From Our Team

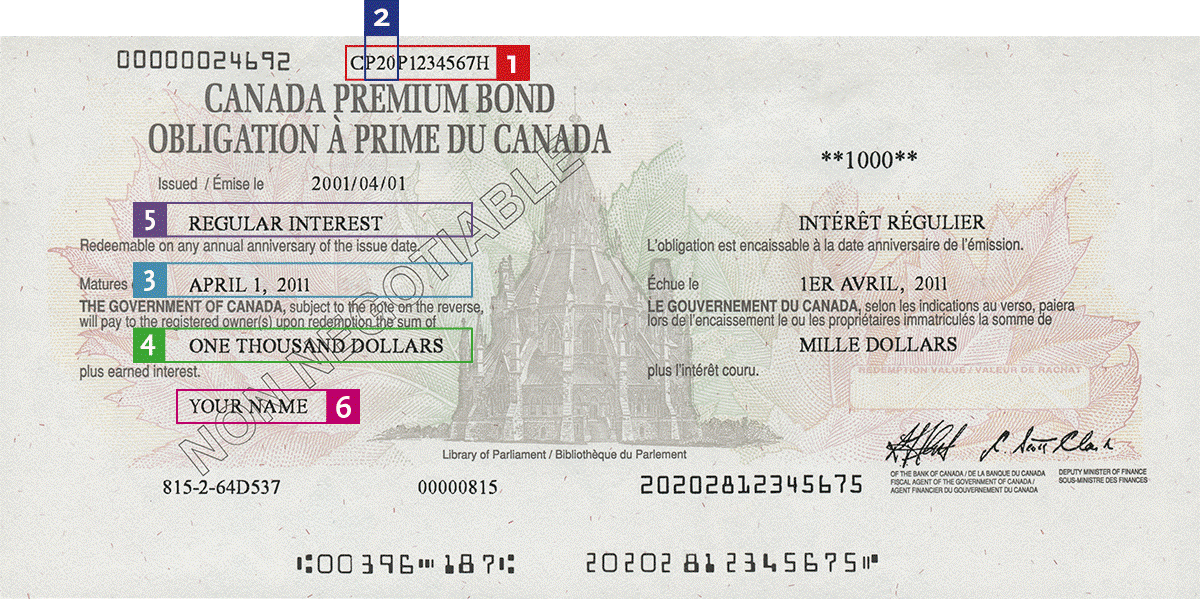

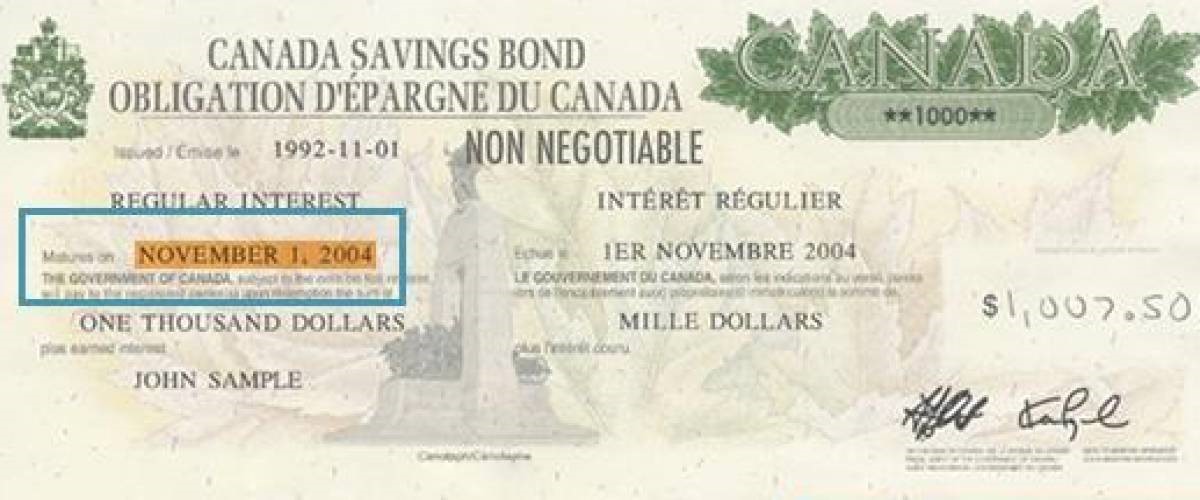

What’s the first thing you remember about money? I was thinking about how different my experience would be from my children’s as I’m sure from most of you. I remember my parents using a calculator in the grocery store and at the time never thought anything of it but now realize my parents had a budget and followed it closely. Remember bank books? I remember taking my bank book into the bank teller who would print out the list of debits and credits on my bank account. At Christmas my grandparents often gave us Canada Savings Bonds!

I got my first car loan at the age of 18 and bought a Pontiac Grand AM. I made extra payments against that loan and paid it out early which I was so proud of only to get into a no-fault accident and the vehicle was written off. My next vehicle was a lease which had its pros and cons of being a dependable vehicle but with a trapped payment.

The smartest loan I ever took was a student loan, my dad had to co-sign for me. I worked hard as a bartender during my first year of college but then decided to focus on my studies which is why I needed the loan. It seemed to take forever to pay that down but it may have been one of the best investments I made.

Today bank books don’t exist and you can’t get a Canada Savings Bond. My children don’t even know what a penny is! Teaching them about budgeting is going to be very different from how I learned from my parents. Technology has changed the way we think about money and how we use it. Because my children are young they think there is an endless supply of money on a plastic card by just tapping it at a machine. Better yet, all you need to do is shop online and two days later it’s delivered at your door.

From RBC Portfolio Advisory Group & RBC Wealth Management

More countries are making the price of carbon emissions mandatory, via cap-and-trade rules or a tax. How should

investors view this new expense? Read more here.

The long-anticipated taper announcement came. But there are a lot of moving parts to the Fed’s outlook and we address three burning questions here.

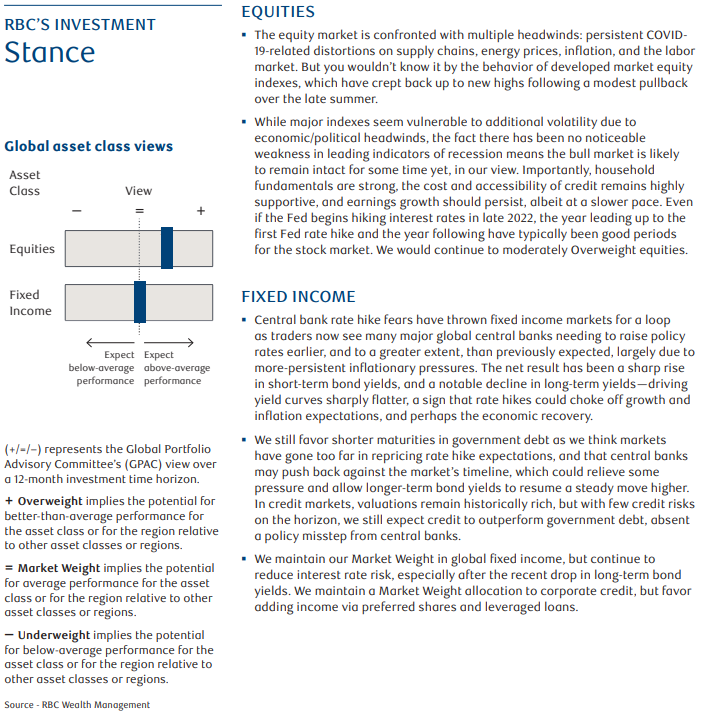

RBC's Investment Stance

Global Monthly Insight link

Just for Fun: