Highlights

-

Directionally, most major central banks have been reducing interest rates to stimulate economic demand – despite inflation continuing to run above desired targets.

-

The market expects continued interest rate cuts from both the Bank of Canada and the U.S. Federal Reserve between now and the end of the year. Lower interest rates have a direct impact on valuations across all asset classes.

-

Traditional fixed income will likely struggle to earn attractive returns in a lower interest rate environment. We favour active managers who can be opportunistic with credit selection, adjust interest rate risk and duration, and have access to global debt markets where mispricing can be exploited.

-

Private and alternative investments are an important and often forgotten asset class. With interest rates steadily falling over the last two years and many global equity markets making new all-time highs, we strongly believe private and alternative investments can provide a stable and uncorrelated return – complementing more traditional stock and bond portfolios. Private infrastructure is becoming a larger investable asset class within the high-net-worth channel, offering resilient returns and the potential for inflation protection.

-

High quality corporate and government bonds trading at a discount to their par value offer a compelling after-tax return, particularly when compared to high interest savings accounts, term deposits and GICs. Discount bonds offer a portion of their return in the form of capital gains, which are tax-advantaged compared to traditional savings vehicles (where all the return is taxed as interest income).

More Accommodation from Central Banks in Q3-2025

Global monetary policy continued to ease in the third quarter as stubborn inflationary pressures have not seen any acceleration from higher tariffs. The Bank of Canada and the U.S. Federal Reserve each cut interest rates by 0.25% in September and the market expects that interest rates will continue to decline. The Bank of England, the Reserve Banks of Australia and New Zealand also reduced interest rates in the third quarter, while the European Central Bank, Bank of Japan, and People’s Bank of China kept rates constant. Interest rates in Switzerland have come all the way down to 0% - a level last seen at the end of 2022.

In September, the U.S. Federal Reserve initiated their first interest rate cut of 2025. Their dual mandate of providing price stability and full employment came into question as job creation in the U.S. appears to be slowing. In fact, the last non-farm payroll release for the month of August showed a gain of 22,000 jobs which is about one-tenth of the average monthly job creation from one year ago. Possible reasons for the weaker labour numbers include tighter immigration in the U.S., slower hiring decisions due to tariff policies, and technological advancements through artificial intelligence which may be displacing some labour and/or creating operational efficiencies. The U.S. Federal Reserve has acknowledged the weaker employment picture and despite the core inflation rate drifting above their targeted 2% level (currently at 3.1%), they preemptively reduced interest rates to help stabilize the economy.

The market anticipates another cut from the Bank of Canada between now and the end of the year (likely 0.25%) – which could come as soon as their next meeting scheduled at the end of October. Expectations for the U.S. Federal Reserve are even more dovish with the potential for two interest rate cuts between now and the end of 2025. Further, the outlook for the next 12 months suggests as many as four interest rate cuts could be in play (resulting in total accommodation of 1%).

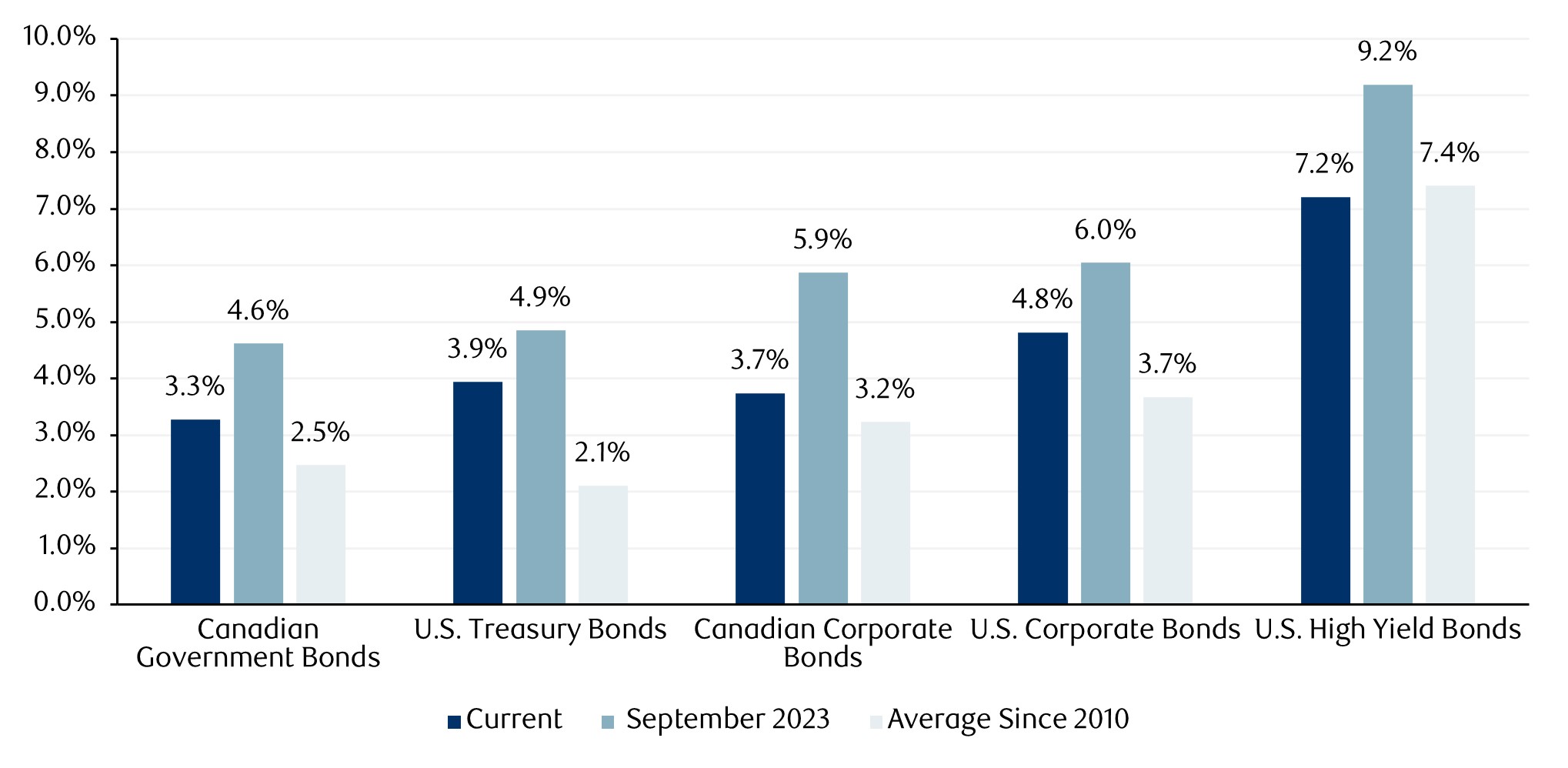

Investment Implications with Interest Rates Trending Lower

When we transitioned our business to RBC a little over two years ago, interest rates were in the process of peaking. Central banks had increased rates to cool an overheated economy following COVID, when inflation rates had been the highest in several decades. At that time, traditional fixed income was attractively priced and served a larger role in a diversified portfolio. As interest rates have declined, we have been actively reducing bond exposure in our portfolios in favour of private credit and credit alternatives. As illustrated in Figure 1, interest rates have come down from two years ago, yet remain much higher than their average rates following the Great Financial Crisis of 2008 and 2009.

Figure 1: Bond Yields

Source: RBC Wealth Management, Bloomberg. Current yield data presented as of September 30th, 2025. “Average Since 2010” yield presented from December 31st, 2009 – September 30th, 2025. Canada Sovereign Bonds represented by the Bloomberg Canada Government Bond Index. U.S. Sovereign Bonds represented by the Bloomberg U.S. Treasury Bond Index. Canada Corporate Bonds represented by the Bloomberg Canada Corporate Bond Index. U.S. Corporate Bonds represented by the Bloomberg U.S. Corporate Bond Index. U.S. High Yield Bonds represented by the Bloomberg U.S. High Yield 1-5Y Bond Index.

We continue to believe that fixed income plays an important role for a diversified portfolio. Historically, bonds have experienced smaller price fluctuations relative to equities, which has led to periods when bonds exhibited a low correlation to the stock market – capital preservation being one of the main features that fixed income provides. Despite lower interest rates, bonds continue to generate modest yield, which is generally predictable. We largely employ actively managed fixed income strategies since we believe an active manager can opportunistically adjust their credit exposure, alter the portfolio’s sensitivity to interest rates through duration management, and be more global in nature where appropriate. Global exposure offers access to unique debt securities that may be scarce or unavailable within domestic fixed income markets. Specifically, the securitized market is an area where one of our investment managers has identified a compelling opportunity in agency residential mortgage-backed securities (agency RMBS).

Agency residential mortgage-backed securities are government-sponsored guaranteed enterprises, which feature a strong credit rating and offer a competitive credit spread relative to their 10-year average, as well as a healthy yield premium compared to investment grade corporate bonds. Figure 2 shows current and longer-term (10-year average) spread levels, which suggests agency RMBS are attractively priced.

Figure 2: Credit Spreads

Source: Bloomberg. Data presented as of August 31, 2025. U.S. IG Corporates represented by ICE BofA US Corporate Index. Asset-Backed Securities represented by ICE BofA US Fixed-Rate ABS Index. Commercial MBS represented by the ICE BofA US Fixed-Rate CMBS Index. Agency RMBS represented by the Fannie Mae Current Coupon MBS Index. Non-Agency RMBS represented by the JPMorgan RMBS Credit Index.

Private Markets: Beyond Stocks and Bonds

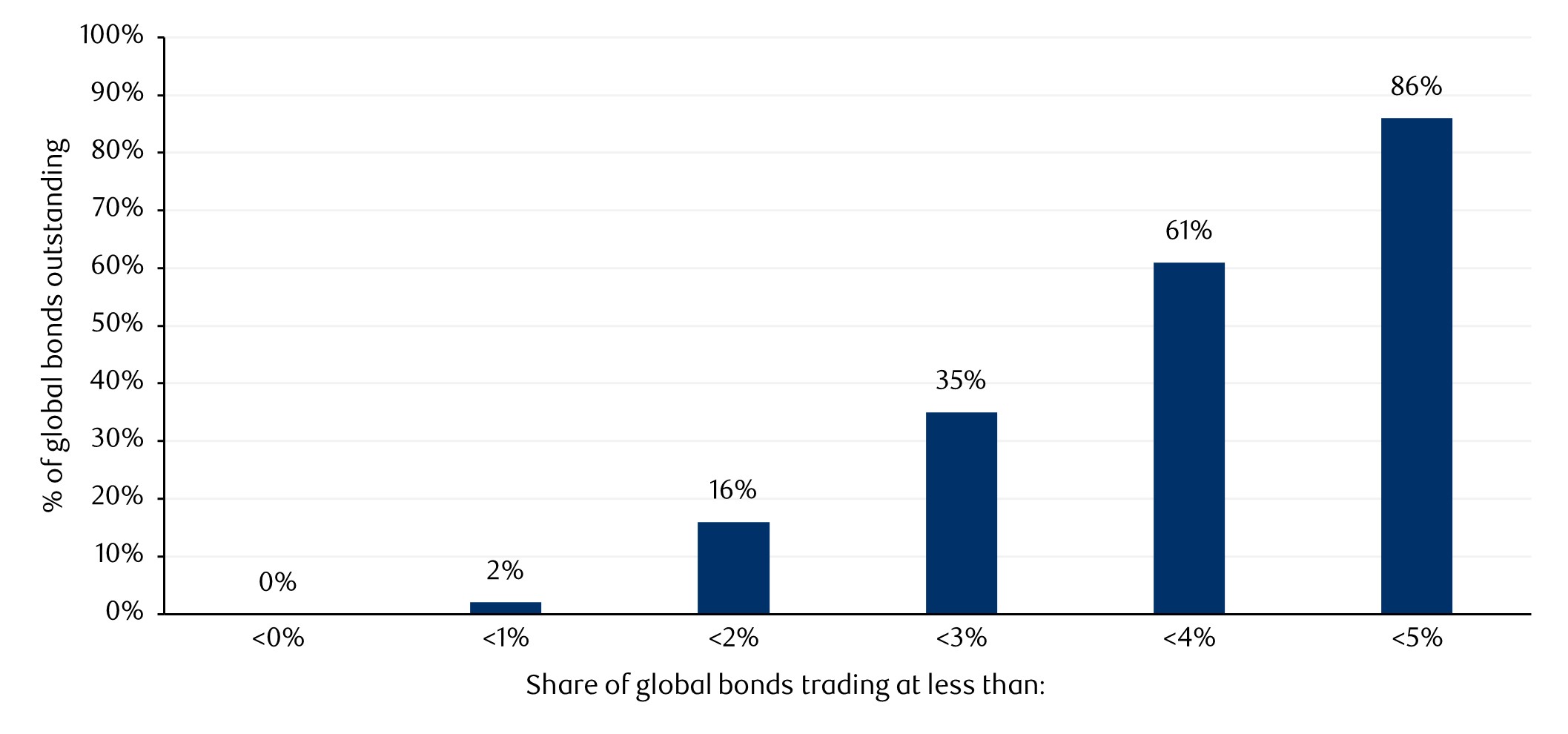

Figure 3: Almost 90% of public fixed income outstanding trades with a yield below 5%

Source: Bloomberg, Apollo Chief Economist.

Yields on fixed income investments are lower compared to two years ago and expected future returns are in the low to mid-single digit range. Approximately 86% of all public fixed income securities carry a yield below 5%, as shown in Figure 3. Further, most equity markets around the world are near all-time highs. We strongly believe in the merits of private and alternative investments, including their ability to deliver differentiated returns. Private investments are not subject to the same day-to-day volatility of public assets and therefore can produce an uncorrelated return. Where appropriate, we have introduced allocations to private credit through a direct lending strategy that is structured with the objective of generating a high single digit yield. We have also conducted due diligence on several fixed income credit alternatives and have begun repurposing traditional bond exposure for these strategies that carry a different risk profile and can generate a higher rate of return. We have been here before – in fact, administered interest rates were much lower following COVID and we are dusting off a similar playbook from that era. This served our clients well as the safety component of the portfolio saw higher potential returns as well as good protection from higher interest rates when inflation became more rampant in 2022.

We will be looking to introduce a new asset class to client portfolios where liquidity is less of a concern. In particular, the private infrastructure space is becoming a larger investable universe. Big pledges, including Trump’s announcement earlier this year of the Stargate Project (USD$500 billion investment announcement to build up to 20 large AI datacenters in the U.S. by 2029) or Germany’s infrastructure fund of EUR500 billion to modernize infrastructure by 2029, the growth of new infrastructure projects is unprecedented. KKR, a leading global investment firm headquartered in New York City, will have an open-ended investment vehicle available this Fall on the RBC investment platform. The KKR Infrastructure Fund provides a core-plus exposure to global infrastructure assets with a stable, recurring and largely inflation protected cash-flows, with the potential for capital appreciation as the assets follow a similar timeline to monetization as a private equity investment.

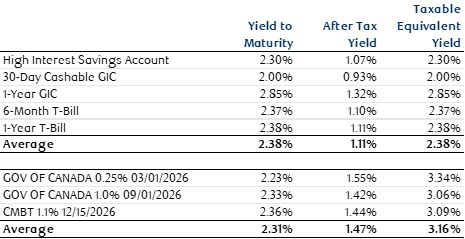

Where to stash your cash: Low-risk alternatives

With the Bank of Canada overnight rate now at 2.5%, high interest savings accounts, term deposits and non-redeemable GICs from the Canadian chartered banks now feature a negative return on an after-tax and after-inflation basis – a sure way to impair your purchasing power. Low coupon discounted Government or high-quality corporate bonds offer a more compelling alternative for taxable accounts.

Bonds trading at a discount to their par value were issued when the interest rate environment was even lower than it is today. These bonds feature a very low coupon, with negligible income recognition and higher price appreciation. The price appreciation from purchase date to maturity is tax-advantaged as a capital gain (investors pay half the tax for $1 of capital gains versus $1 of interest income). As a result, taxable investors can pick up between 0.5% to 1.5% of after-tax yield and tax equivalent yield, respectively. Not to mention, these securities have added flexibility of daily liquidity with next day settlement, should funds be required prior to the security’s maturity date. Lastly, the yields on high interest savings accounts and term deposits are likely going to continue to decline as the Bank of Canada continues to ease policy rates – however, discount bonds generate a fixed return so should the Bank of Canada cut interest rates, the return for a discount bond would not be impacted if held to maturity – unlike other cash and cash equivalent investments. We have summarized the economic benefits that a discount bond strategy provides in Figure 4.

Figure 4: Cash Equivalent and Discount Bond Yields

Source: Bloomberg, Ascendant Wealth Partners. Data presented as of October 16, 2025.

Conclusion

With interest rates trending lower, we believe a review of cash equivalents and traditional fixed income investment exposure is warranted. Enhancements, spanning different levels of risk tolerance, can be found amidst the following alternatives:

- Discount government bonds or high-quality discount corporate bonds for a better after-tax return relative to high interest savings accounts, term deposits and non-redeemable GICs. Discount bonds also offer the flexibility to meet unforeseen liquidity needs with daily liquidity and next day settlement.

- Actively managed traditional fixed income strategies where an investment manager has proven alpha generation and has delivered consistent outperformance.

- Increased exposure to private and alternative investments where returns have the potential to generate mid-to-high single digit returns.

-

Introducing uncorrelated asset classes such as infrastructure or private equity in a moderate size to enhance returns and help reduce volatility.

We encourage you to reach out to your Ascendant Wealth Partners team to discuss and strategize an appropriate solution for your portfolio. We have many tools at our disposal and we can construct a plan that meets your desired risk and return objectives.

We appreciate your continued confidence, trust and support.