Mid-Year Investment Outlook

Highlights

- The shock of tariff uncertainty appears to be waning. Constructive trade negotiations and improving global growth have supported equity markets.

-

Global economic expansion continues, albeit at a slower pace, with U.S. hard data signaling resilience despite trade-related uncertainty.

- U.S. large-cap valuations remain elevated, while global investors are increasingly reallocating to international developed markets, drawn by favourable valuations and supportive policy backdrops.

- Recent data out of Canada and the U.S. show stubbornly elevated inflation. The Bank of Canada is unlikely to reduce interest rates later this month and the U.S. Federal Reserve does not appear ready to reduce rates either, with a strong economy and stable labour market.

- Key risks to monitor include a breakdown in the U.S.–China trade truce, rising fears of U.S. stagflation, and a more hawkish Fed that delays rate cuts due to sticky inflation and stable hard economic data.

- Amid macroeconomic uncertainty, we are maintaining a somewhat cautious asset allocation strategy – well diversified across geographies to capture growth outside of Canada, with meaningful exposure to alternative and private investments.

- We are maintaining exposure to U.S. equities and the U.S. Dollar despite the headwinds of both relative to other equity investments in the first half of the year.

- We see opportunity in short-duration private and tactical credit, which offers a stable income profile with the potential for capital appreciation.

Trade and Geopolitics

The shock of tariff uncertainty appears to be waning. Constructive trade negotiations and improving global growth, particularly in the technology sector, have buoyed equity markets through June.

Recent news headlines focus on letters sent by the U.S. administration to select trade partners, announcing new tariff rates expected to take effect on August 1st. Trump’s latest batch of tariff letters come shortly after an announcement that a 50% tariff will apply to all copper imports into the U.S. – suggesting a continued emphasis on domestic manufacturing and production. Ongoing tariff announcements have been accompanied by some successful trade negotiations, including deals between the U.S. and China, the United Kingdom and Vietnam. Despite Trump’s goal of 90 deals in 90 days, the trade war continues, with additional threats directed at Canada, Mexico and Europe.

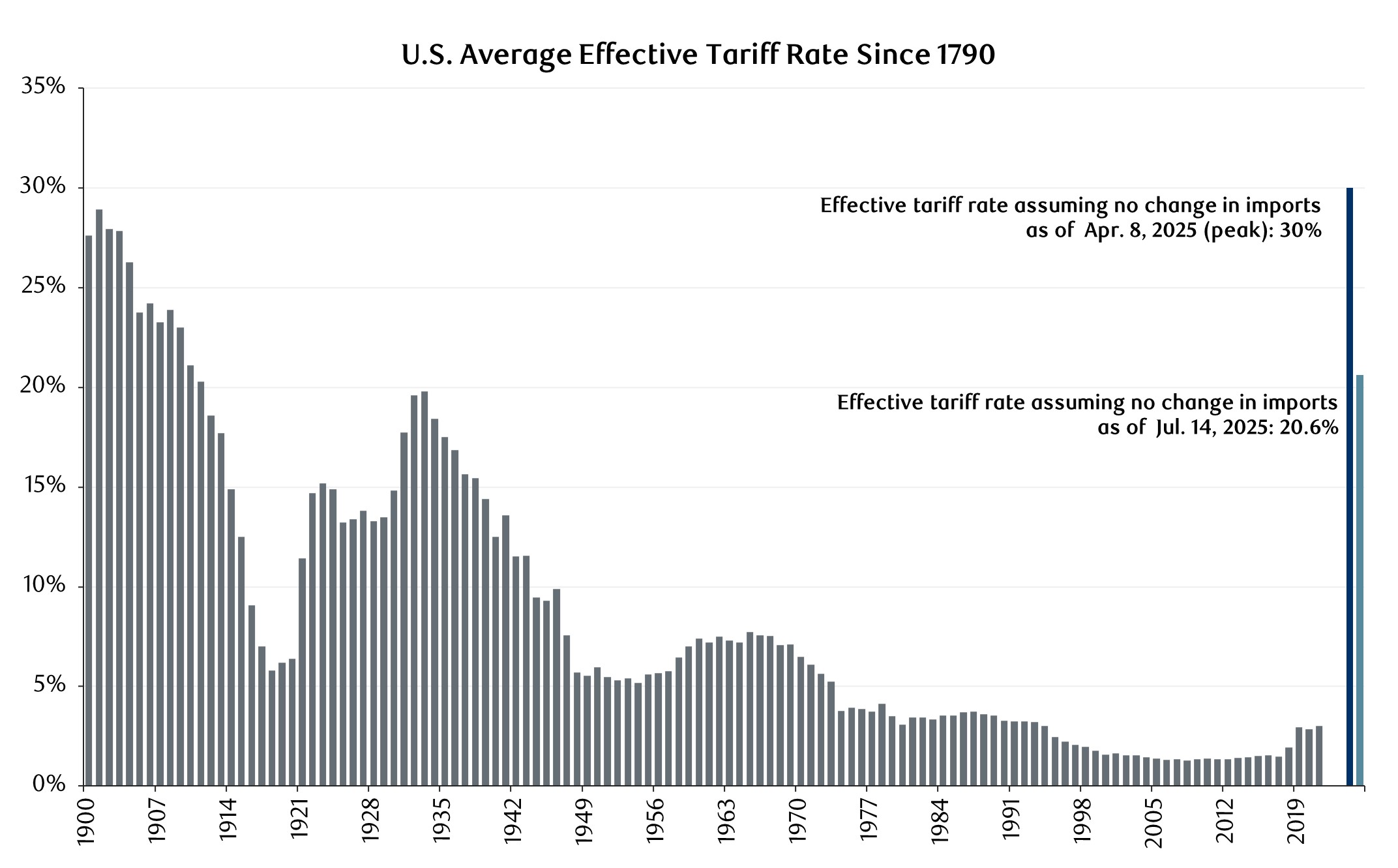

The U.S.–China trade truce has helped reduce recession risk. Tariffs have declined from a peak of 30%, yet remain significantly above the 2.4% level from the start of this year. Figure 1 shows the effective tariff rate for imports on goods dating back to 1900, highlighting a sharp increase to tariff levels not seen since the 1930s.

Figure 1:

Source: Ascendant Wealth Partners, The Budget Lab analysis, Bureau of Economic Analysis. Data presented as of July 14, 2025.

Key geopolitical risks, such as U.S.–China tensions, Middle East instability, and Russia-related sanctions, continue to affect trade and commodities, though their impact on capital markets has so far been limited and short-lived.

Further, investor’s reaction to tariff news has generally become more muted, particularly when compared with the volatility experienced in early April on the days (and subsequent weeks) immediately following Trump’s Liberation Day announcement. Since then, we have seen a sharp V-shape recovery as markets post new all-time highs.

Economic Growth Outlook

The global economy continues to expand, though at a more moderate pace amidst persistent uncertainty in U.S. trade policy. While U.S. sentiment surveys have softened, real-time economic indicators suggest the economy continues to grow. The U.S. labour market remains in good shape and continues to reflect a pattern of “slow hiring and slow firing”, with businesses continuing to hire and retain workers.

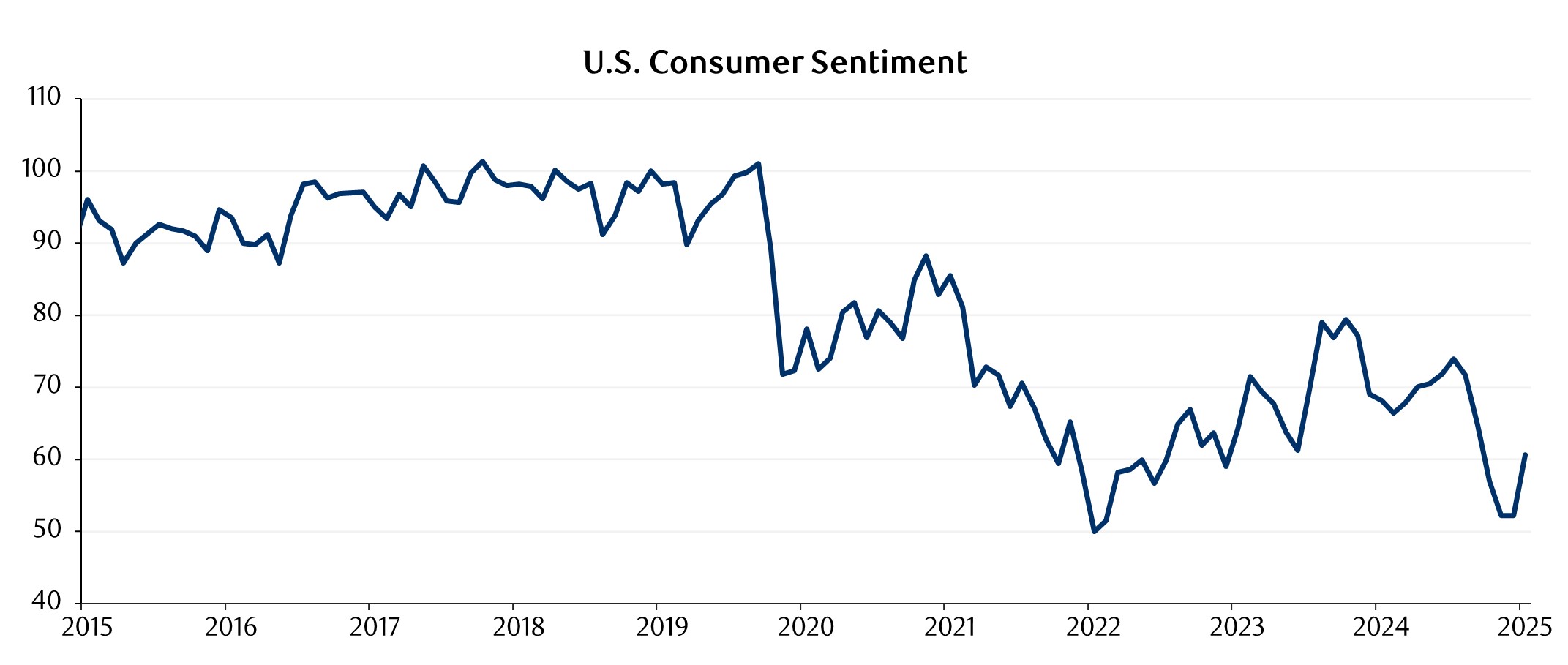

Figure 2 illustrates survey data that gauges sentiment across U.S. consumers. During the market volatility of April and May, the University of Michigan Consumer Sentiment Index recorded the weakest reading since mid-2022 and has since moved higher, consistent with more positive equity markets.

Figure 2:

Source: Ascendant Wealth Partners, The Index of Consumer Sentiment – University of Michigan. Data presented as of June 2025.

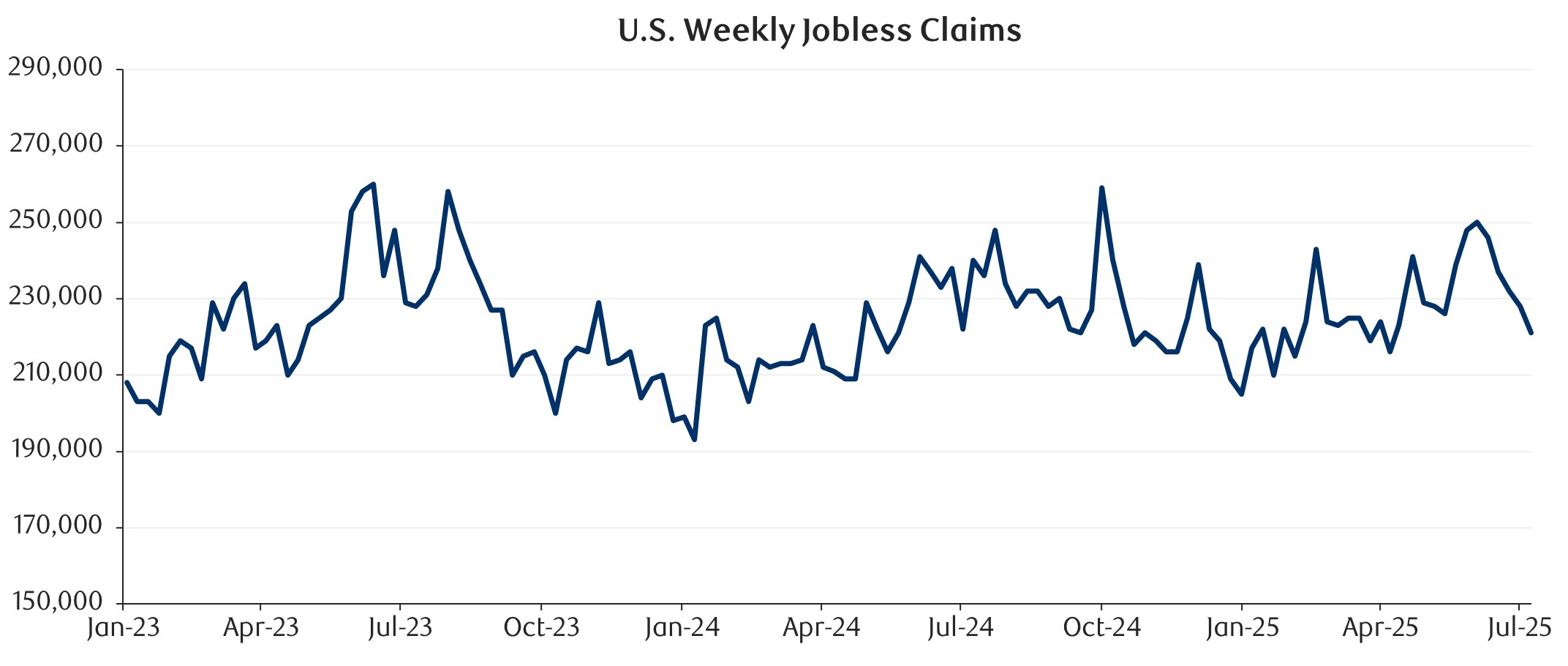

Initial Jobless Claims is a measure of the number of individuals who filed for unemployment insurance for the first time since the prior week. As illustrated in Figure 3, U.S. weekly jobless claims are holding steady. A similar observation can be made when looking at the U.S. unemployment rate, which reported a modest decline to 4.1% in the month of June and remains slightly above 50-year lows. With healthy and stable employment levels, and inflation remaining above target, the U.S. Federal Reserve continues to hold rates at an elevated level, particularly as anticipated effects related to tariffs have yet to appear in the inflation data.

Figure 3:

Source: Ascendant Wealth Partners, U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from FRED, Federal Reserve Bank of St. Louis. Data presented as of July 10, 2025.

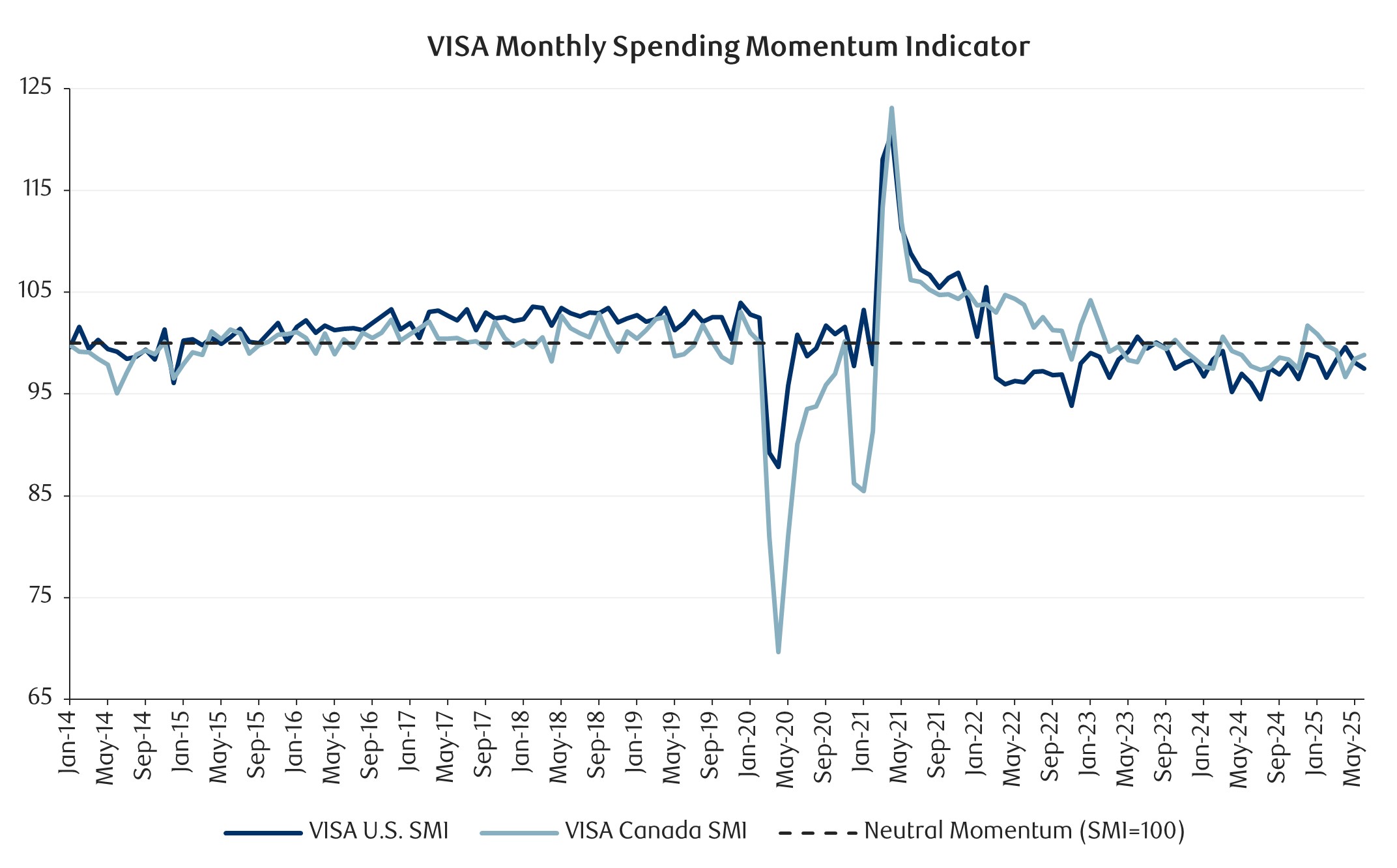

Similarly, although materially below both 2021 and pre-pandemic levels, consumer spending appears relatively stable. The Visa monthly spending momentum index (SMI), shown in Figure 4, tracks the breadth of U.S. and Canadian discretionary spending momentum, seasonally adjusted, with 100 as the threshold for strengthening (>100) or weakening (<100) trends, suggesting no significant change in behaviour. Looking ahead, the third quarter will likely reveal the effects of the Trump trade policies on consumer and business spending. The Canadian economy moderately contracted in April as U.S. trade disruptions plunged goods exports. Losses were substantial in a handful of related sectors, namely manufacturing and wholesale, while most other sectors recorded expansions.

Figure 4:

Source: Ascendant Wealth Partners, Visa Business and Economic Insights, Spending Momentum Index (SMI), Data presented as of July 2, 2025.

Fiscal Stimulus

Rising defence spending and fiscal stimulus have emerged as powerful economic tailwinds across Europe, particularly in Germany, where a landmark €500 Billion Infrastructure Fund (exempt from constitutional debt limits) has been announced. The Fund will finance projects beyond the usual budgetary constraints, allocating €100 billion to federal states and municipalities and €400 billion to the federal government, over a 12-year period. The Fund, together with corresponding proposed policies and climate goals, has opened significant opportunities for private sector involvement, particularly in the energy sector. Further, it is stimulating demand across industries such as manufacturing, technology, and defence-related engineering – expected to boost medium and long-term growth. At the same time, Germany is dramatically expanding its defence budget, expected to increase by two-thirds by 2029. German military expenditure is projected to reach €162bn in 2029, up from €95bn this year.

Other European countries who have notably increased military and defence spending targets during 2025 include: Belgium, Denmark, Estonia, Finland, and Poland. This shift towards proactive fiscal policy and coordinated defence investment is driving industrial activity, lifting GDP growth forecasts, and reshaping Europe’s strategic and economic landscape.

Locally, Canada has also pledged to increase their military budget. NATO leaders met in the Netherlands in late June with Canada promising to increase defence spending to 5% of GDP by 2035 – a notable increase from the current annual military spend of approximately 1.4% of GDP.

Lastly, there will be additional fiscal stimulus with the passing of the One Big Beautiful Bill Act in the U.S., which will continue to expand spending and implies no specific restraint on the deficit to GDP situation. While the bill introduces some spending caps and modest revenue measures, it falls short of the structural reforms needed to rein in the deficit meaningfully. Without significant new sources of revenue (i.e. large-scale tariff revenues or a strong sustained acceleration in economic growth), the U.S. deficit is expected to increase substantially – largely driven by sustained tax cuts which will reduce government revenue, and lead to a growing debt ceiling.

Monetary Policy and Interest Rates

Despite a gradual easing of inflationary pressures, the U.S. Federal Reserve remains cautious about initiating rate cuts, largely due to lingering uncertainty surrounding U.S. trade policy and its potential impact on economic growth and global supply chains. Policymakers are keen to avoid premature easing that could reignite inflation or undermine progress made in anchoring expectations.

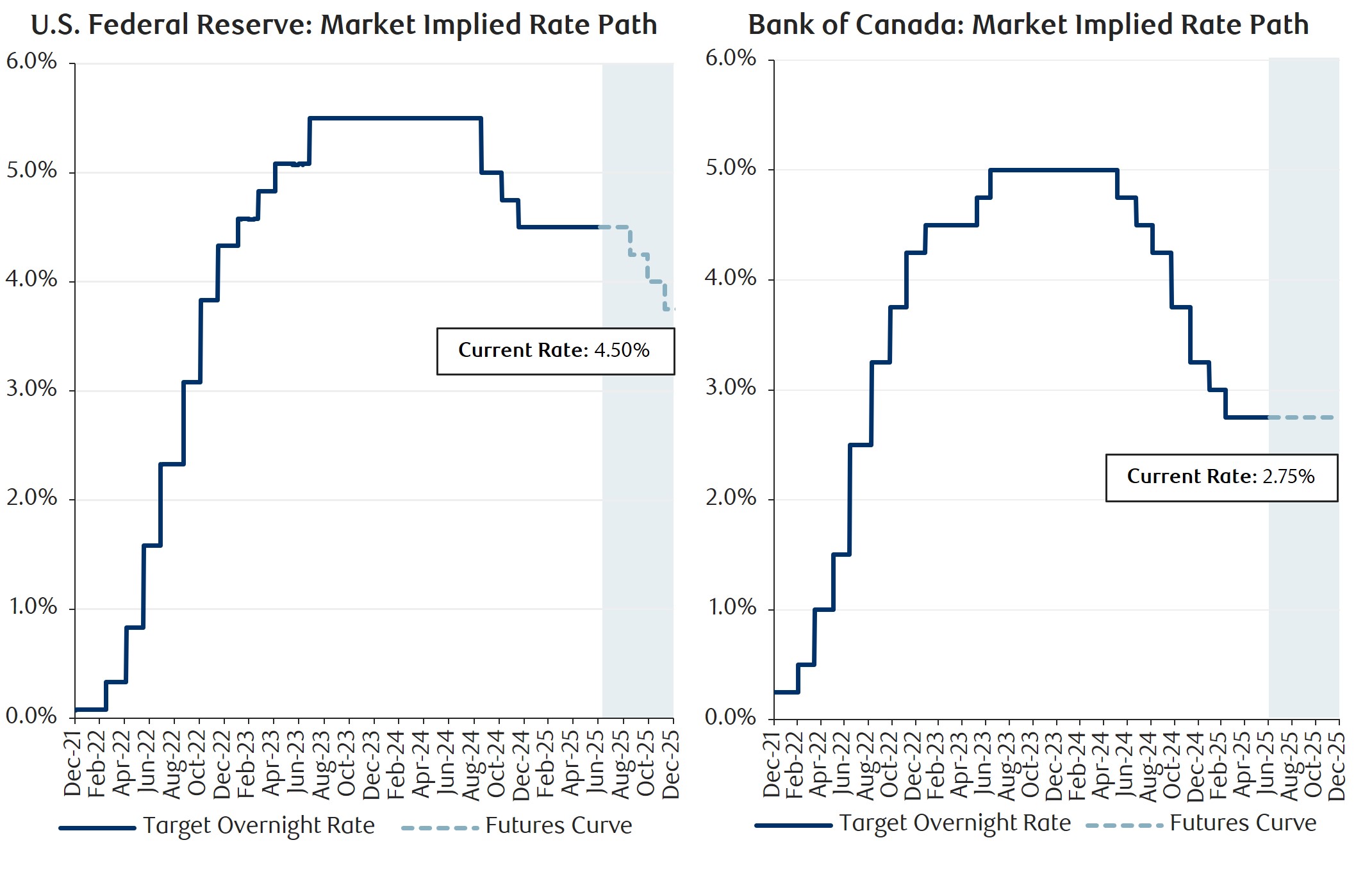

With that said, current monetary policy levels appear relatively restrictive given a flattening, yet elevated, level of inflation. Real interest rates (nominal rates adjusted for inflation) have risen, placing a drag on consumer spending, business investment, and credit sensitive sectors (such as housing). As macroeconomic indicators begin to point towards potential softness in labour and manufacturing, we anticipate that the Federal Reserve will shift its focus from inflation containment to supporting economic resilience. In our view, changing conditions are likely to warrant a resumption of rate cuts but not until later this year. Figure 5 illustrates current market expectations for the path of interest rates in North America.

The Bank of Canada has cut interest rates more aggressively starting in mid-2024, with the current overnight policy rate at 2.75%, not far off from the expected terminal rate. The Canadian economy remains susceptible to tariff impacts, given the nation’s significant trade relationship with the United States.

Figure 5:

Source: Ascendant Wealth Partners, Bloomberg. Market implied rate path presented as of July 3, 2025.

Global Equities and Valuation

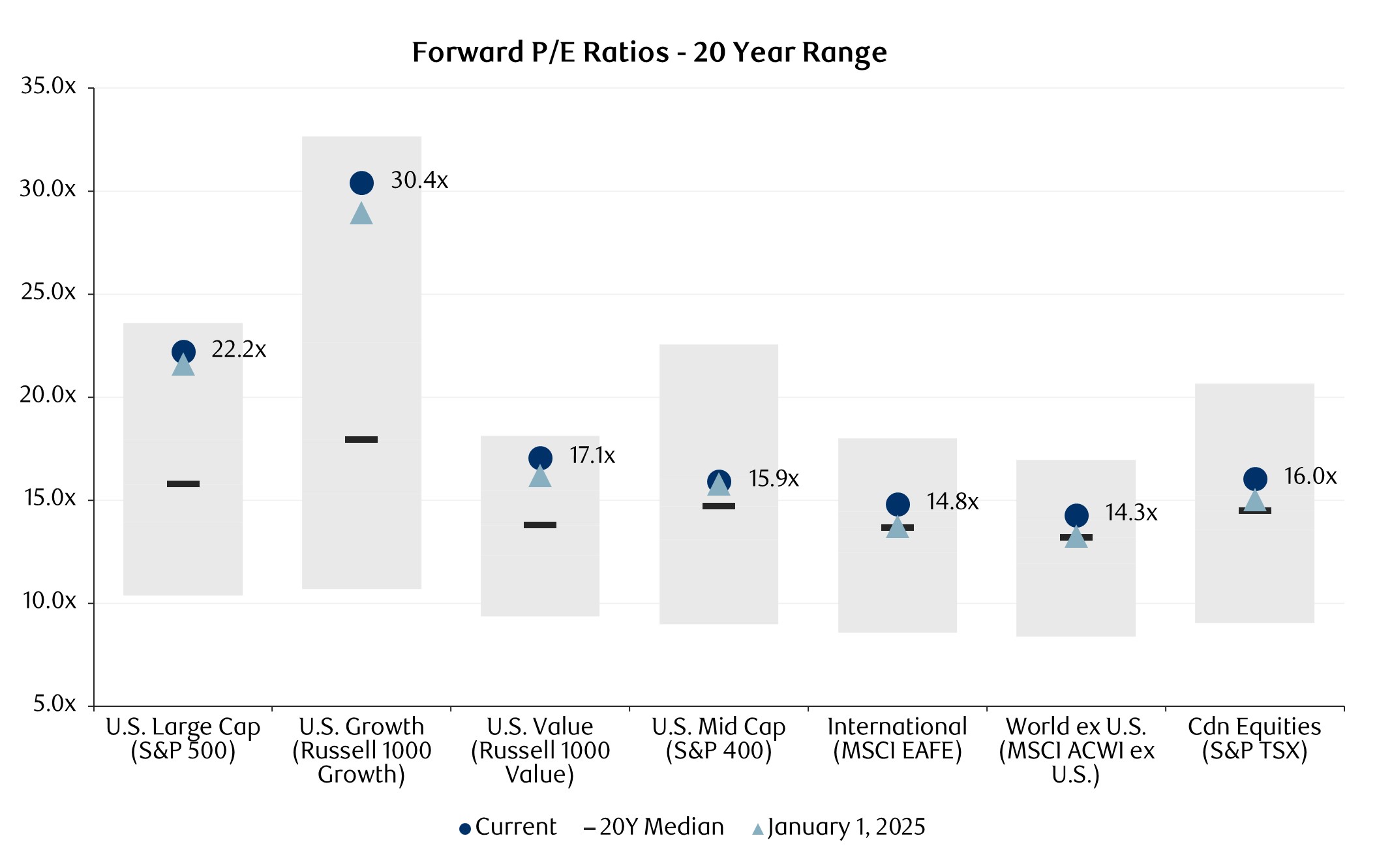

The earnings outlook remains broadly reassuring. Consensus forecasts project 8% earnings growth for the MSCI All Country World Index in 2025. Following Q1 earnings announcements, amid trade-related uncertainties, 2025 S&P 500 EPS forecasts have been revised downward, but still reflect 9% growth. We expect market attention to soon shift toward an expected earnings reacceleration in 2026. Figure 6 illustrates equity valuation levels for different regions around the world. U.S. large-cap equities are pricing in optimistic outcomes, with the S&P 500 trading at 22.2x forward earnings— no longer discounting much economic risk. Tailwinds include a pro-growth fiscal agenda, potential 2026 interest rate cuts, deregulation, and structural themes such as re-shoring of domestic U.S. manufacturing.

Figure 6:

Source: Ascendant Wealth Partners, FactSet. Data presented as of June 30th, 2025. Shaded bars highlight the maximum and minimum price/earnings ratio over the 20-year period shown.

Global asset allocators have increased diversification and shifted capital toward international developed markets, drawn by more attractive valuations (at approximately 14.8x forward earnings) and a supportive macroeconomic policy environment. More recently, the relative outperformance of international equities has diminished when compared to U.S. equity markets. Sustained outperformance will likely depend on a more durable improvement in relative earnings momentum.

Fixed Income and Credit Markets

After a more volatile start to the year, corporate bond spreads have tightened and now sit below long-term averages, supported by a swift pivot in U.S. trade policy in April, which helped contain economic fallout. Fundamentals for the U.S. corporate credit sector remain stable, and investment-grade corporate debt historically does not see a surge in defaults during economic malaise.

Low fixed income yields in Canada have prompted investors to look beyond domestic markets in search of more compelling opportunities. As both Canadian government and corporate bond yields remain subdued, many investors are turning to higher yielding sovereign and corporate credit investments globally (particularly in the U.S., Europe, and emerging markets). Outside of traditional fixed income, we see a compelling opportunity in short-duration private credit, as well as actively managed alternative credit strategies, which offer a stable income profile with the potential for capital appreciation.

With public markets facing valuation headwinds and a growing demand for yield and inflation protection, alternative investments remain a critical component of diversified portfolios. Private markets often exhibit lower correlation to traditional stocks and bonds, helping to enhance portfolio diversification and reduce volatility. Private credit and senior secured loans offer attractive yields and downside protection, particularly in today’s environment of still-elevated base rates and tight public bond spreads.

Currency Markets

The most notable shift in foreign exchange markets is the weakening of the U.S. Dollar against a basket of major global currencies which has declined 10% year-to-date, a rare occurrence during periods of heightened geopolitical risk. This has caused a bounce back in CAD/USD from depressed levels.

The USD decline isn't really from any one factor but stems from several things all coming together at once, including: U.S. trade policy, Trump favouring isolationism, and increased anxiety about rising U.S. debt levels and excessive government spending. The Euro rose roughly 9% against the U.S. Dollar in Q2, fueled by the outlook for Europe’s (relative) stronger growth and significant capital outflows or new active hedges on U.S. assets.

U.S. Dollar weakness has served as a headwind for Canadian investors (owning U.S. assets) so far during 2025 – a reversal of sustained U.S. Dollar strength over the past few years. Figure 7 shows the 10-year trend of the U.S. Dollar Index, which is a measure of the value of the U.S. Dollar against a basket of six foreign currencies (Euro, Swiss Franc, Japanese Yen, Canadian Dollar, British Pound, and Swedish Krona). The Index has faced downward pressure this year as investors have raised concerns over the outlook for the U.S. economy and America’s role within the global financial system amid Washington’s unpredictable tariff policies.

Figure 7:

Source: Ascendant Wealth Partners, FactSet. Data presented as of June 30, 2025.

Conclusion

Despite signs of economic resilience and progress in global trade negotiations, significant structural challenges remain. While fiscal stimulus measures in Europe (particularly Germany’s ambitious infrastructure and defence investments) are driving regional growth and economic activity, the U.S. continues to face mounting fiscal pressures. The recently passed One Big Beautiful Bill Act (BBB) offers only modest deficit control and fails to address underlying imbalances. Absent substantial new revenue sources or a meaningful acceleration in economic growth, U.S. debt levels are expected to rise materially, further straining fiscal sustainability. With that said, capital markets have proven their resilience, performing well against a challenging backdrop.

In summary, the following key themes are evident across client portfolios, where appropriate:

- A higher level of cash given ongoing trade uncertainty

- An underweight position to Canada given the likely increase of tariffs on trade with the U.S.

- Maintaining exposure to U.S. equities and the U.S. Dollar, despite headwinds relative to other equity investments during the first half of the year

- Higher allocations and growing enthusiasm towards international equities, where valuations remain attractive and a number of positive catalysts have emerged (fiscal/monetary support and accelerating earnings growth)

- As interest rates in Canada have declined with Bank of Canada interest rate cuts, we have increased exposure to private credit investments and other actively managed fixed income investments

- Allocation to alternative investments which provide uncorrelated returns and diversification benefits

We encourage investors to remain focused on prudent diversification. The Ascendant Wealth Partners team will remain active as market volatility persists amidst ongoing policy and trade uncertainty.

We appreciate your continued confidence, trust and support.