworth.