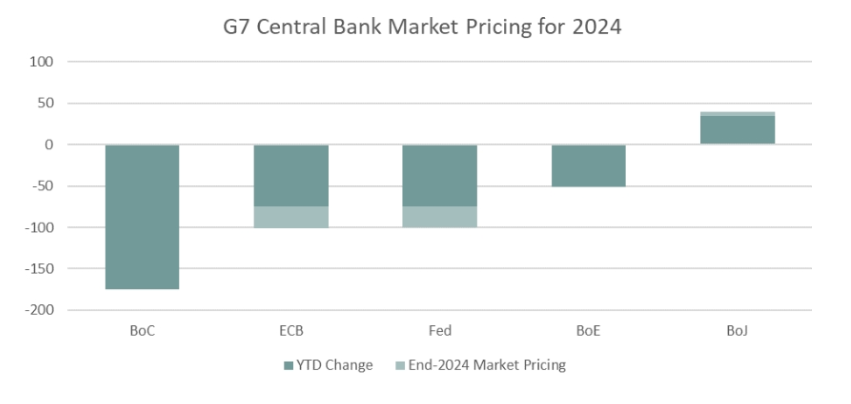

BoC cuts by another 50 bps but with a slightly hawkish tone. The BoC announced a second consecutive 50 bp rate cut in December, bringing total easing for the year to 175 bps—significantly more than other G7 central banks (see Exhibit 1). As recently as a week ago, the futures market and analysts were split on whether the BoC would revert to a 25 bp cut or opt for another 50 bp move, but consensus and market pricing gravitated toward the latter following November’s disappointing jobs report. At 3.25%, the overnight rate is now at the upper end of the 2.25-3.25% range that the BoC considers “neutral” in the long run—that is, neither stimulating nor slowing the economy.

In his press conference, Governor Macklem said the bank delivered two consecutive 50 bp rate cuts “because monetary policy no longer needs to be clearly in restrictive territory.” He said that following substantial rate cuts in 2024, Governing Council anticipates “a more gradual approach to monetary policy” going forward—a strong hint that it plans to revert to 25 bp cuts in early 2025. But the policy statement was even non-committal in that regard, dropping previous language about the likelihood of further rate cuts and simply saying the bank “will be evaluating the need for further reductions in the policy rate one decision at a time.” Those comments lent the statement a hawkish tone, which resulted in a modest increase in Canadian bond yields (US-CA spreads tightening) and slight CAD appreciation.

Exhibit 1: The BoC has cut its policy rate by significantly more than other G7 central banks

Source: Bloomberg, RBC DS

We were somewhat surprised at the BoC’s fairly clear signal that 50 bp cuts are unlikely going forward—we would have thought they’d want to maintain that optionality. That said, market odds of another 50 bp move in January were already minimal, and in a Bloomberg survey ahead of today’s meeting, all 15 respondents were forecasting a 25 bp cut in January. The policy statement flagged downside risk to the BoC’s Q4 GDP growth forecast, which seemingly lowers the bar for the October GDP release (and November flash estimate) later this month. The BoC will also get another jobs report in early January, along with two CPI releases and a Business Outlook Survey ahead of its next meeting. It seems like those releases will have to collectively disappoint for the bank to cut by 50 bps again in January.

Given the BoC’s more cautious approach to rate cuts going forward, what could cause it to pause or slow its rate cutting cycle? Here are a few thoughts:

Recent housing and consumer spending data are showing signs of life, providing some evidence that the rate cuts delivered thus far are having their intended effect. Indeed, Macklem noted “lower interest rates are beginning to pass through to stronger spending by households.” Recent and impending easing in mortgage rules could also support the housing sector. Incoming data on consumer spending and home sales bears extra attention going forward.

The federal government has announced several measures to support consumer spending, and more goodies could be on offer in next week’s fall economic statement. Stimulative fiscal policy could mean fewer rate cuts are needed—former BoC Deputy Governor Carolyn Wilkins’ rule of thumb was that $5-7 billion of additional government spending is roughly as stimulative as a 25 bp rate cut. The government’s recently announced GST holiday and cash transfers, at a cost of $6.3 billion, can thus be seen as delivering a 25 bp rate cut on the BoC’s behalf. However, the temporary nature of this stimulus could cause the BoC to look through it. Macklem also noted that the GST holiday will temporarily weigh on headline inflation and the BoC will focus on core measures for a better read on inflation.

Trump takes office on January 20th and has threatened across the board 25% tariffs on imports from Canada, to which the federal government has pledged to respond. Tit-for-tat tariffs that boost inflation could cause the BoC to re-evaluate its policy path, though it would have to balance that against any economic drag from increased protectionism. Macklem called this “a major new uncertainty.”

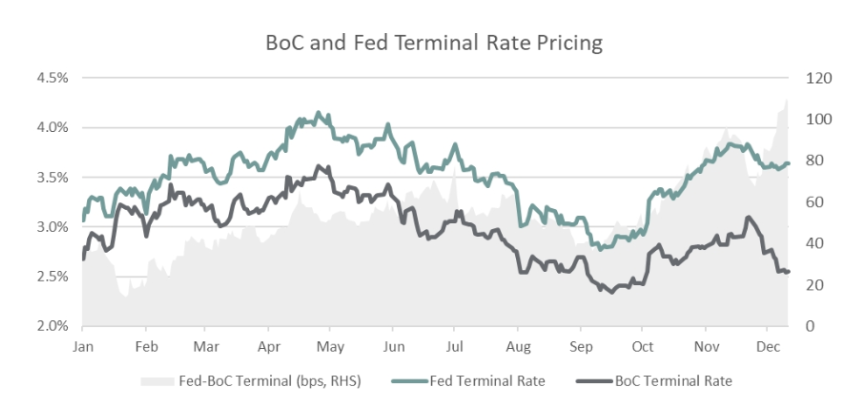

Finally, any further, significant currency depreciation could test the BoC’s resolve to diverge from the Fed. Governor Macklem has previously noted that there are limits to Canada-US monetary policy divergence, but we haven’t reached them yet. Assuming a 25 bp rate cut by the Fed next week, the policy rate gap heading into 2025 will be ~113 bps. That’s about the same as the terminal rate gap priced into the futures market (i.e., where the Fed and BoC are expected to end their easing cycles; see Exhibit 2). Historically, the BoC’s overnight rate has been as much as 200 bps higher or lower than the fed funds rate. RBC Capital Markets is forecasting a 2% terminal rate for the BoC and 4.00-4.25% for the Fed—that is, at the historical bounds for policy divergence—and sees USD/CAD rising to 1.43 by mid-2025 from ~1.41 today.

Exhibit 2: Market pricing for the BoC’s terminal rate has declined in recent weeks

Source: Bloomberg, RBC DS

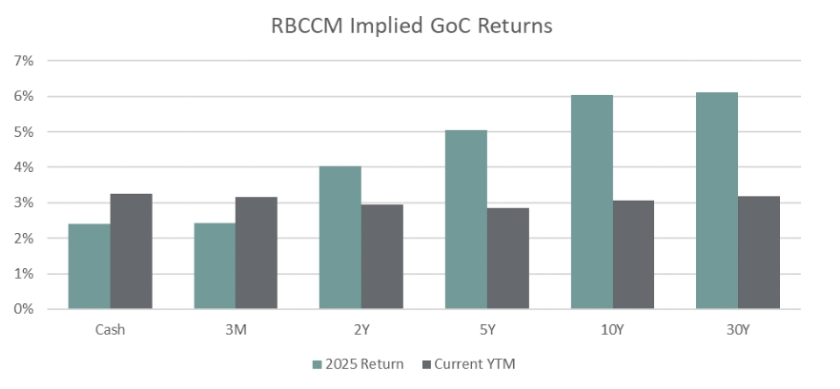

Market pricing for the BoC’s terminal rate has come down to ~2.55%, but that’s still above RBC Capital Markets’ forecast for the bank to cut as low as 2% this cycle. If the latter proves correct, Government of Canada (GoC) yields should decline in 2025, causing longer duration government bonds—whose prices are more sensitive to changes in yields—to outperform on a total return basis. Exhibit 3 shows 2025 implied returns across the GoC curve based on RBC Capital Markets’ forecasts. A similar view has informed our overweight/long duration positioning in the Canadian Fixed Income Reference Portfolio (CFIRP). We maintain that view but are a bit less confident following the BoC’s relatively hawkish tone today, which seems to indicate less urgency to get monetary policy toward a somewhat stimulative stance—something we think is warranted given persistent slack in Canada’s economy.

Exhibit 3: Based on RBC Capital Markets’ forecasts, the mid to long end of the GoC curve should outperform in 2025 as yields decline

Source: Bloomberg, RBC DS

Beth Arseneau, FMA, CIM

Portfolio Manager

416-960-4592

beth.arseneau@rbc.com