It certainly hasn’t been a routine week for capital markets … beware the Ides of March. For those following, we began the week with two U.S. banks being taken offline due to solvency issues. SVB, the first and largest, got caught having its own money (reserves) tied up in long-dated securities. We believe the rationale was that when interest rates were incredibly low during COVID, the only way to make any money from those reserves was to extend the terms on the investments in order to earn some amount of term premium. However, as inflation emerged and then raged, The Fed began raising interest rates quite aggressively. Take it from us, rising interest rates have a negative effect on the value of already-issued securities like government and corporate bonds. It is a mathematical relationship that as interest rates rise, bond prices drop, and they dropped by a lot. [Interesting to know that the banks do not need to mark to market their bond portfolios (i.e. report their current market values), unless or until they actually have to sell a bond. In other words, the paper loss of lower bond prices in their portfolio is not material as it is generally expected that those bonds will be held to maturity.]

At the same time, quite a number of SVB’s customers / clients began drawing funds either for business reasons or to obtain a better yields on competing short term cash investments. As a result, SVB needed to sell securities from its reserves to cover those withdrawals which triggered losses and all of a sudden the bank’s liquidity became a concern since it could no longer report many of their remaining bond positions at their original purchase prices, but instead at their current lower market values. A detailed discussion of this takes us into regulatory liquidity and reserve requirements which we’d prefer to stay out of (this is boring enough already).

No surprise, fingers are being pointed and accusations are flying. Management of the bank (for being derelict and incompetent), The Fed (for raising interest rates so aggressively), the bank regulators (for not doing a good job) and legislators (for loosening bank regulations in 2018) are all being blamed for this. In the short, they likely all deserve some amount of blame but knowing who’s to blame right now isn’t the primary concern. The U.S. government, as it has done in past, has stepped in to save the bank. It has guaranteed all depositors, even those with deposits in excess of the FDIC insurance threshold of $250,000, will be made whole and will have access to their funds (management, holders of the bank’s bonds and shareholders have all paid the price, however). While this should cause a sigh of relief, that was only the first shoe to drop …

A little later in the week, problem-child Swiss bank, Credit Suisse, returned to the news with more bad news … this time that it too was facing a funding squeeze (we’ll also skip over those details). Needless to say, any relief on the U.S. banking front immediately evaporated and investors became suspicious of anyone who lends money.

Where does this leave us? Well, futures were down pretty hard this morning when the markets opened, but as of noon, every major index in North America is flashing green, so a change of heart over the course of the morning.

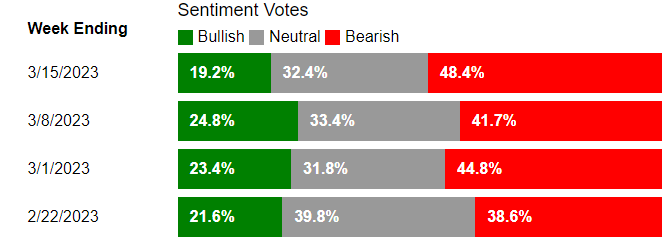

The graphic below tells a story … no surprise, investors got pretty bearish this week, and for those who read our every word closely, you know that this is a good sign and what we call a contrary indicator. Bears hold cash, bulls are heavily invested. We want more cash on the sidelines waiting to come back into the markets, not less. It is the buying that drives up stock prices, definitely not the selling.

The question asked in this survey is “where do you think the market will be in the next 6 months?” Not that anyone knows for sure, but this is really only a sentiment measure, not a forecasting test.

Source: AAII Investor Sentiment Survey

We’ve been at work adding here and there through the dip. Banks will survive, some will be sold, and others will gain customers. The next item to watch for is by how much The Fed raises its interest rate next week. We may be closer to a pause than we thought we were last week.

* This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns*